Markets

How Every Asset Class, Currency, and Sector Performed in 2019

Another year is in the books, and for investors 2019 was quite the turnaround story.

Despite an early backdrop of heightened volatility, escalating trade tensions, Brexit uncertainty, and calls for a recession, the year progressed in an unexpectedly pleasant fashion. The Fed used its limited arsenal to provide additional stimulus, and global markets soaked it up to extend the decade-long bull run.

By the end of 2019, every major asset class was in the black — and the S&P 500 surged to finish with its best annual return since 2013.

Markets Roundup for 2019

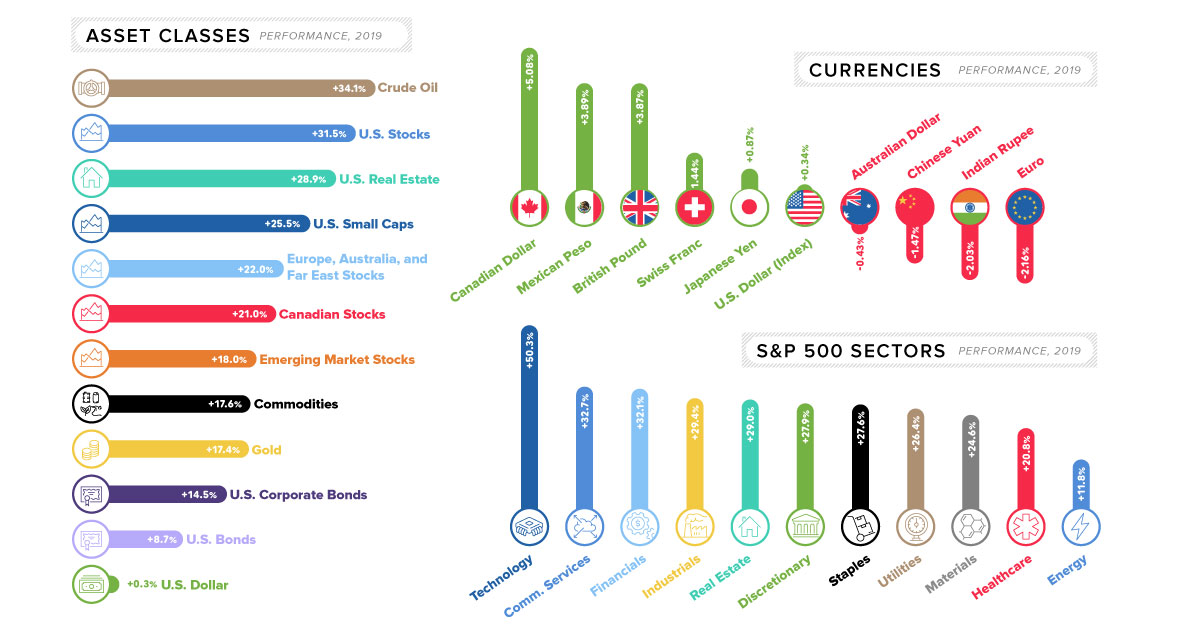

Let’s take a look at major asset classes in 2019, to see how they fared:

Note: all indices here (i.e. S&P 500, Russell 2000, etc.) are using total returns, with dividends re-invested.

The first thing you’ll notice when looking at the above data is that every major asset class had a positive return for the year. The only real difference lies in the magnitude of that positive return.

Even though stocks experienced some of the best gains on the year, the winning asset may be a surprising one: crude oil.

The oil price (WTI) started the year at about $46/bbl and it closed the year at over $61/bbl, good for a 34% gain. And with escalating tensions between the U.S. and Iran, energy prices could be shooting even higher in 2020.

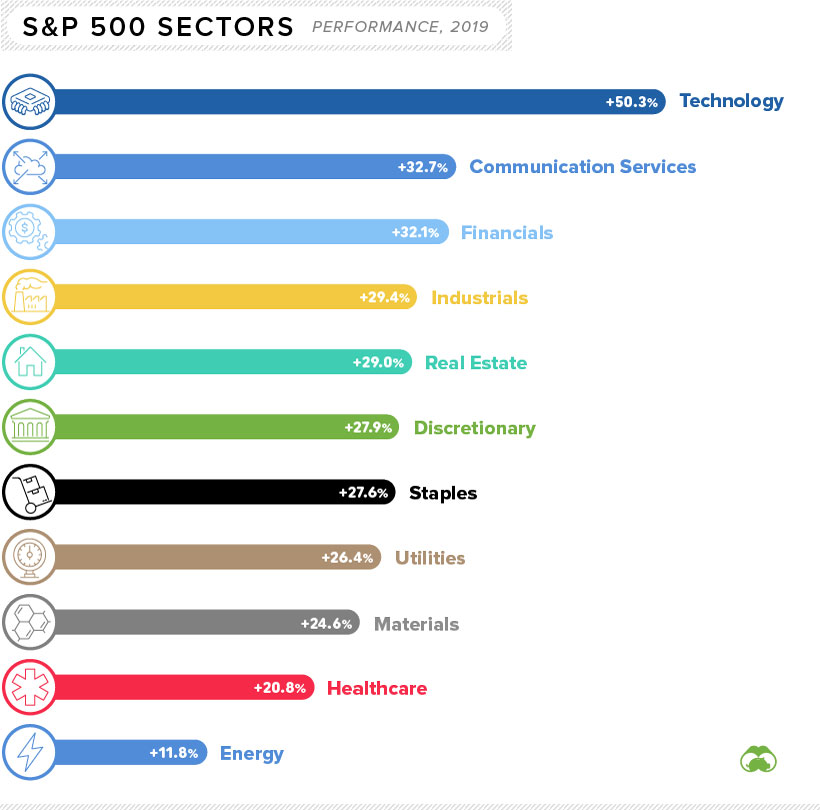

Performance by S&P 500 Sector

Strangely enough, rising oil prices did not do enough to buoy energy stocks — the poorest performing S&P 500 sector.

Although oil was up on the year, natural gas actually fell in price by about 26% in 2019. This effectively cancels out the gains made by oil, putting energy producers at the bottom of the list:

Not surprisingly, technology stocks excelled in 2019.

Tech was led by a big bounceback from Apple, a big winner that gained more than 80% over the course of the year. Other strong sectors in the benchmark U.S. index included communication services and financials.

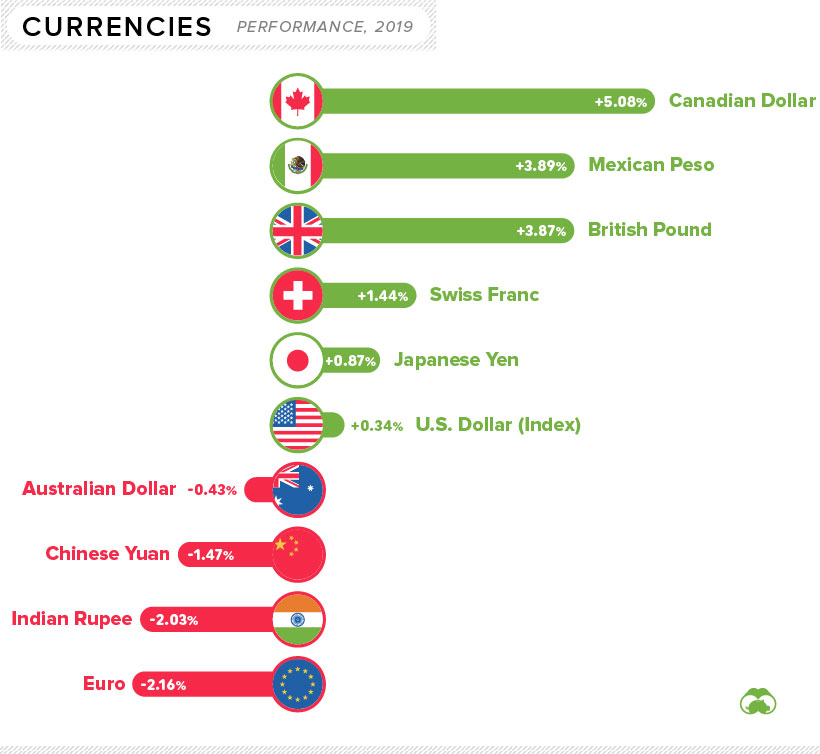

The Currency Game

Now let’s look how currencies moved in 2019.

Below movements are all against the U.S. dollar, with the exception of the U.S. dollar itself, which is measured against a basket of currencies (U.S. Dollar Index):

The biggest currency mover on the year was the Canadian dollar, which jumped over 5% partially thanks to rising oil prices. Meanwhile, the biggest decrease went to the euro, which fell over 2% against the U.S. dollar.

It’s also worthwhile to note that Bitcoin had a particularly strong rebound in 2019, rising over 90% against the U.S. dollar.

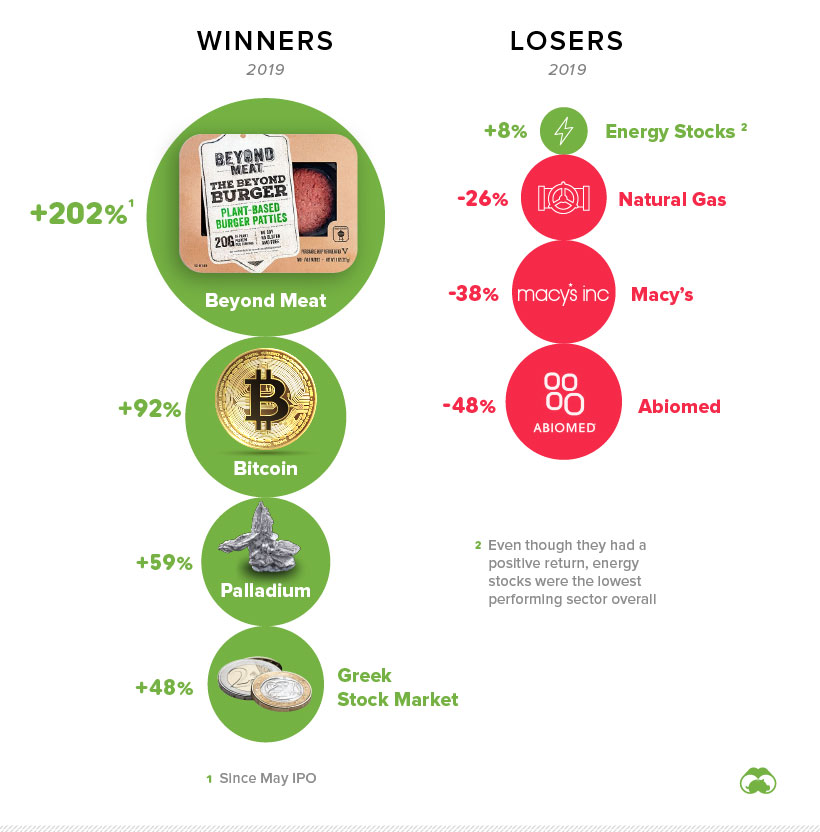

Winners and Losers

Finally, we’ve put together a more arbitrary list of winners and losers for the year, incorporating all of the above and more.

Both the Greek and Russian stock markets had banner years, each returning close to 50% in dollar terms. Faux meat brands also captured investors’ imaginations, with Beyond Meat leading the charge. Palladium was a standout commodity, gaining 59% on the year.

We’ve chosen energy stocks as a loser, since they were the poorest performing sector on the S&P 500. Meanwhile, Macy’s and Abiomed were two of the worst large cap stocks to own in 2019.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023