Green

Visualized: The Top 5 Questions on Sustainable Investing for Advisers

Visualized: The Top Five Questions on Sustainable Investing

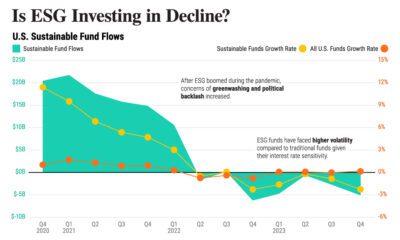

Today, the surge in green investing has been compared to the dot-com boom of the 2000s.

Back then, the internet was anticipated to radically reshape economies. Many companies fell to the wayside, and now 20 years later, tech stocks currently make up roughly 40% of the S&P 500 by market capitalization. Like the dot-com era, green firms are projected to structurally change the way businesses function.

Given the rising interest in green assets, this infographic from MSCI answers the most important questions advisers need answered on sustainable investing.

1. Which type of sustainable investing is right for my client?

First, let’s start with the basics—understanding the terms used to describe sustainable investing:

- Sustainable investing: An umbrella term that typically refers to all types of sustainable, impact, and environmental, social, and governance (ESG) integration approaches

- Impact investing: A type of investing approach that generates measurable social or environmental benefits

- Socially responsible investing (SRI): An investing approach that aligns with an investor’s ethical, religious, or personal values, while actively reducing negative environmental or social consequences

- ESG integration: Considers material environmental, social, and governance factors to enhance long-term risk adjusted returns through its investment approach

- Climate investing: Looks to reduce exposure to climate risk, identify low-carbon investment opportunities, or align portfolios with “net-zero” climate targets

Knowing the key terms of the sustainable landscape allows advisers to more accurately address client objectives, goals, and beliefs.

2. How can I start a conversation with clients about ESG?

Begin by asking what motivates clients. Typically, motivations fall into one of three core objectives:

- Can ESG factors improve my risk-adjusted returns?

- Can I have a positive impact on society through my investments?

- Are my investments consistent with my ethical, political, or religious beliefs?

Client priorities could include financial returns, impact, values, or a combination. Once these have been established, investors can choose from a universe of funds and investment vehicles that more strongly align with their goals.

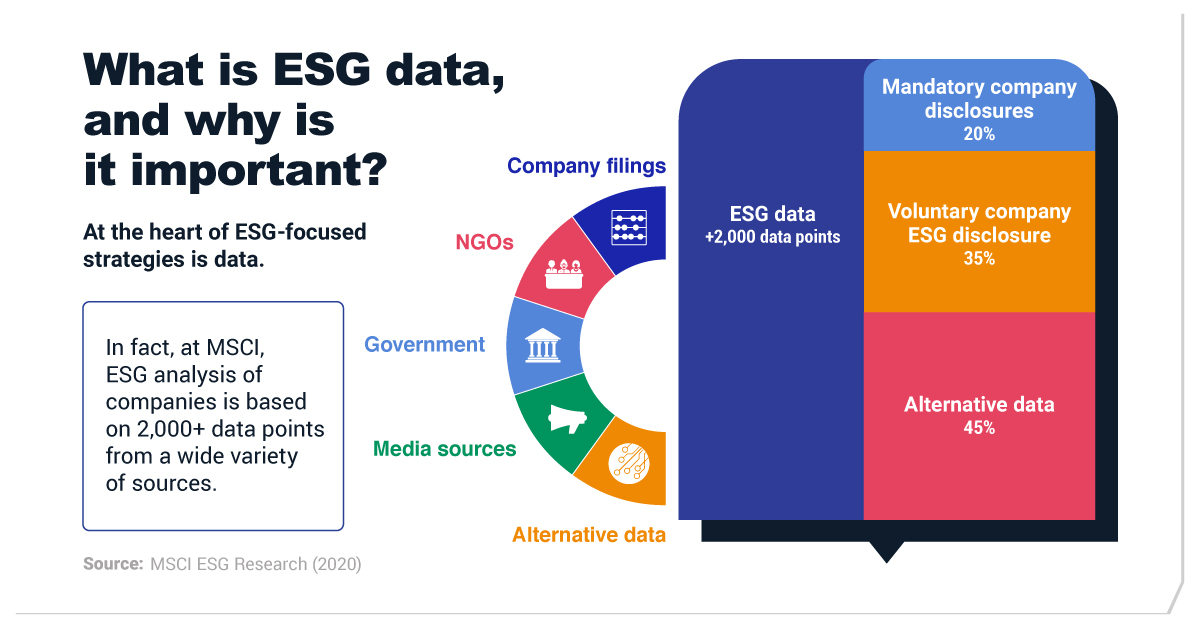

3. What is ESG data and why is it important?

At the heart of ESG-focused strategies is data. In some cases, ESG analysis of companies is based on over 2,000 data points from a wide cross-section of sources. For MSCI ESG Research, they fall within these three categories:

- Mandatory company disclosures: 20%

- Voluntary company ESG disclosure: 35%

- Alternative data: 45%

Alternative data commonly makes up 45% of the total ESG dataset—constituting far beyond what a company publicly discloses. Still, ESG data can seem vague or elusive. But this doesn’t have to be the case. Rather, ESG data can be broken down and obtained from the following five sources:

- Company filings: Shareholder results, voluntary ESG disclosures

- Non-governmental organizations (NGOs): Global Reporting Initiative (GRI), Task Force on Climate-related Financial Disclosures (TCFD), UN Sustainable Development Goals

- Government: U.S. Environmental Protection Agency (EPA), European Central Bank (ECB)

- Media sources: Major headlines

- Alternative data: Geo mapping, water scarcity data, flood risk analysis

Importantly, after ESG analysts identify the risks and opportunities most relevant to a company, multiple data points coalesce to inform a company’s ESG profile.

4. Why are environmental risks becoming more important?

Rising global temperatures and ecological disruptions pose imminent risks to humanity.

Along with this, other future risks could include: eroding shareholder value, blocked project proposals, regulation compliance costs, and higher borrowing costs. In response, national, corporate, and investor commitments to achieving net-zero emissions in alignment with the Paris Agreement have proliferated.

How does this affect the risk-return profile of investments?

According to research, climate change could erase $7.75 million in value over five years from a hypothetical $100 million portfolio that shared similar returns and volatility over a five-year period to the median global developed market fund as of December, 2019.

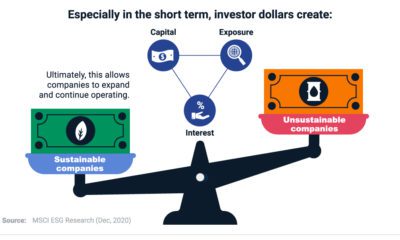

5. Will the consideration of ESG in a portfolio lead to underperformance?

Let’s turn our attention to performance, one of the most pressing questions surrounding ESG.

Companies with strong ESG profiles have an MSCI ESG rating of AAA or AA, meaning they lead their industry in managing the most significant ESG risks and opportunities. Studies show that companies with better ESG ratings have illustrated stronger performance, higher dividend payouts, and stronger earnings stability historically, on average.

They have also illustrated the following attributes:

- Lower cost of capital

- Less exposure to systemic risk

- Lower volatility

- Higher profitability

In addition, companies with strong MSCI ESG ratings may possess greater resilience. Stocks with high MSCI ESG ratings have had lower financial drawdowns during crises compared to their market-capitalization-weighted parent index.

Sustainable Investing: Shaping the Dialogue

Companies with higher environmental risks—including heavy carbon polluters, waste emitters, and poor water management—are facing greater scrutiny. At the same time, client demand is shifting to ESG, and the conversation is changing.

These questions can serve as a launching point for advisers to help clients seize new opportunities and mitigate investment risks.

Green

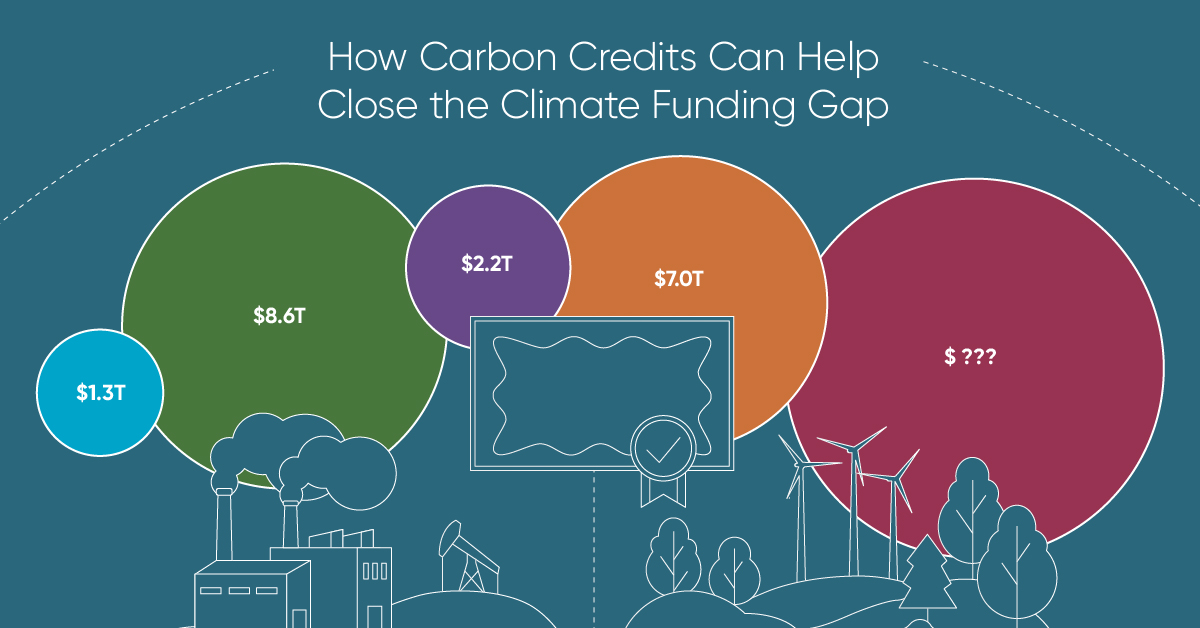

How Carbon Credits Can Help Close the Climate Funding Gap

To keep a 1.5℃ world within reach, global emissions need to fall by as much as 45% by 2030, and carbon credits could help close the gap.

How Carbon Credits Can Help Close the Climate Funding Gap

Governments around the world have committed to the goals of the Paris Agreement, but their climate pledges are insufficient. To keep a 1.5℃ world within reach, global emissions need to fall by as much as 45% by 2030.

Bold and immediate action is essential, but so are resources that will make it happen.

In this graphic, we have partnered with Carbon Streaming to look at the role that the voluntary carbon market and carbon credits can play in closing that gap.

More Funds are Needed for Climate Finance

According to data from the Climate Policy Initiative, climate finance, which includes funds for both adaptation and mitigation, needs to increase at least five-fold, from $1.3T in 2021/2022, to an average $8.6T annually until 2030, and then to just over $10T in the two decades leading up to 2050.

That adds up to a very large number, but consider that in 2022, $7.0T went to fossil fuel subsidies, which almost covers the annual estimated outlay. And the world has shown that when pressed, governments can come up with the money, if the global pandemic is any indication.

Mobilizing Carbon Finance to the Developing World

But the same cannot be said of the developing world, where debt, inequality, and poverty reduce the ability of governments to act. And this is where carbon credits can play an important role. According to analyses from Ecosystem Marketplace, carbon credits help move capital from developed countries, to where funds are needed in the developing world.

For example, in 2019, 69.2% of the carbon credits by volume in the voluntary carbon market were purchased by buyers in Europe, and nearly a third from North America. Compare that to over 90% of the volume of carbon credits sold in the voluntary carbon market in 2022 came from projects that were located outside of those two regions.

Carbon Credits Can Complement Decarbonization Efforts

Carbon credits can also complement decarbonization efforts in the corporate world, where more and more companies have been signing up to reduce emissions. According to the 2022 monitoring report from the Science Based Targets initiative, 4,230 companies around the world had approved targets and commitments, which represented an 88% increase from the prior year. However, as of year end 2022, combined scope 1 and 2 emissions covered by science-based targets totaled approximately 2 GtCO2e, which represents just a fraction of global emissions.

The fine print is that this is just scope 1 and 2 emissions, and doesn’t include scope 3 emissions, which can account for more than 70% of a company’s total emissions. And as these emissions come under greater and greater scrutiny the closer we get to 2030 and beyond, the voluntary carbon credit market could expand exponentially to help meet the need to compensate for these emissions.

Potential Carbon Credit Market Size in 2030

OK, but how big? In 2022, the voluntary carbon credit market was around $2B, but some analysts predict that it could grow to between $5–250 billion by 2030.

| Firm | Low Estimate | High Estimate |

|---|---|---|

| Bain & Company | $15B | $30B |

| Barclays | N/A | $250B |

| Citigroup | $5B | $50B |

| McKinsey & Company | $5B | $50B |

| Morgan Stanley | N/A | $100B |

| Shell / Boston Consulting Group | $10B | $40B |

Morgan Stanley and Barclays were the most bullish on the size of the voluntary carbon credit market in 2030, but the latter firm was even more optimistic about 2050, and predicted that the voluntary carbon credit market could grow to a colossal $1.5 trillion.

Carbon Streaming is Focused on Carbon Credit Integrity

Ultimately, carbon credits could have an important role to play in marshaling the resources needed to keep the world on track to net zero by 2050, and avoiding the worst consequences of a warming world.

Carbon Streaming uses streaming transactions, a proven and flexible funding model, to scale high-integrity carbon credit projects to advance global climate action and UN Sustainable Development Goals.

Learn more at www.carbonstreaming.com.

-

Green1 week ago

Green1 week agoRanking the Top 15 Countries by Carbon Tax Revenue

This graphic highlights France and Canada as the global leaders when it comes to generating carbon tax revenue.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

South Asian nations are the global hotspot for pollution. In this graphic, we rank the world’s most polluted countries according to IQAir.

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001

One country is taking reforestation very seriously, registering more than 400,000 square km of forest growth in two decades.

-

Green3 weeks ago

Green3 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

The country with the most forest loss since 2001 lost as much forest cover as the next four countries combined.

-

Markets2 months ago

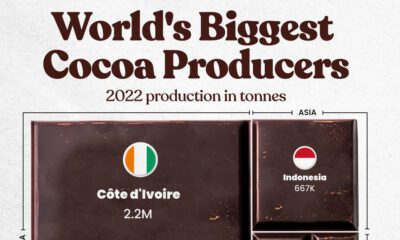

Markets2 months agoThe World’s Top Cocoa Producing Countries

Here are the largest cocoa producing countries globally—from Côte d’Ivoire to Brazil—as cocoa prices hit record highs.

-

Environment2 months ago

Environment2 months agoCharted: Share of World Forests by Country

We visualize which countries have the biggest share of world forests by area—and while country size plays a factor, so too, does the environment.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023