Technology

Why Startups Fail: Here’s the 20 Most Common Reasons

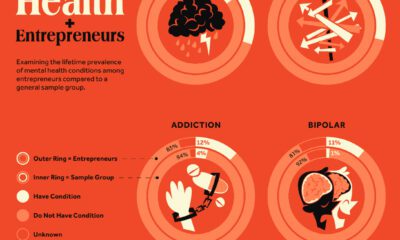

For anyone who launches a new venture, there’s a grim reality involved: eventually 90% of startups bite the dust, and 51% of all businesses die off within a period of five years.

While failure is not fatal, there’s definitely no harm in stacking the odds in your favor in the first place. With some proper insight and critical thinking, the chance of a venture’s success can be increased by mitigating some of the most common startup risks.

That’s why it is not enough to know how many startups fail – we must know why startups fail.

CB Insights, a venture capital database, did their homework based on 101 startup post-mortems to pin down causes on why startups failed. Here’s the results in infographic form:

Why Startups Fail

The most common reason for startups to meet the grim reaper was a dreaded lack of “product/market fit”.

In other words, a startup was unable to satisfy a real market need with its product. Famed investor Marc Andreessen says that product/market fit is so important, that the lifespan of a startup can be broken up into two parts: before product/market fit, and after the fit is achieved. Once it is obtained, it’s a game-changer that increases the chance of success tremendously.

Presumably, the startups that never achieve such a fit end up in the graveyard. The analysis from CB Insights above agrees, showing 42% of startups fail because they do not solve a real market need.

The two other major reasons why startups fail include running out of cash (29%) as well as not having the right team (23%).

Inevitably, there’s no changing the fact that the vast majority of startups will meet their bitter end. That said, a better understanding of the above causes of failure may help to mitigate the risks of any new venture. And even if a startup does meet its maker, the founder may still have another shot: failed entrepreneurs often find more success the second time around.

As Winston Churchill says: “Success is not final, failure is not fatal: it is the courage to continue that counts.”

Original graphic by: Lance Surety Bond Associates

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001