Markets

Visualized: Mid-Year Interest Rate Cut Forecasts for 2024

Published

2 days agoon

Article/Editing:

Graphics/Design:

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Mid-Year Interest Rate Cut Forecasts for 2024

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Today, many institutions are trimming back their rate cut expectations given strong labor market data and slow progress on inflation.

At the beginning of 2024, several banks forecasted five or more interest rate cuts over the year, while the median projection for Federal Reserve policymakers was three quarter-point cuts by fiscal year-end in March. Now, it has pared this back to one rate cut this year.

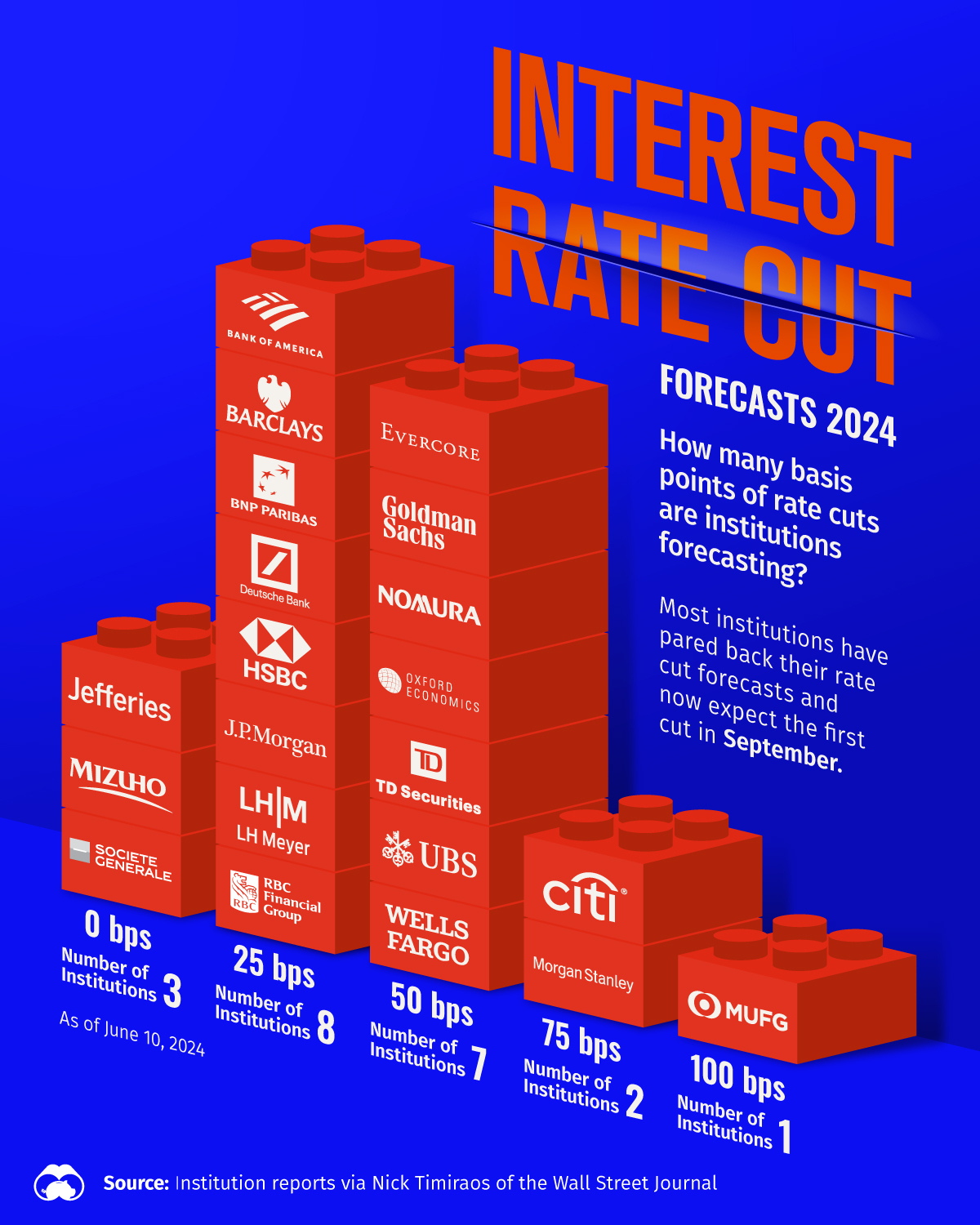

This graphic shows mid-year interest rate forecasts, based on institution reports via Nick Timiraos of the Wall Street Journal.

Will the Fed Cut Interest Rates This Year?

Below, we show interest rate forecasts across 21 institutions as of June 2024:

| Forecasted Rate Cuts in 2024 | Number of Institutions as of June | Number of Institutions as of April | Names of Institutions |

|---|---|---|---|

| 0 bps | 3 | 1 | Jefferies, Mizuho, Societe Generale |

| 25 bps | 8 | 0 | Bank of America, Barclays, BNP Paribas, Deutsche Bank, HSBC, JP Morgan, LH Meyer, RBC |

| 50 bps | 7 | 1 | Evercore ISI, Goldman Sachs, Nomura, Oxford Economics, TD Securities, UBS, Wells Fargo |

| 75 bps | 2 | 9 | Citigroup, Morgan Stanley |

| 100 bps | 1 | 5 | MUFG |

| 125 bps | 0 | 3 | N/A |

Overall, more than half of the institutions seen in the above table anticipate the first rate cut to take place in September.

Citigroup, for example, is forecasting quarter-point rate cuts in September, November, and December. In June, the bank scaled back their projections, which were previously calling for four cuts beginning in July. A key indicator that the bank is watching is the unemployment rate, which slowly increased to 4% in May, up from 3.9% a month earlier. It also expects inflation to continue cooling over the coming months.

Like Citigroup, Goldman Sachs and Nomura see the first rate cut taking place in September.

In more of a hawkish camp, JP Morgan anticipates the first cut to be in November due to continued momentum in the labor market. This year, the bank has shifted from three interest rate cuts to one, citing that job weakness may take several months to play out.

Today, many banks are aware that while inflation has moderated, the Fed is keeping a close watch on future inflation risks. As of May, inflation stands at 3.3%, falling for two consecutive months after trending upward in early 2024.

U.S. interest rates have remained at 5.25-5.50% since July 2023, sitting at their highest level in 23 years. Yet, despite higher borrowing costs, it is taking longer than anticipated to beat inflation or dampen consumer spending. Part of the reason is that many people and corporations locked in low interest rates seen during the pandemic, and the impact of higher interest rates hasn’t fully begun to bite.

You may also like

-

Visualizing Global Inflation Forecasts (2024-2026)

-

Visualized: Interest Rate Forecasts for Advanced Economies

-

Charted: Who Has Savings in This Economy?

-

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

U.S. Debt Interest Payments Reach $1 Trillion

-

Where U.S. Inflation Hit the Hardest in March 2024

Energy

5 Ways Nuclear Can Power The Future

As global electricity demand rises, nuclear power stands out as a leading solution to help ensure a stable and low-carbon energy future.

Published

12 hours agoon

July 3, 2024By

Selin Oğuz

Published

12 hours agoon

By

Selin OğuzGraphics & Design

Range Disclosures

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s full or summary prospectus, which may be obtained by visiting www.rangeetfs.com/nukz. Read it carefully before investing or sending money.

Risk Disclosures: Investing involves risk, including possible loss of principal. There is no guarantee the Fund will achieve its stated investment objectives. The Fund is non-diversified. Its concentration in an industry or sector can increase the impact of, and potential losses associated with, the risks from investing in those industries/sectors. Investments in the energy industry are subject to significant volatility due to changes in commodity prices. Additional risks include changes in exchange rates, government regulation, world events, economic and political conditions in the countries where energy companies are located or do business, and risks for environmental damage claims. Nuclear companies may be subject to substantial government regulation and contractual fixed pricing, which may increase the cost of doing business and limit the earnings of these companies. A significant portion of revenues of nuclear companies depends on a relatively small number of customers, including governmental entities and utilities. As a result, governmental budget constraints may have a material adverse effect on the stock prices of companies in this sub-industry. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Investments in smaller companies typically exhibit higher volatility. The Fund may invest in securities denominated in foreign currencies. Because the Fund’s NAV is determined in U.S. dollars, the Fund’s NAV could decline if currencies of the underlying securities depreciate against the U.S. dollar or if there are delays or limits on repatriation of such currencies. Currency exchange rates can be very volatile and can change quickly and unpredictably. Distributed by SEI Investments Distribution Co. (SIDCO)

Visualized: 5 Ways Nuclear Can Power the Future

Global electricity consumption from data centers, cryptocurrencies, and artificial intelligence (AI) is poised for a dramatic leap, projected to nearly double between 2022 and 2026.

This surge highlights the ever-growing need for reliable and sustainable energy solutions to power our increasingly digital world.

Created in partnership with Range ETFs, this infographic highlights five reasons why nuclear power may be best suited to meet this growing demand, using data from various sources such as the U.S. Department of Energy and the U.S. Energy Information Administration.

Nuclear Power is…

Data centers and AI systems require substantial and uninterrupted electricity to power their computing and cooling infrastructure. Here’s how nuclear power can be a solution:

1. Low Carbon

Unlike fossil fuels, nuclear power generates electricity without emitting greenhouse gases. And because nuclear plants have long operational lives, their lifecycle emissions are comparable to renewable sources such as wind and solar, according to the UN Economic Commission for Europe, making it a crucial player in the fight against climate change.

2. Flexible

Advancements in nuclear technology have led to the development of smaller, more versatile reactors called small modular reactors (SMRs). These compact reactors can be located virtually anywhere, including right next to data centers. This flexibility reduces transmission loss and ensures a more efficient delivery of power where it is most needed.

3. Dependable

Data centers require uninterrupted power that intermittent energy sources, such as wind and solar, cannot consistently meet.

Nuclear power, on the other hand, is a dispatchable energy source, which means it can be quickly turned on and off to meet electricity demand in real time. This makes it incredibly dependable and fit for powering energy-hungry data centers.

4. Safe

Despite common misconceptions, nuclear power is one of the safest forms of electricity.

| Energy Source | Deaths per TWh of electricity production |

|---|---|

| Coal | 24.62 |

| Oil | 18.43 |

| Natural Gas | 2.82 |

| Hydropower | 1.3 |

| Wind | 0.04 |

| Nuclear | 0.03 |

| Solar | 0.02 |

The death rate per terawatt hour (TWh) of electricity produced from nuclear power is significantly lower than it is for coal, oil, and natural gas. Moreover, modern reactor designs, such as SMRs, now integrate advanced safety features that surpass even those of traditional nuclear reactors, further minimizing risks.

5. Optimal

Nuclear power has the highest capacity factor out of all other common electricity sources. This means that the ratio of its actual electricity output to its maximum possible output is very high.

In other words, nuclear power operates at full capacity 93% of the time, whereas geothermal, the energy source with the second-highest capacity factor, operates at full capacity 71% of the time. Natural gas comes in third place, with a capacity factor of 54%.

Nuclear’s high capacity factor means it can consistently meet large-scale electricity demands, making it an ideal solution for powering the growing number of data centers and AI operations.

The Resurgence of Nuclear Power

The rapid growth of AI and data centers is driving a resurgence of interest in nuclear power. Industry leaders and technology companies are investing in nuclear projects across the U.S. and beyond, recognizing its potential to provide a reliable, sustainable energy source.

As the demand for electricity continues to rise, nuclear power stands out as a leading solution to help ensure a stable and low-carbon energy future.

Consider investing in the bright future of nuclear power.

You may also like

-

Energy1 week ago

Energy1 week agoVisualizing Saudi Aramco’s Massive Oil Reserves

Saudi Aramco controls almost 259 billion barrels worth of oil and gas reserves.

-

Energy1 month ago

Energy1 month agoComparing Saudi Aramco’s $1.9T Valuation to Its Rivals

See how much larger Saudi Aramco’s market cap is compared to rivals like Chevron, ExxonMobil, and Shell.

-

Energy1 month ago

Energy1 month agoRanked: The World’s Largest Lithium Producers in 2023

Three countries account for almost 90% of the lithium produced in the world.

-

Energy2 months ago

Energy2 months agoWho’s Building the Most Solar Energy?

China’s solar capacity triples USA, nearly doubles EU.

-

Energy2 months ago

Energy2 months agoMapped: The Age of Energy Projects in Interconnection Queues, by State

This map shows how many energy projects are in interconnection queues by state and how long these projects have been queued up, on average.

-

Energy2 months ago

Energy2 months agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

Subscribe

Popular

-

Sports1 week ago

Sports1 week agoA Look at Cristiano Ronaldo’s Euro Records

-

Wealth7 days ago

Wealth7 days agoMapped: The World’s Wealthiest Cities, by Millionaires and Billionaires

-

Economy1 week ago

Economy1 week agoWhich Countries Have the Highest Corporate Tax Rates in the G20?

-

Currency1 week ago

Currency1 week agoCharted: The Death of Cash Transactions Around the World

-

Money1 week ago

Money1 week agoMapped: Millionaire Migration in 2024

-

United States1 week ago

United States1 week agoMapped: Median Income by State in 2024

-

Markets1 week ago

Markets1 week agoThe Most Popular Stocks in Hedge Fund Portfolios

-

Real Estate1 week ago

Real Estate1 week agoMapped: The World’s Least Affordable Housing Markets in 2024