Markets

Visualized: A Global Risk Assessment of 2022 and Beyond

Visualized: A Global Risk Assessment of 2022 and Beyond

Since the start of the global pandemic, we’ve been navigating through tumultuous waters, and this year is expected to be as unpredictable as ever.

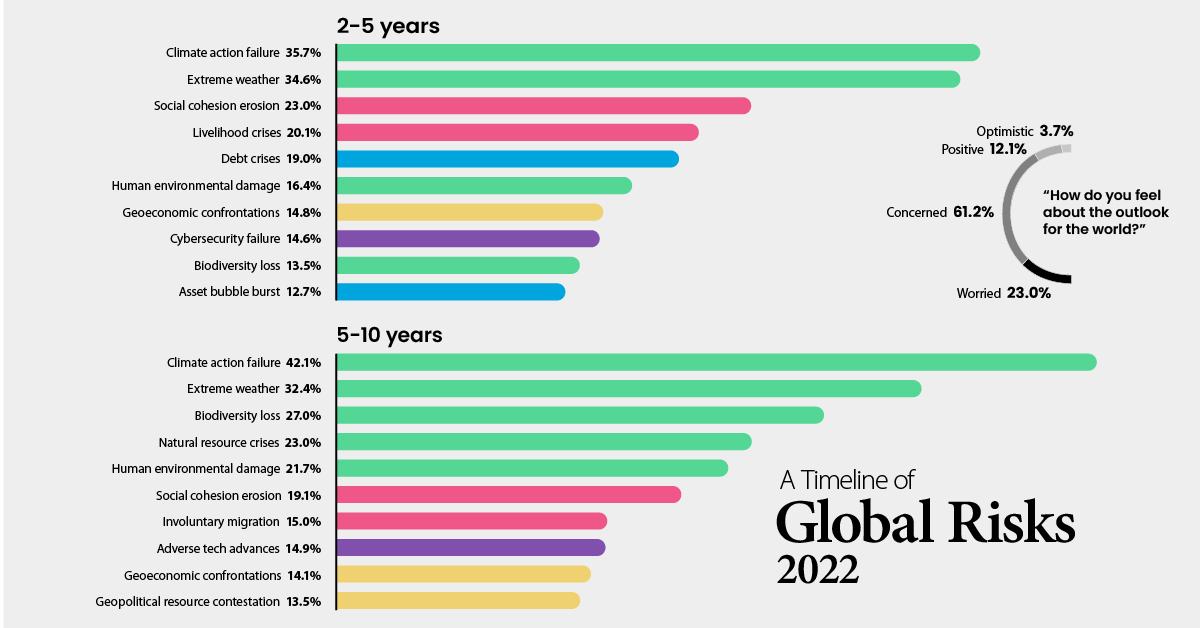

In the latest annual edition of the Global Risks Report by the World Economic Forum (WEF), it was found that a majority of global leaders feel worried or concerned about the outlook of the world, and only 3.7% feel optimistic.

Ever year, the report identifies the top risks facing the world, as identified by nearly 1,000 surveyed experts and leaders across various disciplines, organizations, and geographies.

What global risks are leaders and experts most concerned about, and which ones are posing imminent threats? Let’s dive into the key findings from the report.

Methodology for WEF’s Global Risk Assessment

In the survey, respondents were asked to compare 37 different risks, which were broken down into five categories: economic, environmental, geopolitical, societal, and technological.

To get a sense of which risks were seen as more urgent than others, respondents were asked to identify when they believed these threats would become a serious problem to the world, based on the following timeframes:

- Short-term threats: 0-2 years

- Medium-term threats: 2-5 years

- Long-term threats: 5-10 years

By categorizing global risks into these time horizons, it helps provide a better idea of the problems that decision makers and governments may have to deal with in the near future, and how these risks may interrelate with one another.

Short-Term Risks

When it comes to short-term threats, respondents identified societal risks such as “the erosion of social cohesion” and “livelihood crises” as the most immediate risks to the world.

| Timeframe | Category | Threat | % of Respondents |

|---|---|---|---|

| 0-2 years | 🟢 Environmental | Extreme weather | 31.1% |

| 0-2 years | 🔴 Societal | Livelihood crises | 30.4% |

| 0-2 years | 🟢 Environmental | Climate action failure | 27.5% |

| 0-2 years | 🔴 Societal | Social cohesion erosion | 27.5% |

| 0-2 years | 🔴 Societal | Infectious diseases | 26.4% |

| 0-2 years | 🔴 Societal | Mental health deterioration | 26.1% |

| 0-2 years | 🟣 Technological | Cybersecurity failure | 19.5% |

| 0-2 years | 🔵 Economic | Debt crises | 19.3% |

| 0-2 years | 🟣 Technological | Digital inequality | 18.2% |

| 0-2 years | 🔵 Economic | Asset bubble burst | 14.2% |

These societal risks have worsened since the start of COVID-19. And as emerging variants threaten our journey towards normalcy, the pandemic continues to wreak havoc worldwide, with no immediate signs of slowing down.

According to respondents, one problem triggered by the pandemic is rising inequality, both worldwide and within countries.

Many developed economies managed to adapt as office workers pivoted to remote and hybrid work, though many industries, such as hospitality, still face significant headwinds. Easy access to vaccines has helped these countries mitigate the worst effects of outbreaks.

Regions with low access to vaccines have not been so fortunate, and the economic divide could become more apparent as the pandemic stretches on.

Medium-Term Risks

A majority of respondents believe we’ll continue to struggle with pandemic-related issues for the next three years. Because of this, the medium-term risks identified by respondents are fairly similar to the short-term risks.

| Timeframe | Category | Threat | % of Respondents |

|---|---|---|---|

| 2-5 years | 🟢 Environmental | Climate action failure | 35.7% |

| 2-5 years | 🟢 Environmental | Extreme weather | 34.6% |

| 2-5 years | 🔴 Societal | Social cohesion erosion | 23.0% |

| 2-5 years | 🔴 Societal | Livelihood crises | 20.1% |

| 2-5 years | 🔵 Economic | Debt crises | 19.0% |

| 2-5 years | 🟢 Environmental | Human environmental damage | 16.4% |

| 2-5 years | 🟡 Geopolitical | Geoeconomic confrontations | 14.8% |

| 2-5 years | 🟣 Technological | Cybersecurity failure | 14.6% |

| 2-5 years | 🟢 Environmental | Biodiversity loss | 13.5% |

| 2-5 years | 🔵 Economic | Asset bubble burst | 12.7% |

The pressing issues caused by COVID-19 mean that many key governments and decision-makers are struggling to prioritize long-term planning, and no longer have the capacity to help out with global issues. For example, the UK government postponed its foreign aid target until at least 2024. If countries continue to prioritize themselves in an effort to mitigate the impact of COVID-19, the inequality gap could widen even further.

Respondents also worry about rising debt levels triggering a crisis. The debt-to-GDP ratio globally spiked by 13 percentage points in 2020, a figure that will almost certainly continue to rise in the near future.

Long-Term Risks

Respondents identified climate change as the biggest threat to humanity in the next decade.

| Timeframe | Category | Threat | % of Respondents |

|---|---|---|---|

| 5-10 years | 🟢 Environmental | Climate action failure | 42.1% |

| 5-10 years | 🟢 Environmental | Extreme weather | 32.4% |

| 5-10 years | 🟢 Environmental | Biodiversity loss | 27.0% |

| 5-10 years | 🟢 Environmental | Natural resource crises | 23.0% |

| 5-10 years | 🟢 Environmental | Human environmental damage | 21.7% |

| 5-10 years | 🔴 Societal | Social cohesion erosion | 19.1% |

| 5-10 years | 🔴 Societal | Involuntary migration | 15.0% |

| 5-10 years | 🟣 Technological | Adverse tech advances | 14.9% |

| 5-10 years | 🟡 Geopolitical | Geoeconomic confrontations | 14.1% |

| 5-10 years | 🟡 Geopolitical | Geopolitical resource contestation | 13.5% |

Climate inaction—essentially business as usual—could lead to a global GDP loss between 4% and 18%, with varying impacts across different regions.

Experts also pointed out that current decarbonization commitments made at COP26 last year still aren’t enough to slow warming to the 1.5°C goal set in the Paris Climate Agreement, so more action is needed to mitigate environmental risk.

That said, efforts to curb climate change and solve long-term issues will likely have negative short-term impacts on the global economy and society. So risk mitigation efforts need to be in place as we work to reach net-zero and ultimately slow down climate change.

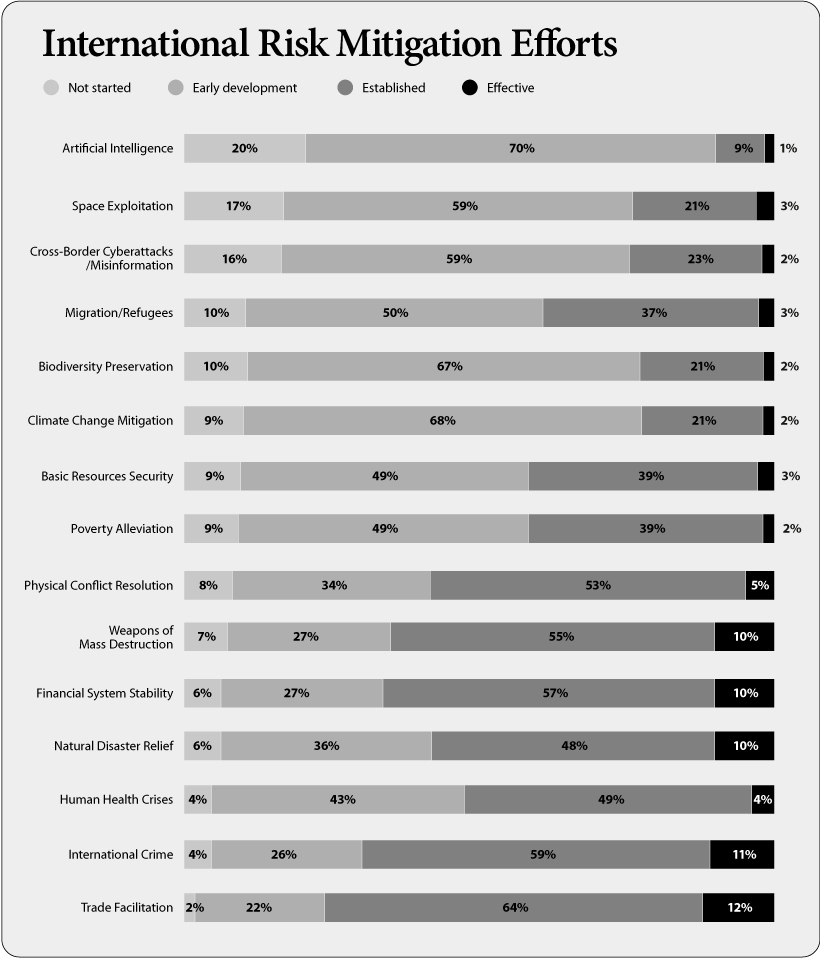

Risk Mitigation Efforts

People’s thoughts on risk mitigation were gauged in the WEF survey. Respondents were asked to identify which risks our world is most equipped to handle, and which ones they believe we’re less prepared for.

“Trade facilitation,” “international crime,” and “weapons of mass destruction” were risks that respondents felt we’ve effectively prepared for. On the flip side, “artificial intelligence” and “cross-border cyberattacks and misinformation” are areas where most respondents think we’re most unprotected against.

As society becomes increasingly reliant on digital infrastructure, experts predict we will see an uptick in cyber attacks and cybercrime. New AI-enabled technologies that offer ransomware-as-a-service allow anyone to engage in cybercrime—even those without the technical knowledge needed to build malware.

How Do We Move Forward?

Based on the findings from this year’s survey, WEF identified five lessons that governments, businesses, and decision-makers should utilize in order to build resilience and prepare for future challenges:

- Build a holistic mitigation framework: Rather than focusing on specific risks, it’s helpful to identify the big-picture worst-case scenario and work back from there. Build holistic systems that protect against adverse outcomes.

- Consider the entire ecosystem: Examine third-party services and external assets, and analyze the broader ecosystem in which you operate.

- Embrace diversity in resilience strategies: Not all strategies will work across the board. Complex problems will require nuanced efforts. Adaptability is key.

- Connect resilience efforts with other goals: Many resilience efforts could benefit multiple aspects of society. For instance, efficient supply chains could strengthen communities and contribute to environmental goals.

- Think of resilience as a journey, not a destination: Remaining agile and vigilant is vital when building out resilience programs, as these efforts are new and require reflection in order to improve.

The next few years will be riddled with complex challenges, and our best chance at mitigating these global risks is through increased collaboration and consistent reassessment.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.

-

Automotive1 week ago

Automotive1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money1 week ago

Money1 week agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population