Technology

Visualizing the Rise of Investment Tech

View the full size version of this infographic

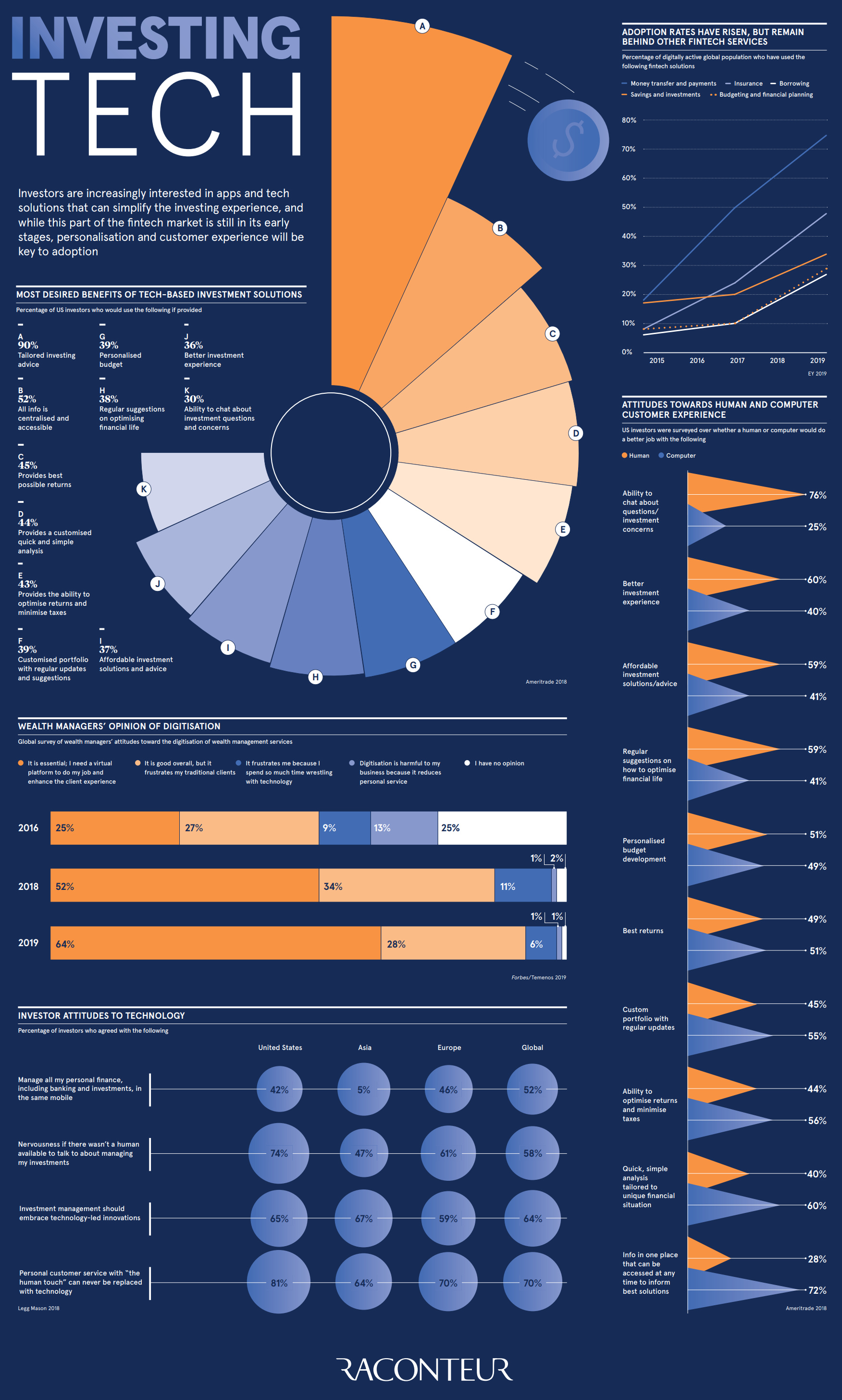

Visualizing the Rise of Investment Tech

For the high resolution version of this infographic, click here.

Investors and wealth managers are always looking to capitalize on their investments—and the latest innovations are arming them with more efficient tools to get there.

Fintech solutions are increasingly being adopted among the digitally active population, as 64% of surveyed wealth managers consider digitization essential in 2019.

Today’s graphic from Raconteur highlights the benefits of investment technology, and touches on shifting sentiments in human vs. digital interactions. Where do investors and wealth managers see the next epoch of investment fintech heading?

Fantastic Features: Top Benefits

According to a TD Ameritrade survey of 1,000 investors, a whopping 90% consider getting tailored investing advice to be the most important feature of any tech tool. In second place, 52% place value in easy access to their data.

Here are the other benefits at top of mind for investors when it comes to investment tech:

- 45% seek the best possible returns

- 44% look for customized, quick, and simple analysis

- 39% are interested in customized portfolios

- 39% want the benefit of personalized budgets

- 38% desire regular suggestions for optimizing financial health

But how well are these applications being adopted in everyday investment scenarios?

The Fintech Boom by the Numbers

Investment apps such as RobinHood have drastically risen in popularity, but still lag behind more mainstream segments in the fintech space:

Fintech Categories Ranked by Adoption Rate, 2015 to 2019

| Category | 2015 Adoption Rate | 2017 Adoption Rate | 2019 Adoption Rate |

|---|---|---|---|

| Money transfer and payments | 18% | 50% | 75% |

| Insurance | 8% | 24% | 48% |

| Savings and investments | 17% | 20% | 34% |

| Budgeting and financial planning | 8% | 10% | 29% |

| Borrowing | 6% | 10% | 27% |

Source: EY

Borrowing apps have the lowest global usage rates—only 27% of the digitally active global population—whereas nearly 75% have adopted money transfer and payment apps.

Human vs Machine: The Customer Experience

Do humans or machines have the edge in managing your investments?

The aforementioned survey by TD Ameritrade also asked investors which of the following are performed better by each group, with mixed results:

| 👨 Humans perceived as better | 🤖 Robots perceived as better | |

|---|---|---|

| • Ability to chat about questions or investment concerns | • Info in one place that can be accessed at any time to inform best solutions |

|

| • Investment experience | • Best returns | |

| • Affordable investment solutions or advice | • Ability to optimize returns and minimize taxes |

|

| • Regular suggestions on how to optimize financial life | • Quick, simple analysis tailored to unique financial situation |

|

| • Personalized budget development | • Custom portfolio with regular updates |

When it comes to managing tasks such as calculations, updates, and portfolio optimization, the majority of investors consider a computer to be better suited to the tasks at hand. However, when they are discussing investment concerns, personalization, or financial advice, the majority of customers prefer a human opinion.

Interestingly, 81% of U.S. investors believe that investment technology could never replace the “human touch”, compared to 70% of European investors or 64% in Asia.

Wealth Managers are Going Digital

Over time, wealth managers have grown to embrace the digitization of their industry.

The proportion of surveyed high-level executives who see digitization as essential to the industry jumped from just 25% in 2016 to 64% in 2019.

In another recent survey about views on most impactful types of fintech apps, more than 68% of wealth managers agreed that robo-advisors are among the most important developments, with AI-based investing apps following closely behind at 45%.

Towards a More Personalized Future

At the end of the day, investors want better, more personalized advice at their disposal—and for that advice to generate more profitable returns. Along with their wealth managers, investors are increasingly interested in solutions that can simplify portfolio management.

Digitization and automation of manual processes have been a welcome change for many industry professionals. While investment technology is still in early stages, wealth managers can personalize investor experiences through the adoption of tech─and increase their chances of future success by maintaining a seamless customer experience.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Travel1 week ago

Travel1 week agoRanked: The World’s Top Flight Routes, by Revenue

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024