Economy

Visualizing Layoffs at Prominent Startups Triggered by COVID-19

Layoffs at Prominent Startups Triggered by COVID-19

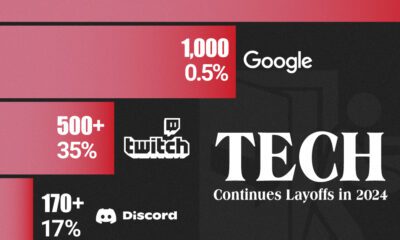

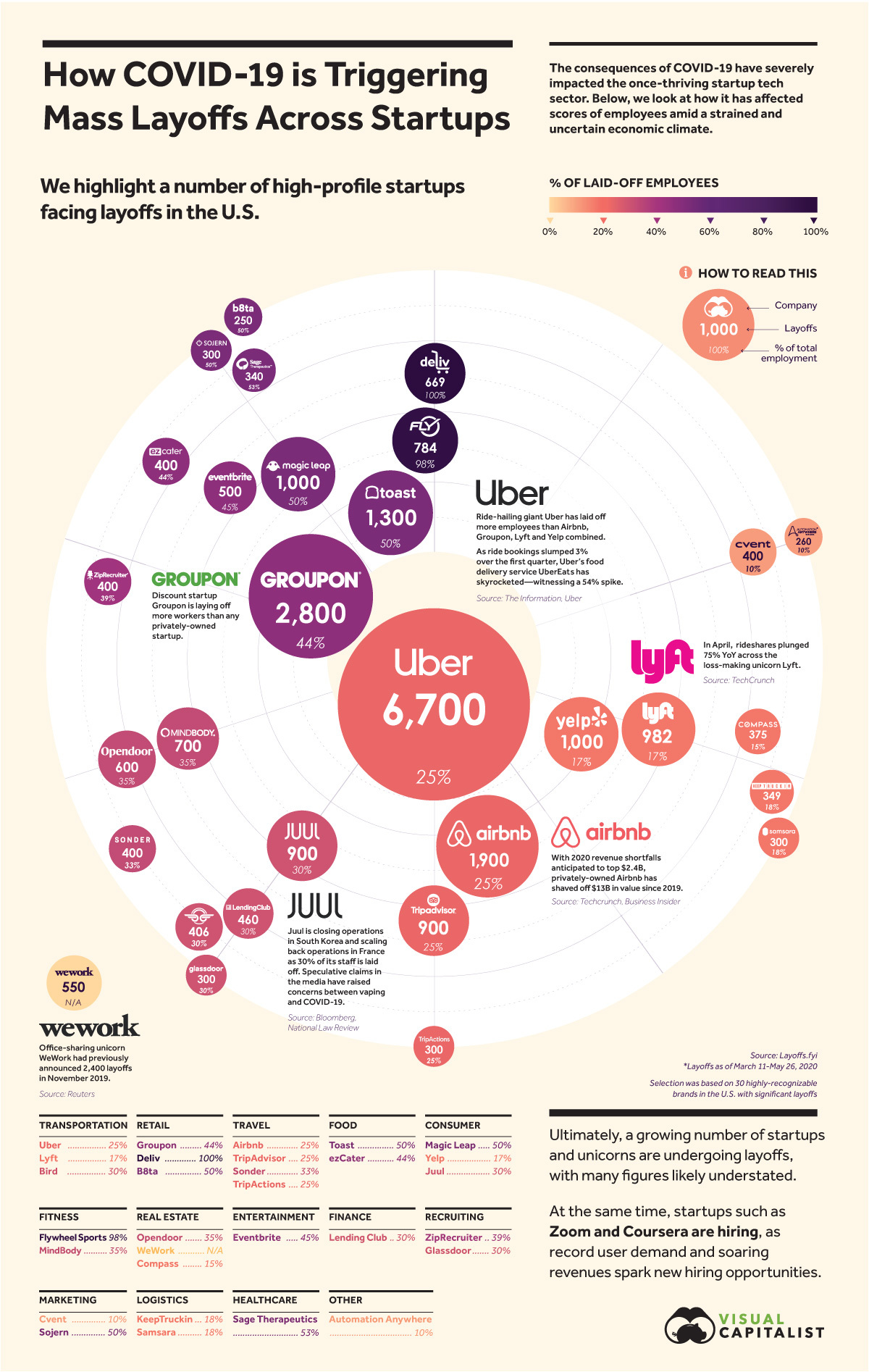

As the pandemic reverberates through almost every industry imaginable, tech startups are also feeling the pain.

Since mid-March, countless startups and unicorns have undergone layoffs.

Today’s infographic pulls data from Layoffs.fyi, and navigates the cascading layoffs across 30 of the most recognizable startups in America. Each of the companies have slashed over 250 employees between March 11 and May 26, 2020—capturing a snapshot of the continuing fallout of COVID-19.

Silicon Valley Takes a Hit

Unsurprisingly, many of the hardest hit startups are related to the travel and mobility industry.

Closing 45 offices, Uber has laid off 6,700 employees since mid-March. Uber CEO Dara Khosrowshahi, who was granted a $45M earnings package in 2018, announced he will also waive his $1M base salary for the remainder of the year.

| Company | # Layoffs | % of Employees | Industry |

|---|---|---|---|

| Uber | 6,700 | 25% | Transportation |

| Lyft | 982 | 17% | Transportation |

| Bird | 406 | 30% | Transportation |

| Airbnb | 1,900 | 25% | Travel |

| TripAdvisor | 900 | 25% | Travel |

| Sonder | 400 | 33% | Travel |

| TripActions | 300 | 25% | Travel |

| Magic Leap | 1,000 | 50% | Consumer |

| Yelp | 1,000 | 17% | Consumer |

| Juul | 900 | 30% | Consumer |

| Groupon | 2,800 | 44% | Retail |

| Deliv | 669 | 100% | Retail |

| B8ta | 250 | 50% | Retail |

| Toast | 1,300 | 50% | Food |

| ezCater | 400 | 44% | Food |

| Flywheel Sports | 784 | 98% | Fitness |

| MindBody | 700 | 35% | Fitness |

| Opendoor | 600 | 35% | Real Estate |

| WeWork | 550 | N/A | Real Estate |

| Compass | 375 | 15% | Real Estate |

| ZipRecruiter | 400 | 39% | Recruiting |

| Glassdoor | 300 | 30% | Recruiting |

| Cvent | 400 | 10% | Marketing |

| Sojern | 300 | 50% | Marketing |

| KeepTruckin | 349 | 18% | Logistics |

| Samsara | 300 | 18% | Logistics |

| Eventbrite | 500 | 45% | Entertainment |

| Lending Club | 460 | 30% | Finance |

| Sage Therapeutics | 340 | 53% | Healthcare |

| Automation Anywhere | 260 | 10% | Other |

*Layoffs reported between March 11-May 26, 2020

Meanwhile, as room bookings dropped by over 40% across several countries, Airbnb laid off a quarter of its workforce. The tech darling is anticipating a $2.4B revenue shortfall in 2020.

Like many other big names—including Lyft, Uber, and WeWork—Airbnb is struggling to achieve profitability. In the first nine months of 2019, it lost $322M at the height of the market cycle.

Until 2021, gig-economy revenues are projected to drop by at least 30%.

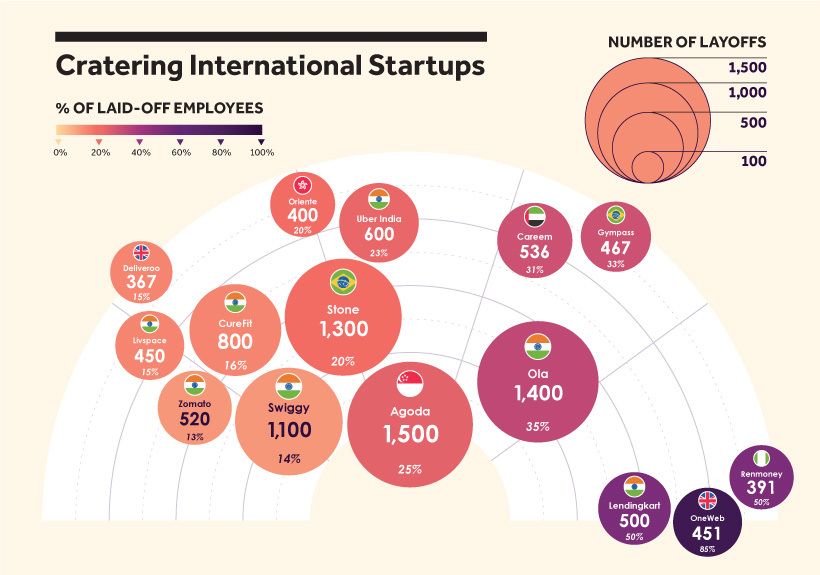

International Startups Struggling

Startups in the U.S. aren’t the only ones scrambling to conserve cash and cut costs.

Brazil-based unicorn Stone has let go of 20% of its workforce. The rapidly growing digital payments company includes Warren Buffett as a major stakeholder, holding an 8% share as of March 2020.

At the same time, India-based ride-hailing Ola has witnessed revenue declines of 95% since mid-March. It laid off 1,400 employees as bookings drastically declined.

| Company | # Layoffs | % of Employees | Location |

|---|---|---|---|

| Swiggy | 1,100 | 14% | India |

| Agoda | 1,500 | 25% | Singapore |

| Ola | 1,400 | 35% | India |

| Stone | 1,300 | 20% | Brazil |

| CureFit | 800 | 16% | India |

| Uber India | 600 | 23% | India |

| Careem | 536 | 31% | U.A.E. |

| Zomato | 520 | 13% | India |

| Lendingkart | 500 | 50% | India |

| Gympass | 467 | 33% | Brazil |

| OneWeb | 451 | 85% | United Kingdom |

| Livspace | 450 | 15% | India |

| Oriente | 400 | 20% | Hong Kong |

| Renmoney | 391 | 50% | Nigeria |

| Deliveroo | 367 | 15% | United Kingdom |

Similarly, Uber India has rivaled Ola in dominance across India’s $10B ride-hailing market since launching three years after Ola, in 2013. Now, almost 25% of the Uber India workforce have been laid off.

Of course, these reports do not fully take into account the growing impact of COVID-19, but help paint a picture as the cracks emerge.

Pandemic-Proof?

While the job market remains murky, what startups are looking to hire?

Coursera, an online education startup, listed 60 openings in May. By the end of the year, the company plans to hire 250 additional staff. Within the peak of widespread global lockdowns, the platform attracted 10M new users.

Meanwhile, Canva, an Australia-based graphic design unicorn, is seeking to fill 100 positions worldwide. In partnership with Google for Education, Canva offers project-based learning tools designed for classrooms, in addition to free graphic design resources.

At the same time, tech heavyweights Facebook and Amazon reported openings. Booming startups such as Plaid, Zoom, and Pinterest are also listing new positions as shifting consumer demand continues to shape unpredictable and historic hiring markets.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

Can I share this graphic?

Can I share this graphic? When do I need a license?

When do I need a license? Interested in this piece?

Interested in this piece?