Markets

The Stocks Driving S&P 500 Returns in 2024

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

The Stocks Driving S&P 500 Returns in 2024

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The S&P 500 is sitting at near-record highs, returning 15% year-to-date as of June 26, 2024.

Today, a limited number of stocks are powering the stock market’s rally as investors pour money into companies that are advancing AI technologies. As share prices skyrocket, many wonder if company valuations are overheated—or if they are supported by strong corporate fundamentals.

This graphic shows the top 10 S&P 500 stocks driving stock market returns in 2024, based on data from Goldman Sachs.

Big Tech Stocks Are Fueling Gains

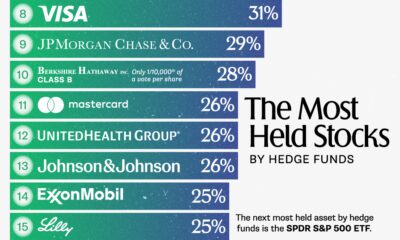

Below, we show the companies making the largest contribution to the S&P 500’s rally:

| Rank | Company | Ticker | Contribution to S&P 500 Return YTD as of June 13, 2024 |

|---|---|---|---|

| 1 | Nvidia | NVDA | 4.94% |

| 2 | Microsoft | MSFT | 1.24% |

| 3 | Alphabet | GOOGL | 0.97% |

| 4 | Meta | META | 0.84% |

| 5 | Apple | AAPL | 0.81% |

| 6 | Amazon | AMZN | 0.72% |

| 7 | Broadcom | AVGO | 0.62% |

| 8 | Eli Lilly & Co. | LLY | 0.60% |

| 9 | Berkshire Hathaway | BRK.B | 0.22% |

| 10 | QUALCOMM | QCOM | 0.21% |

| Total S&P 500 Return YTD 2024 | 14.65% |

As of June 13, 2024.

Chipmaker Nvidia has driven over a third of S&P 500 returns this year, with its share price soaring 162% year-to-date as of June 13, 2024.

In June, Nvidia became the world’s most valuable firm, commanding an estimated 70% to 95% of the AI chip market. In the latest quarter, revenue surged by threefold compared to a year earlier amid high chip demand. Overall, big tech companies such as Meta, Amazon, and Microsoft made up roughly 45% of its data-center revenue, with Meta running a staggering 350,000 H100 chips to power its AI systems this year alone.

Falling in second is Microsoft, which has invested billions in AI startups including OpenAI and Wayve, a self-driving car firm. Microsoft is a cloud service provider for ChatGPT, the large language model built by OpenAI. As AI demand exceeds capacity, and other business segments see solid growth, Microsoft’s revenue increased 17% year-over-year as of the second quarter of 2024.

Google’s parent, Alphabet, ranks next, followed by Meta and Apple. Each of these companies is working on their own large language model which costs millions to train and run. Together, the top five stocks are driving about 60% of the S&P 500’s returns.

As we can see, just two of the top 10 S&P 500 stocks are not big tech names: pharmaceutical giant Eli Lilly and Berkshire Hathaway. This year, Eli Lilly’s share price is surging due to strong demand for its weight loss drug, Zepbound. During the first quarter of 2024, the newly-approved drug generated over $517 million in sales. Given its reported effectiveness, some analysts are forecasting it could be the best-selling drug ever in American history.

Markets

Which Countries Have the Highest Corporate Tax Rates in the G20?

Interestingly, BRICS members cover the spectrum of corporate tax rates in the G20 from highest (India, Brazil) to lowest (Russia).

Which Countries Have the Highest Corporate Tax Rates in G20?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In the wake of the 1999 Asian financial crisis, government representatives from the 20 largest economies in the world decided to informally gather to coordinate policy on trade. Thus began the G20.

Together the bloc accounts for more than 85% of the world economy and has been credited with unified policy action in response to world events.

However, despite this shared affiliation, this group is still made of fundamentally different economies with varied policies towards their business entities.

For a quick overview, we visualize and rank the G20 countries by their headline corporate tax rates. Data is sourced from Trading Economics, accessed June 2024. Data for the EU and the African Union (both G20 members) has not been included.

Ranked: G20 Members by Their Corporate Tax Rates

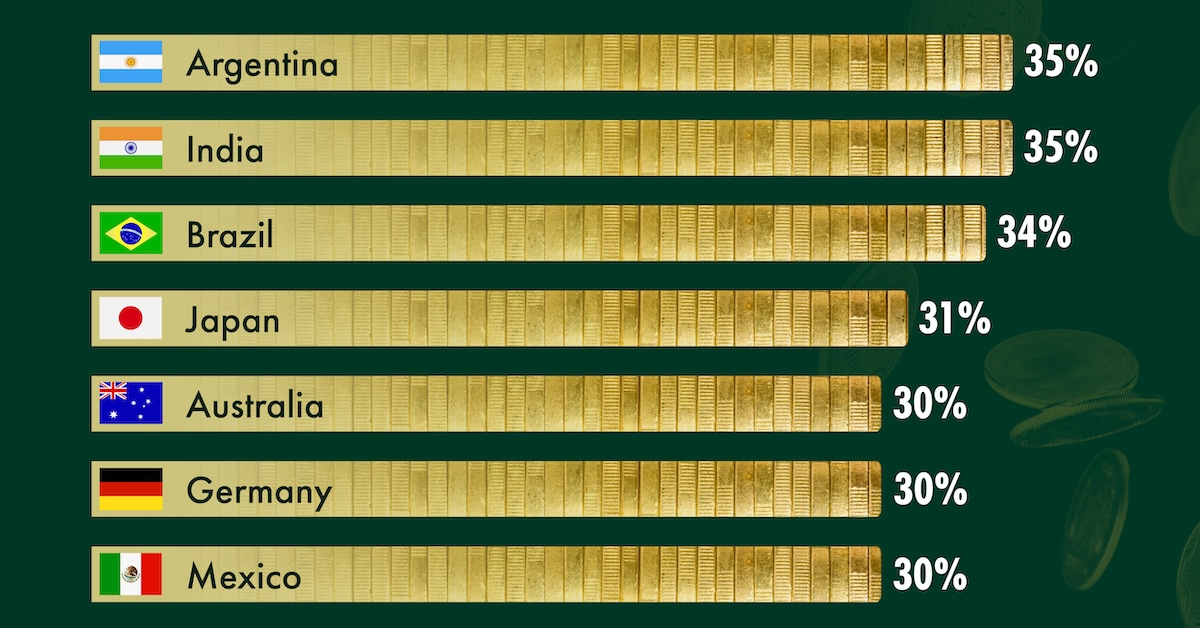

Argentina and India have the highest corporate income tax rates, at 35% in the G20.

However, both countries have a progressive ladder for taxation, so this headline number may only apply to a smaller subset of firms. For foreign companies with a “permanent entity” in India, the rate climbs past 40%.

| Rank | G20 Member | Corporate Tax Rate |

|---|---|---|

| 1 | 🇦🇷 Argentina | 35% |

| 2 | 🇮🇳 India | 35% |

| 3 | 🇧🇷 Brazil | 34% |

| 4 | 🇯🇵 Japan | 31% |

| 5 | 🇦🇺 Australia | 30% |

| 6 | 🇩🇪 Germany | 30% |

| 7 | 🇲🇽 Mexico | 30% |

| 8 | 🇨🇦 Canada | 27% |

| 9 | 🇿🇦 South Africa | 27% |

| 10 | 🇨🇳 China | 25% |

| 11 | 🇫🇷 France | 25% |

| 12 | 🇹🇷 Türkiye | 25% |

| 13 | 🇬🇧 UK | 25% |

| 14 | 🇮🇹 Italy | 24% |

| 15 | 🇰🇷 South Korea | 24% |

| 16 | 🇮🇩 Indonesia | 22% |

| 17 | 🇺🇸 U.S. | 21% |

| 18 | 🇷🇺 Russia | 20% |

| 19 | 🇸🇦 Saudi Arabia | 20% |

Note: EU and African Union not included. Figures rounded. Data accessed June 2024.

Interestingly, BRICS countries cover the spectrum of corporate tax rates. Starting from the highest (India, Brazil) to middle of the pack (South Africa, China) to lowest (Russia).

On the other hand, most of the G7 cluster in the mid-ranges (24–30%), with Japan the highest outlier (31%) and the U.S. the lowest exception (21%).

In fact, after Saudi Arabia and Russia (20%), the U.S. has the third-lowest corporate tax rate of all G20 economies.

This wasn’t always the case. The 2018 “Trump Tax” law was the largest overhaul of the tax code in three decades, part of which reduced the corporate tax rate from 35% to 21%.

-

Money2 weeks ago

Money2 weeks agoVisualizing the Wealth of Americans Under 40 (1989-2023)

-

Markets1 week ago

Markets1 week agoRanked: Which NHL Team Takes Home the Most Revenue?

-

Maps1 week ago

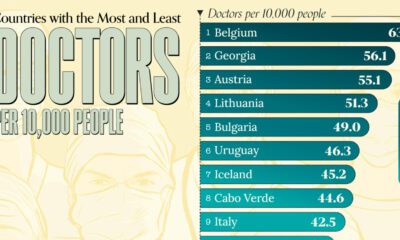

Maps1 week agoMapped: Highest and Lowest Doctor Density Around the World

-

Money1 week ago

Money1 week agoRanked: The World’s Top 10 Billionaires in 2024

-

Markets1 week ago

Markets1 week agoAll of the World’s Trillion-Dollar Companies in One Chart

-

Markets1 week ago

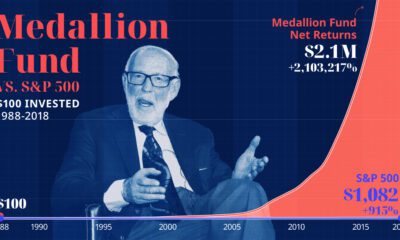

Markets1 week agoThe Growth of $100 Invested in Jim Simons’ Medallion Fund

-

Markets1 week ago

Markets1 week agoCharted: Four Decades of U.S. Tech IPOs

-

Retail1 week ago

Retail1 week agoRanked: The 20 Top Retailers Worldwide, by Revenue