Technology

The Game of Life: Visualizing China’s Social Credit System

The Game of Life: Visualizing China’s Social Credit System

In an attempt to imbue trust, China has announced a plan to implement a national ranking system for its citizens and companies. Currently in pilot mode, the new system will be rolled out in 2020, and go through numerous iterations before becoming official.

While the system may be a useful tool for China to manage its growing 1.4 billion population, it has triggered global concerns around the ethics of big data, and whether the system is a breach of fundamental human rights.

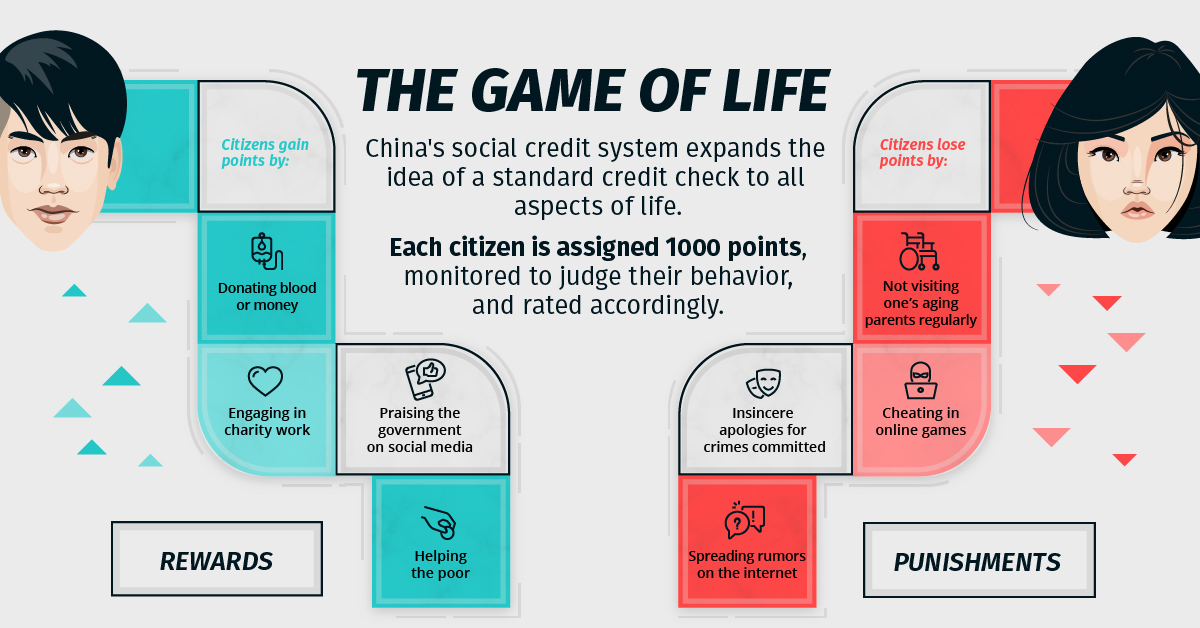

Today’s infographic looks at how China’s proposed social credit system could work, and what the implications might be.

The Government is Always Watching

Currently, the pilot system varies from place to place, whereas the new system is envisioned as a unified system. Although the pilot program may be more of an experiment than a precursor, it gives a good indication of what to expect.

In the pilot system, each citizen is assigned 1,000 points and is consistently monitored and rated on how they behave. Points are earned through good deeds, and lost for bad behavior. Users increase points by donating blood or money, praising the government on social media, and helping the poor. Rewards for such behavior can range from getting a promotion at work fast-tracked, to receiving priority status for children’s school admissions.

In contrast, not visiting one’s aging parents regularly, spreading rumors on the internet, and cheating in online games are considered antisocial behaviors. Punishments include public shaming, exclusion from booking flights or train tickets, and restricted access to public services.

Big Data Goes Right to the Source

The perpetual surveillance that comes with the new system is expected to draw on huge amounts of data from a variety of traditional and digital sources.

Police officers have used AI-powered smart glasses and drones to effectively monitor citizens. Footage from these devices showing antisocial behavior can be broadcast to the public to shame the offenders, and deter others from behaving similarly.

For more serious offenders, some cities in China force people to repay debts by switching the person’s ringtone without their permission. The ringtone begins with the sound of a police siren, followed by a message such as:

“The person you are calling has been listed as a discredited person by the local court. Please urge this person to fulfill his or her legal obligations.”

Two of the largest companies in China, Tencent and Alibaba, were enlisted by the People’s Bank of China to play an important role in the credit system, raising the issue of third-party data security. WeChat—China’s largest social media platform, owned by Tencent—tracked behavior and ranked users accordingly, while displaying their location in real-time.

Following data concerns, these tech companies—and six others—were not awarded any licenses by the government. However, social media giants are still involved in orchestrating the public shaming of citizens who misbehave.

The Digital Dang’an

The social credit system may not be an entirely new initiative in China. The dang’an (English: record) is a paper file containing an individual’s school reports, information on physical characteristics, employment records, and photographs.

These dossiers, which were first used in the Maoist years, helped the government in maintaining control of its citizens. This gathering of citizen’s data for China’s social credit system may in fact be seen as a revival of the principle of dang’an in the digital era, with the system providing a powerful tool to monitor citizens whose data is more difficult to capture.

Is the System Working?

In 2018, people with a low score were prohibited from buying plane tickets almost 18 million times, while high-speed train ticket transactions were blocked 5.5 million times. A further 128 people were prohibited from leaving China, due to unpaid taxes.

The system could have major implications for foreign business practices—as preference could be given to companies already ranked in the system. Companies with higher scores will be rewarded with incentives which include lower tax rates and better credit conditions, with their behavior being judged in areas such as:

- Paid taxes

- Customs regulation

- Environmental protection

Despite the complexities of gathering vast amounts of data, the system is certainly making an impact. While there are benefits to having a standardized scoring system, and encouraging positive behavior—will it be worth the social cost of gamifying human life?

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money1 week ago

Money1 week agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population