Business

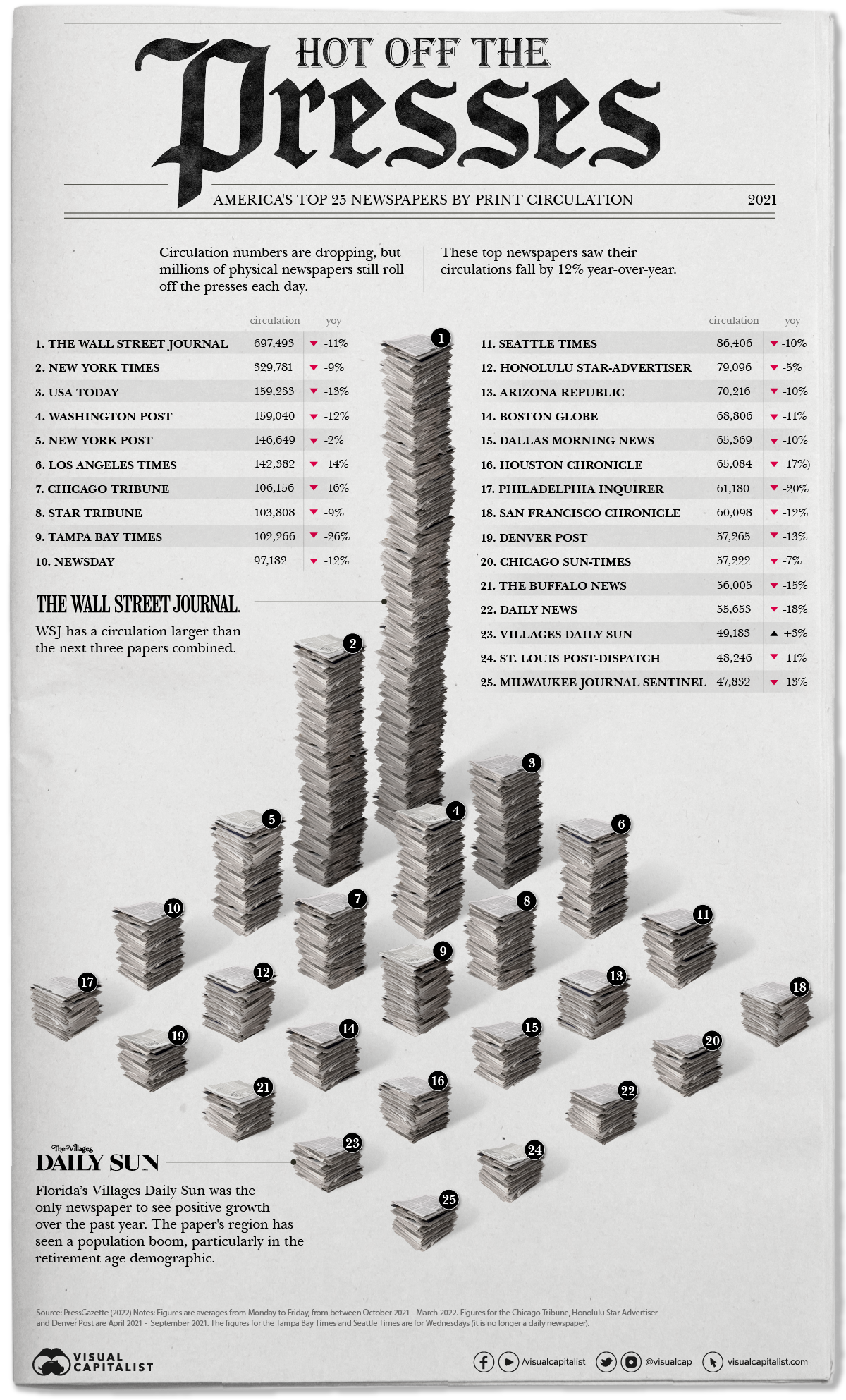

Visualized: The Top 25 U.S. Newspapers by Daily Circulation

Visualized: The Top 25 U.S. Newspapers by Daily Circulation

Most people today—more than 8 in 10 Americans—get their news via digital devices, doing their reading on apps, listening to podcasts, or scrolling through social media feeds.

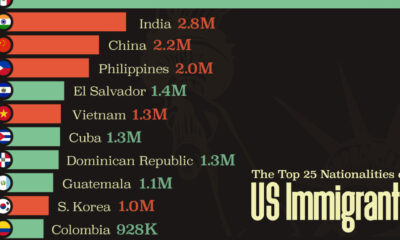

It’s no surprise then that over the last year, only one U.S. newspaper of the top 25 most popular in the country saw positive growth in their daily print circulations.

Based on data from Press Gazette, this visual stacks up the amount of daily newspapers different U.S. publications dole out and how that’s changed year-over-year.

Extra, Extra – Read All About It

The most widely circulated physical newspaper is the Wall Street Journal (WSJ) by a long shot—sending out almost 700,000 copies a day. But it is important to note that this number is an 11% decrease since 2021.

Here’s a closer look at the data.

| Rank | Newspaper | Average Daily Print Circulation | Year-Over-Year Change |

|---|---|---|---|

| #1 | Wall Street Journal | 697,493 | −11% |

| #2 | New York Times | 329,781 | −9% |

| #3 | USA Today | 159,233 | −13% |

| #4 | Washington Post | 159,040 | −12% |

| #5 | New York Post | 146,649 | −2% |

| #6 | Los Angeles Times | 142,382 | −14% |

| #7 | Chicago Tribune | 106,156 | −16% |

| #8 | Star Tribune | 103,808 | −9% |

| #9 | Tampa Bay Times | 102,266 | −26% |

| #10 | Newsday | 97,182 | −12% |

| #11 | Seattle Times | 86,406 | −10% |

| #12 | Honolulu Star-Advertiser | 79,096 | −5% |

| #13 | Arizona Republic | 70,216 | −10% |

| #14 | Boston Globe | 68,806 | −11% |

| #15 | Dallas Morning News | 65,369 | −10% |

| #16 | Houston Chronicle | 65,084 | −17% |

| #17 | Philadelphia Inquirer | 61,180 | −20% |

| #18 | San Francisco Chronicle | 60,098 | −12% |

| #19 | Denver Post | 57,265 | −13% |

| #20 | Chicago Sun-Times | 57,222 | −7% |

| #21 | The Buffalo News | 56,005 | −15% |

| #22 | Daily News | 55,653 | −18% |

| #23 | Villages Daily Sun | 49,183 | 3% |

| #24 | St. Louis Post-Dispatch | 48,246 | −11% |

| #25 | Milwaukee Journal Sentinel | 47,832 | −13% |

These papers, although experiencing negative growth when it comes to print, are still extremely popular and widely-read publications digitally—not only in the U.S., but worldwide. For example, the New York Times reported having reached 9 million subscribers globally earlier this year.

The one paper with increased print circulation was The Villages Daily Sun, which operates out of a retirement community in Florida. Elderly people tend to be the most avid readers of print papers. Another Florida newspaper, the Tampa Bay Times, was the worst performer at -26%.

In total, 2,500 U.S. newspapers have shut down since 2005. One-third of American newspapers are expected to be shuttered by 2025. This particularly impacts small communities and leaves many across America in ‘news deserts.’

Print vs. Digital Newspapers

Regardless of print’s downturn, digital subscriptions remain much higher for most of these papers. As one example, The Washington Post has over 3 million online subscribers, compared to their 159,000 print readers.

To put things in perspective, around 24 million print papers now circulate throughout the U.S. on any given day. But looking back at the industry’s peak in the 1980s, almost 64 million were distributed on any given weekday.

And digital is not done growing. Newsroom hires have been ramping up for “digital-native” news sites—publications that started online and never had a print version. On the flipside, employment at traditional papers has more than halved since 2008.

Problems with Media

American news media can be extremely divisive. Many newsrooms across the country play into fear, sensationalism, and partisan politics.

Digital news only makes this worse, utilizing algorithms designed to keep a person’s eyes on the page longer, pushing stories with narratives a person shows interest in, and often taking them down a rabbit hole of fringe information—sometimes towards the extremes.

Additionally, the business of journalism is an increasingly less lucrative industry. Most revenue comes from digital ads running on news sites—so rather than selling the news to consumers, it’s the time and attention of consumers that is being sold to advertisers. Furthermore, some of the best quality content is locked up behind subscription-based paywalls.

Print may actually be one way to avoid some of the more obvious issues, particularly because there’s no way to track the data on which stories you read. But all publications still have inherent bias, of course, and it’s clear that print papers are not bouncing back any time soon.

Finance

Ranked: The World’s 50 Largest Private Equity Firms

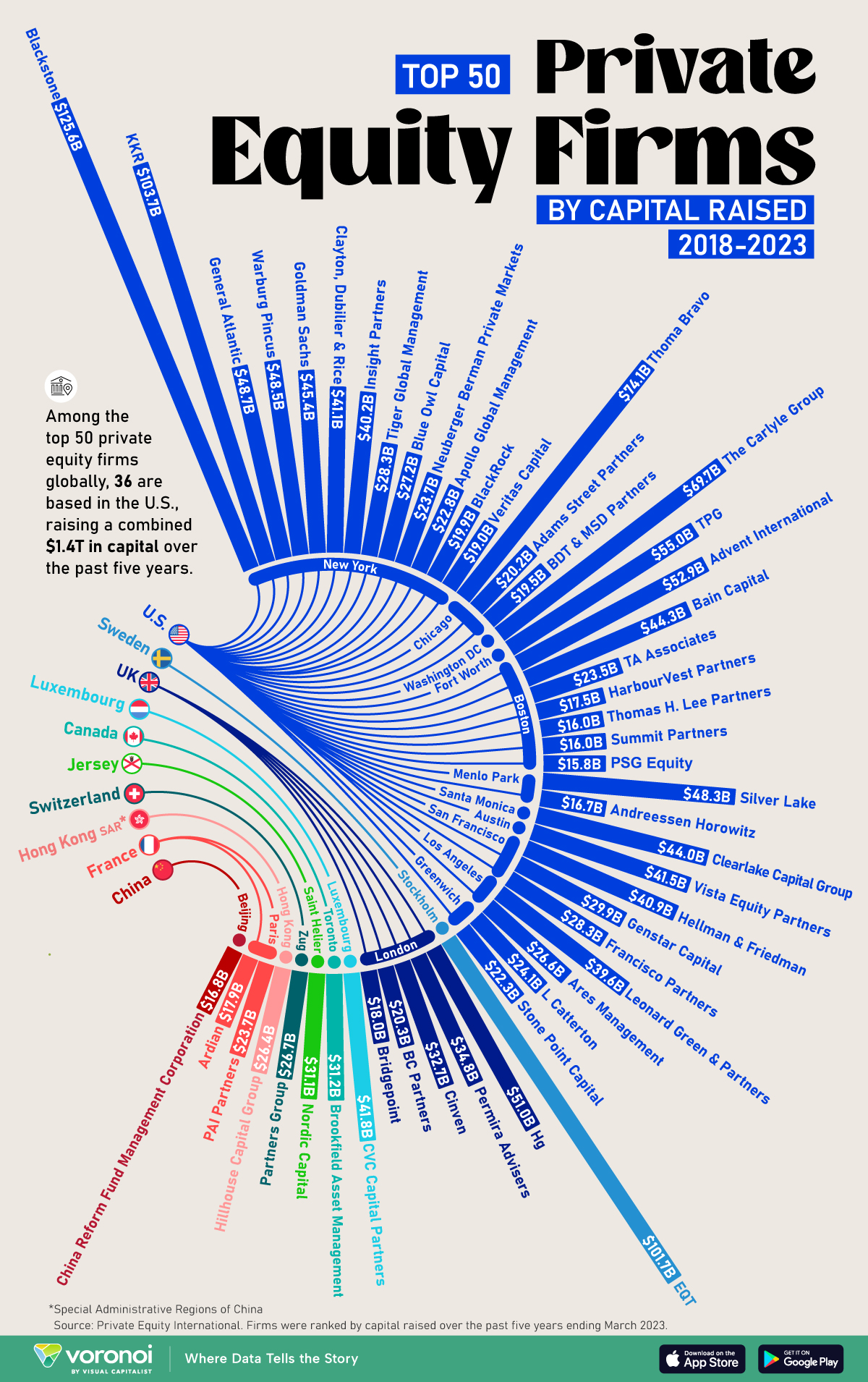

In this graphic, we show the largest private equity firms in the world—from titan Blackstone to China’s leading alternative funds.

The World’s 50 Largest Private Equity Firms

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In 2023, private equity firms controlled $8.2 trillion in assets globally according to McKinsey & Company, a figure that has rapidly expanded since the industry first emerged 40 years ago.

As large investors such as pension funds and insurance companies increasingly look to private markets, these alternative asset managers have seen their assets grow by more than twofold in the last five years.

This graphic shows the top 50 private equity firms worldwide, based on data from Private Equity International (PEI).

The Top 50 Private Equity Firms

To determine the rankings, private equity firms were defined as those that raise capital with the purpose of directly investing in businesses, covering diversified private equity, venture capital, growth equity, buyouts, along with turnaround or control-oriented distressed investment capital.

The ranking does not include funds of funds, private investment in public equity (PIPE), or funds that follow a secondaries, real estate, infrastructure, hedge fund, debt or mezzanine strategies.

Below, we show the 50 biggest private equity companies around the world, measured by the scale of capital raised over the five-year period ending March 31, 2023:

| Ranking | Fund Manager | City | Capital Raised |

|---|---|---|---|

| 1 | Blackstone | New York | $125.6B |

| 2 | KKR | New York | $103.7B |

| 3 | EQT | Stockholm | $101.7B |

| 4 | Thoma Bravo | Chicago | $74.1B |

| 5 | The Carlyle Group | Washington DC | $69.7B |

| 6 | TPG | Fort Worth | $55.0B |

| 7 | Advent International | Boston | $52.9B |

| 8 | Hg | London | $51.0B |

| 9 | General Atlantic | New York | $48.7B |

| 10 | Warburg Pincus | New York | $48.5B |

| 11 | Silver Lake | Menlo Park | $48.3B |

| 12 | Goldman Sachs | New York | $45.4B |

| 13 | Bain Capital | Boston | $44.3B |

| 14 | Clearlake Capital Group | Santa Monica | $44.0B |

| 15 | CVC Capital Partners | Luxembourg | $41.8B |

| 16 | Vista Equity Partners | Austin | $41.5B |

| 17 | Clayton, Dubilier & Rice | New York | $41.1B |

| 18 | Hellman & Friedman | San Francisco | $40.9B |

| 19 | Insight Partners | New York | $40.2B |

| 20 | Leonard Green & Partners | Los Angeles | $39.6B |

| 21 | Permira Advisers | London | $34.8B |

| 22 | Cinven | London | $32.7B |

| 23 | Brookfield Asset Management | Toronto | $31.2B |

| 24 | Nordic Capital | Saint Helier | $31.1B |

| 25 | Genstar Capital | San Francisco | $29.9B |

| 26 | Francisco Partners | San Francisco | $28.3B |

| 27 | Tiger Global Management | New York | $28.3B |

| 28 | Blue Owl Capital | New York | $27.2B |

| 29 | Partners Group | Zug | $26.7B |

| 30 | Ares Management | Los Angeles | $26.6B |

| 31 | Hillhouse Capital Group | Singapore | $26.4B |

| 32 | L Catterton | Greenwich | $24.1B |

| 33 | Neuberger Berman Private Markets | New York | $23.7B |

| 34 | PAI Partners | Paris | $23.7B |

| 35 | TA Associates | Boston | $23.5B |

| 36 | Apollo Global Management | New York | $22.8B |

| 37 | Stone Point Capital | Greenwich | $22.3B |

| 38 | BC Partners | London | $20.3B |

| 39 | Adams Street Partners | Chicago | $20.2B |

| 40 | BlackRock | New York | $19.9B |

| 41 | BDT & MSD Partners | Chicago | $19.5B |

| 42 | Veritas Capital | New York | $19.0B |

| 43 | Bridgepoint | London | $18.0B |

| 44 | Ardian | Paris | $17.9B |

| 45 | HarbourVest Partners | Boston | $17.5B |

| 46 | China Reform Fund Management Corporation | Beijing | $16.8B |

| 47 | Andreessen Horowitz | Menlo Park | $16.7B |

| 48 | Thomas H. Lee Partners | Boston | $16.0B |

| 49 | Summit Partners | Boston | $16.0B |

| 50 | PSG Equity | Boston | $15.8B |

Private equity titan Blackstone is the top in the United States and the world, raising $125.6 billion in capital from 2018 to 2023.

Headquartered in New York, Blackstone’s total assets under management stood at $991 billion as of the first quarter of 2023, and have since surpassed $1 trillion this year. For perspective, this is comparable to the GDP of the Netherlands.

Following next in line are KKR and Sweden’s EQT, each raising over $100 billion. In fact, this was the first time three firms achieved this $100 billion equity-raise milestone in PEI’s ranking over a five-year period. This was particularly notable given a challenging fundraising landscape amid higher borrowing costs and lagging dealmaking activity.

North American Firms Dominate Private Equity

As we can see, the vast majority of the biggest private equity firms are based in America, accounting for 36 of the top 50 firms globally. North American PE firms made up $1.34 trillion (72%) of the $1.85 trillion raised by the top 50 firms in the ranking.

Falling in second by a wide margin is Europe, with nine firms making up $179 billion (9.7%) of the total funds raised. Many of Europe’s largest private equity firms are based in London, England, with the most prominent asset managers in the city being Hg and Permira Advisors.

Across Asia, the top alternative investment firm was Singapore-based Hillhouse Capital Group, which launched in 2005. The firm has backed several internet companies spanning from Tencent, the largest publicly-traded company in China, to Baidu, but has faced increasing setbacks amid regulatory crackdowns and a sluggish Chinese stock market.

-

United States1 week ago

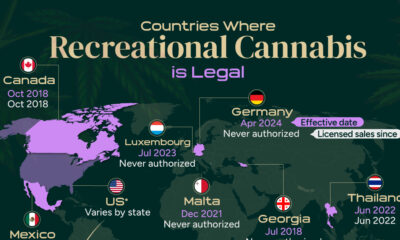

United States1 week agoMapped: Countries Where Recreational Cannabis is Legal

-

Healthcare2 weeks ago

Healthcare2 weeks agoLife Expectancy by Region (1950-2050F)

-

Markets2 weeks ago

Markets2 weeks agoThe Growth of a $1,000 Equity Investment, by Stock Market

-

Markets2 weeks ago

Markets2 weeks agoMapped: Europe’s GDP Per Capita, by Country

-

Money2 weeks ago

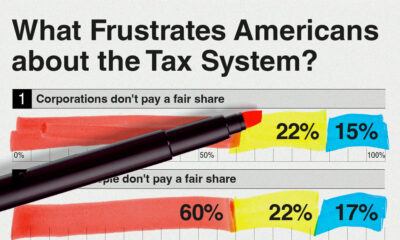

Money2 weeks agoCharted: What Frustrates Americans About the Tax System

-

Technology2 weeks ago

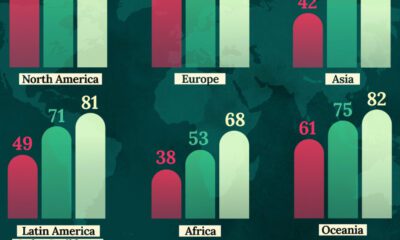

Technology2 weeks agoCountries With the Highest Rates of Crypto Ownership

-

Mining2 weeks ago

Mining2 weeks agoWhere the World’s Aluminum is Smelted, by Country

-

Personal Finance2 weeks ago

Personal Finance2 weeks agoVisualizing the Tax Burden of Every U.S. State