Money

Making Billions: The Richest People in the World

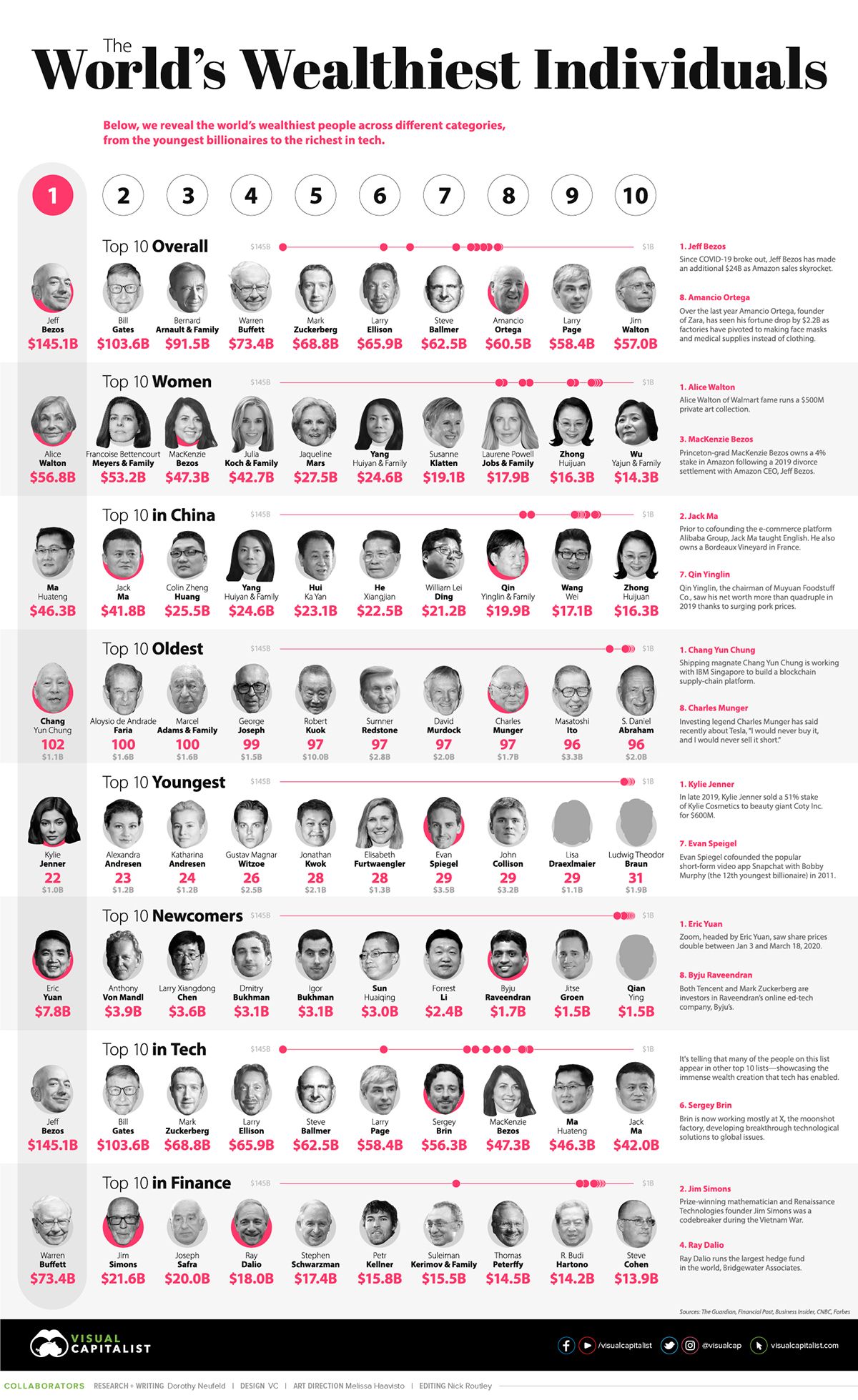

The Richest People in the World

In the last year, the wealth controlled by the world’s top 10 billionaires has jumped by over $76B.

Even in the teeth of jittery markets, many of the world’s richest people have seen their wealth surge to new heights as COVID-19 unfolds.

Today’s infographic draws data from Forbes Billionaire’s List and shows a broad cross-section of the world’s billionaires – highlighting their stratospheric wealth in the current economic climate.

Wealth in Astonishing Circumstances

The below table shows the fortunes of the world’s 10 richest people, comparing the numbers from March 5, 2019 to the most recent data from April 22, 2020.

| Rank | Name | Net Worth 2020* | Net Worth 2019* | Change 2019-2020 |

|---|---|---|---|---|

| #1 | Jeff Bezos | $145B | $131B | +$14.1B |

| #2 | Bill Gates | $104B | $97B | +$7.1B |

| #3 | Bernard Arnault & Family | $92B | $76B | +$15.5B |

| #4 | Warren Buffett | $73B | $83B | -$9.1B |

| #5 | Mark Zuckerberg | $69B | $62B | +$6.5B |

| #6 | Larry Ellison | $66B | $63B | +$3.4B |

| #7 | Steve Ballmer | $63B | $41B | +$21.3B |

| #8 | Amancio Ortega | $61B | $63B | -$2.2B |

| #9 | Larry Page | $58B | $51B | +$7.6B |

| #10 | Jim Walton | $57B | $45B | +$12.0B |

| Total Change | +$76.2B |

Source: Forbes – *As of April 22, 2020 **As of March 5, 2019

Gaining the highest across the top 10 is former Microsoft CEO Steve Ballmer, who saw his fortune rise over $21 billion since March 2019.

Facing the steepest losses belong to investing luminary Warren Buffett, whose net worth has dropped over $9 billion over the past year. At year-end 2019 Buffett was a 11% shareholder in Delta Airlines. In April, Buffett sold 13 million shares in the airline.

Meanwhile, Mark Zuckerberg’s fortune is holding steady. Amazingly, the Facebook founder still remains one of the world’s youngest billionaires (ranking 22nd out of 2,095) despite first joining the billionaire club a dozen years ago.

Newcomers to the List

As a new decade begins, who are among the most newly-minted billionaires?

Eric Yuan, CEO of Zoom has climbed in the ranks as online video communication demand soars. Zoom went public in April 2019 at a stunning $9.2 billion IPO valuation. As of April 24, 2020, Zoom was valued at over $44.3 billion.

| Rank | Name | Net Worth | Source of Wealth |

|---|---|---|---|

| #1 | Eric Yuan | $7.8B | Zoom |

| #2 | Anthony von Mandl | $3.9B | Mark Anthony Brands |

| #3 | Larry Xiangdong Chen | $3.6B | GSX Techedu |

| #4 | Dmitry Bukhman | $3.1B | Playrix |

| #5 | Igor Bukhman | $3.1B | Playrix |

| #6 | Sun Huaiqing | $3.0B | Guangdong Marubi Biotechnology |

| #7 | Forrest Li | $2.4B | Sea Group |

| #8 | Byju Raveendran | $1.7B | Byju's |

| #9 | Jitse Groen | $1.5B | Takeaway.com |

| #10 | Qian Ying | $1.5B | Muyuan Foods |

*As of April 22, 2020

Similarly, Netherland’s Jitse Groen has witnessed his food-delivery company Takeaway.com expand extensively. Takeaway.com currently operates in 11 countries across Europe and received regulatory approval to complete a $7.6 billion merger with JustEat in April.

Forrest Li who runs Sea, an online-gaming and e-commerce company, has similarly joined the ranks. Tencent and private equity firm General Atlantic are among its major stakeholders.

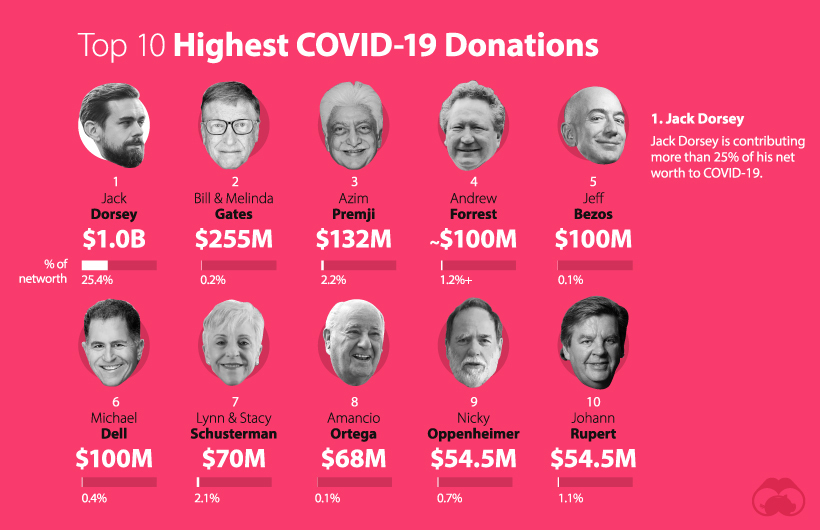

The COVID-19 Response

As the global economy contends with a loss of confidence and job losses, some of the world’s richest people are stepping up to the plate.

Twitter CEO Jack Dorsey is donating roughly 25% of his net worth to COVID-19 in the form of Square stock, valued at $1B.

His donation, which was placed in a donor-advised fund called Start Small LLC, is more than four times higher than any other billionaire. That said, after the pandemic, Dorsey also stated that this money may also go towards girl’s health and education, as well as universal basic income (UBI).

| Rank | Name | COVID-19-Related Donation | % of Net Worth |

|---|---|---|---|

| #1 | Jack Dorsey | $1B | 25.6% |

| #2 | Bill & Melinda Gates | $255M | 0.2% |

| #3 | Azim Premji | $132M | 2.2% |

| #4 | Andrew Forrest | $100M+ | 1.2%+ |

| #5 | Jeff Bezos | $100M | 0.1% |

| #6 | Michael Dell | $100M | 0.4% |

| #7 | Lynn Schusterman, Stacy Schusterman | $70M | 2.1% |

| #8 | Amancio Ortega | $68M | 0.1% |

| #9 | Nicky Oppenheimer | $54.5M | 0.7% |

| #10 | Johann Rupert | $54.5M | 1.1% |

*As of April 15, 2020

Overall, 77 of the world’s billionaires have made public contributions related to the COVID-19 pandemic, just a fraction of the world’s ultra-rich.

As COVID-19 continues to spread globally, will the world’s billionaires still accumulate wealth at greater speeds, or will a different picture emerge as unconventional policies around the world become increasingly commonplace?

Money

Charted: Who Has Savings in This Economy?

Older, better-educated adults are winning the savings game, reveals a January survey by the National Opinion Research Center at the University of Chicago.

Who Has Savings in This Economy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Two full years of inflation have taken their toll on American households. In 2023, the country’s collective credit card debt crossed $1 trillion for the first time. So who is managing to save money in the current economic environment?

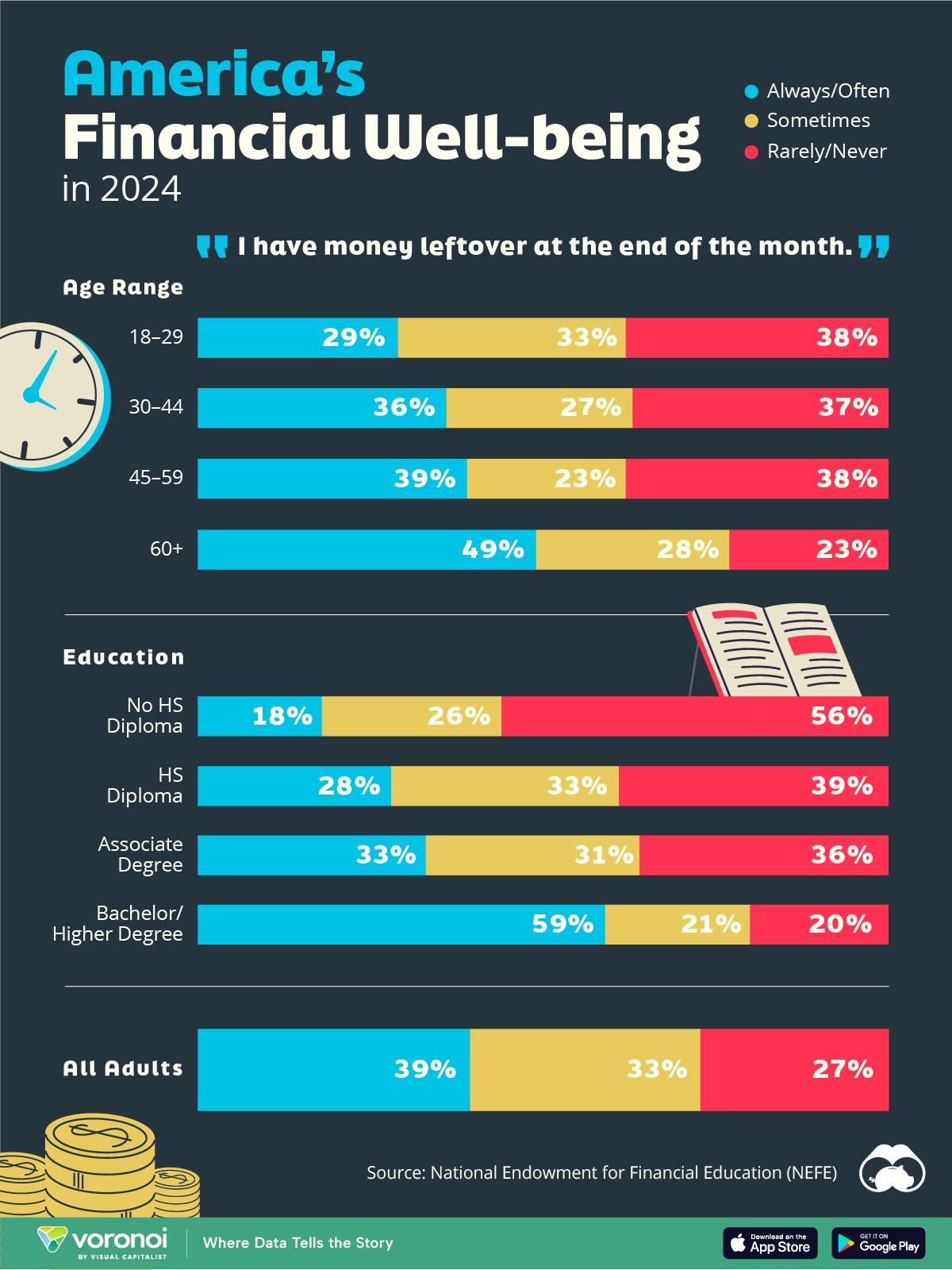

We visualize the percentage of respondents to the statement “I have money leftover at the end of the month” categorized by age and education qualifications. Data is sourced from a National Endowment for Financial Education (NEFE) report, published last month.

The survey for NEFE was conducted from January 12-14, 2024, by the National Opinion Research Center at the University of Chicago. It involved 1,222 adults aged 18+ and aimed to be representative of the U.S. population.

Older Americans Save More Than Their Younger Counterparts

General trends from this dataset indicate that as respondents get older, a higher percentage of them are able to save.

| Age | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| 18–29 | 29% | 33% | 38% |

| 30–44 | 36% | 27% | 37% |

| 45–59 | 39% | 23% | 38% |

| Above 60 | 49% | 28% | 23% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

Perhaps not surprisingly, those aged 60+ are the age group with the highest percentage saying they have leftover money at the end of the month. This age group spent the most time making peak earnings in their careers, are more likely to have investments, and are more likely to have paid off major expenses like a mortgage or raising a family.

The Impact of Higher Education on Earnings and Savings

Based on this survey, higher education dramatically improves one’s ability to save. Shown in the table below, those with a bachelor’s degree or higher are three times more likely to have leftover money than those without a high school diploma.

| Education | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| No HS Diploma | 18% | 26% | 56% |

| HS Diploma | 28% | 33% | 39% |

| Associate Degree | 33% | 31% | 36% |

| Bachelor/Higher Degree | 59% | 21% | 20% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

As the Bureau of Labor Statistics notes, earnings improve with every level of education completed.

For example, those with a high school diploma made 25% more than those without in 2022. And as the qualifications increase, the effects keep stacking.

Meanwhile, a Federal Reserve study also found that those with more education tended to make financial decisions that contributed to building wealth, of which the first step is to save.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries