Markets

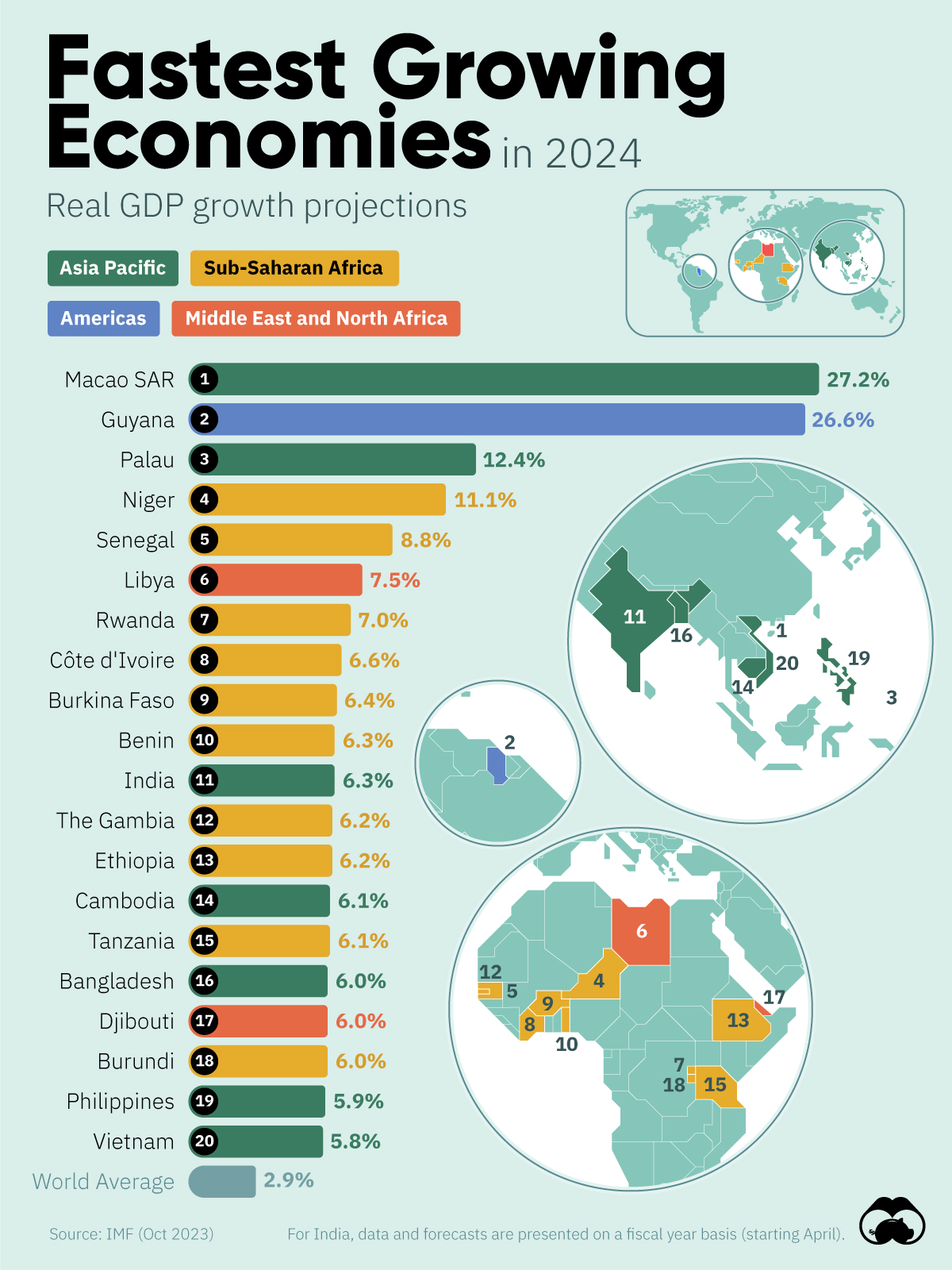

Ranked: The Fastest Growing Economies In 2024

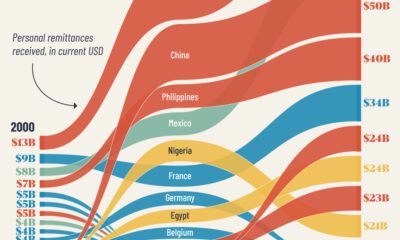

IMF Projections: The Fastest Growing Economies in 2024

Which countries will see the most economic growth in 2024?

To answer this question, we’ve visualized GDP growth forecasts from the IMF’s October 2023 World Economic Outlook. Unsurprisingly, many of these countries are located in Asia and Sub-Saharan Africa—two of the world’s fastest growing regions.

| Country | Region | GDP Growth 2024 (%) |

|---|---|---|

| 🇲🇴 Macao SAR | Asia Pacific | 27.2 |

| 🇬🇾 Guyana | Americas | 26.6 |

| 🇵🇼 Palau | Asia Pacific | 12.4 |

| 🇳🇪 Niger | Sub-Saharan Africa | 11.1 |

| 🇸🇳 Senegal | Sub-Saharan Africa | 8.8 |

| 🇱🇾 Libya | Middle East and North Africa | 7.5 |

| 🇷🇼 Rwanda | Sub-Saharan Africa | 7.0 |

| 🇨🇮 Côte d'Ivoire | Sub-Saharan Africa | 6.6 |

| 🇧🇫 Burkina Faso | Sub-Saharan Africa | 6.4 |

| 🇧🇯 Benin | Sub-Saharan Africa | 6.3 |

| 🇮🇳 India | Asia Pacific | 6.3 |

| 🇬🇲 The Gambia | Sub-Saharan Africa | 6.2 |

| 🇪🇹 Ethiopia | Sub-Saharan Africa | 6.2 |

| 🇰🇭 Cambodia | Asia Pacific | 6.1 |

| 🇹🇿 Tanzania | Sub-Saharan Africa | 6.1 |

| 🇧🇩 Bangladesh | Asia Pacific | 6.0 |

| 🇩🇯 Djibouti | Middle East and North Africa | 6.0 |

| 🇧🇮 Burundi | Sub-Saharan Africa | 6.0 |

| 🇵🇭 Philippines | Asia Pacific | 5.9 |

| 🇻🇳 Vietnam | Asia Pacific | 5.8 |

| 🌍 World Average | -- | 2.9 |

For India, data and forecasts are presented on a fiscal year basis (starting April). Continue reading below for additional context on these figures.

Highlights: Asia Pacific

The fastest growing economies in Asia are forecasted to be Macao (+27.2%), Palau (+12.4%), and India (+6.3%).

- The economy of Macao is heavily reliant on tourism, an industry that represents over 60% of the region’s jobs, as well as roughly 70% of its GDP.

- Palau is a tiny country consisting of 340 islands, representing an overall land area of 180 square miles (466 square kilometers). According to the U.S. State Department, tourism represents approximately 40% of Palau’s GDP.

- India, which recently became the world’s largest country by population, is expected to reach a peak of 1.7 billion people by 2064.

Highlights: Sub-Saharan Africa

Sub-Saharan Africa accounts for half of the top 20 list, with Niger (+11.1%) and Senegal (+8.8%) leading.

- A recent military coup could have serious implications on Niger’s future economic growth. The country’s Agadem oil field, which is majority owned by China National Petroleum Corporation (CNPC), could see its exports disrupted as a result of global sanctions.

- Senegal’s economy is also linked to the oil industry, meaning its growth could fluctuate in the years to come.

Oil Drives Growth for Guyana

Guyana (+26.6%), with a population of only 815,000, is expected to be the second fastest growing economy in 2024. Interestingly, it was the world’s fastest growing economy last year, with a 62% increase in GDP, and is likely to claim that title again in 2023 with expected growth of 37%.

This growth is largely driven by rising oil exports from Stabroek Block, an offshore oil field being developed by an Exxon Mobil-led consortium. According to BBC, Guyana has over 11 billion barrels in oil reserves.

Markets

The Stocks Driving S&P 500 Returns in 2024

We show the top 10 S&P 500 stocks that are fueling the market’s rally as the index hovers near record-highs.

The Stocks Driving S&P 500 Returns in 2024

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The S&P 500 is sitting at near-record highs, returning 15% year-to-date as of June 26, 2024.

Today, a limited number of stocks are powering the stock market’s rally as investors pour money into companies that are advancing AI technologies. As share prices skyrocket, many wonder if company valuations are overheated—or if they are supported by strong corporate fundamentals.

This graphic shows the top 10 S&P 500 stocks driving stock market returns in 2024, based on data from Goldman Sachs.

Big Tech Stocks Are Fueling Gains

Below, we show the companies making the largest contribution to the S&P 500’s rally:

| Rank | Company | Ticker | Contribution to S&P 500 Return YTD as of June 13, 2024 |

|---|---|---|---|

| 1 | Nvidia | NVDA | 4.94% |

| 2 | Microsoft | MSFT | 1.24% |

| 3 | Alphabet | GOOGL | 0.97% |

| 4 | Meta | META | 0.84% |

| 5 | Apple | AAPL | 0.81% |

| 6 | Amazon | AMZN | 0.72% |

| 7 | Broadcom | AVGO | 0.62% |

| 8 | Eli Lilly & Co. | LLY | 0.60% |

| 9 | Berkshire Hathaway | BRK.B | 0.22% |

| 10 | QUALCOMM | QCOM | 0.21% |

| Total S&P 500 Return YTD 2024 | 14.65% |

As of June 13, 2024.

Chipmaker Nvidia has driven over a third of S&P 500 returns this year, with its share price soaring 162% year-to-date as of June 13, 2024.

In June, Nvidia became the world’s most valuable firm, commanding an estimated 70% to 95% of the AI chip market. In the latest quarter, revenue surged by threefold compared to a year earlier amid high chip demand. Overall, big tech companies such as Meta, Amazon, and Microsoft made up roughly 45% of its data-center revenue, with Meta running a staggering 350,000 H100 chips to power its AI systems this year alone.

Falling in second is Microsoft, which has invested billions in AI startups including OpenAI and Wayve, a self-driving car firm. Microsoft is a cloud service provider for ChatGPT, the large language model built by OpenAI. As AI demand exceeds capacity, and other business segments see solid growth, Microsoft’s revenue increased 17% year-over-year as of the second quarter of 2024.

Google’s parent, Alphabet, ranks next, followed by Meta and Apple. Each of these companies is working on their own large language model which costs millions to train and run. Together, the top five stocks are driving about 60% of the S&P 500’s returns.

As we can see, just two of the top 10 S&P 500 stocks are not big tech names: pharmaceutical giant Eli Lilly and Berkshire Hathaway. This year, Eli Lilly’s share price is surging due to strong demand for its weight loss drug, Zepbound. During the first quarter of 2024, the newly-approved drug generated over $517 million in sales. Given its reported effectiveness, some analysts are forecasting it could be the best-selling drug ever in American history.

-

Markets2 weeks ago

Markets2 weeks agoCharted: Stock Buybacks by the Magnificent Seven

-

Maps1 week ago

Maps1 week agoMapped: 15 Countries with the Highest Smoking Rates

-

Sports1 week ago

Sports1 week agoRanked: Which NHL Team Takes Home the Most Revenue?

-

Maps1 week ago

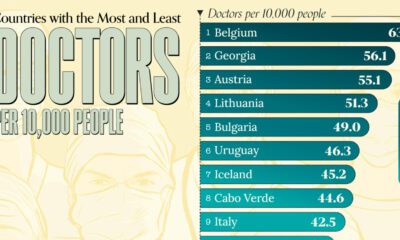

Maps1 week agoMapped: Highest and Lowest Doctor Density Around the World

-

Money1 week ago

Money1 week agoRanked: The World’s Top 10 Billionaires in 2024

-

Stocks1 week ago

Stocks1 week agoAll of the World’s Trillion-Dollar Companies in One Chart

-

Markets1 week ago

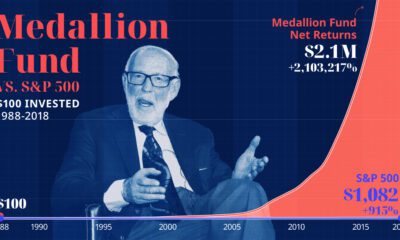

Markets1 week agoThe Growth of $100 Invested in Jim Simons’ Medallion Fund

-

Stocks1 week ago

Stocks1 week agoCharted: Four Decades of U.S. Tech IPOs