Markets

Which Countries Own the Most U.S. Debt?

The Foreign Countries Holding the Most U.S. Debt

In the international finance system, U.S. debt can be bought and held by virtually anyone.

In fact, if you hold a U.S. Treasury bond or a T-Bill in your portfolio right now, you are already a creditor to the United States government.

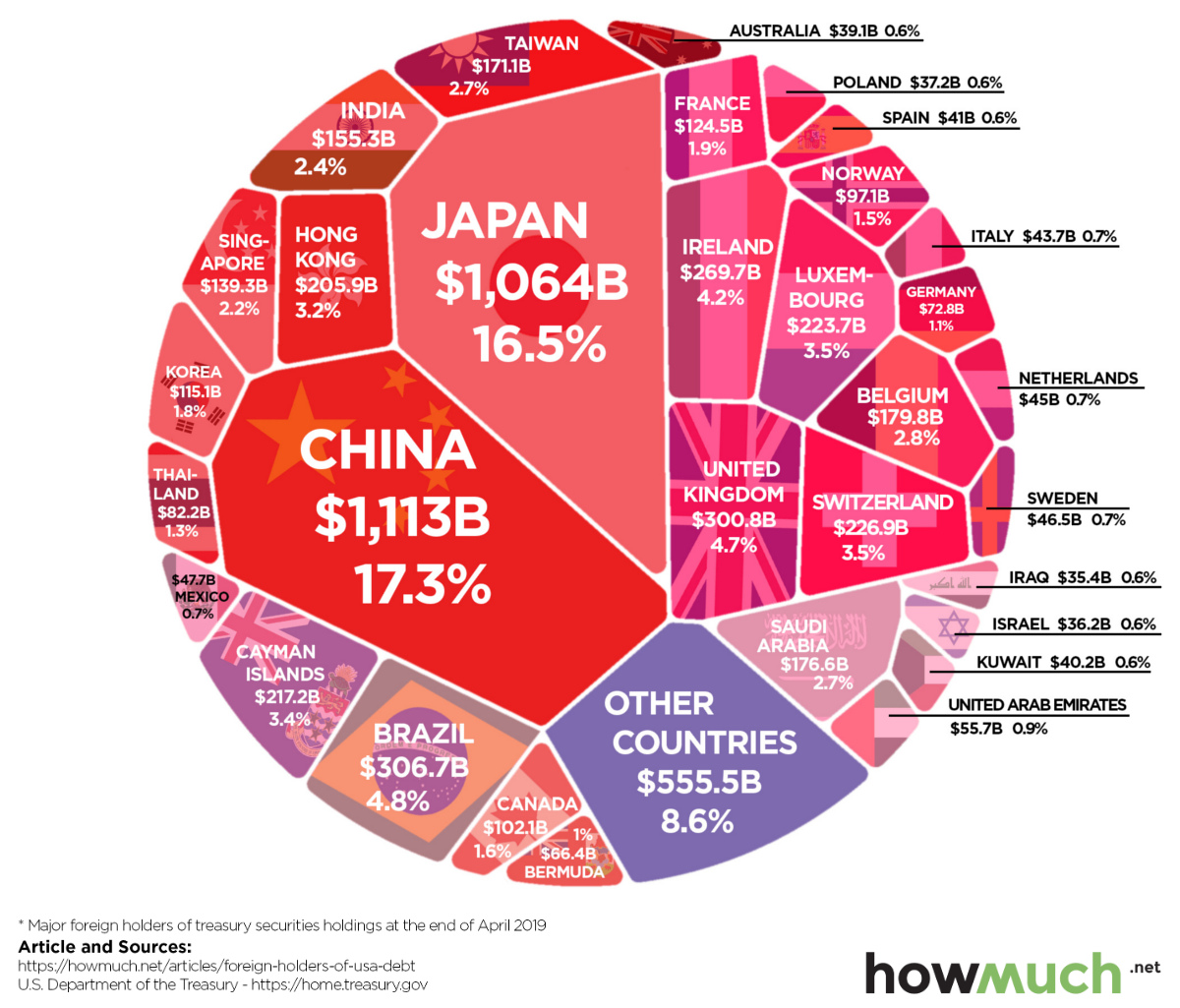

And as you can see in today’s chart from HowMuch.net, foreign countries like China and Japan can also accumulate large positions in U.S. Treasurys, making them significant players in the overall United States debt pie.

U.S. Debt: The Big Picture

The United States federal debt currently sits at $22 trillion, and it’s held by a range of domestic and foreign investors.

| Entity | Debt Holdings | Share of Total |

|---|---|---|

| U.S. Government and Federal Reserve | $8.1 trillion | 36.8% |

| Foreign and international | $6.3 trillion | 28.5% |

| Mutual funds | $2.06 trillion | 9.4% |

| Pension funds | $0.92 trillion | 4.2% |

| Banks | $0.77 trillion | 3.5% |

| State and local governments | $0.69 trillion | 3.1% |

| Other investors | $3.18 trillion | 14.5% |

| Total | $21.97 trillion | 100.0% |

As you can see, about $8.1 trillion of debt is held by departments of the U.S. government or the Federal Reserve. This number would include securities sitting in retirement accounts of federal employees, social security trust funds, or any of the Treasurys sitting on the Fed’s balance sheet.

Next, another $7.6 trillion of debt is held by domestic investors. These are marketable securities held by banks, mutual funds, pension funds, insurance companies, and other investors.

While debt held domestically is mostly uninteresting, a bigger question mark is the $6.3 trillion of debt that is owned by foreign countries. After all, couldn’t a country like China “weaponize” its large holdings of Treasury securities as a form of retaliation in the ongoing trade war?

Foreign Owners of the Debt

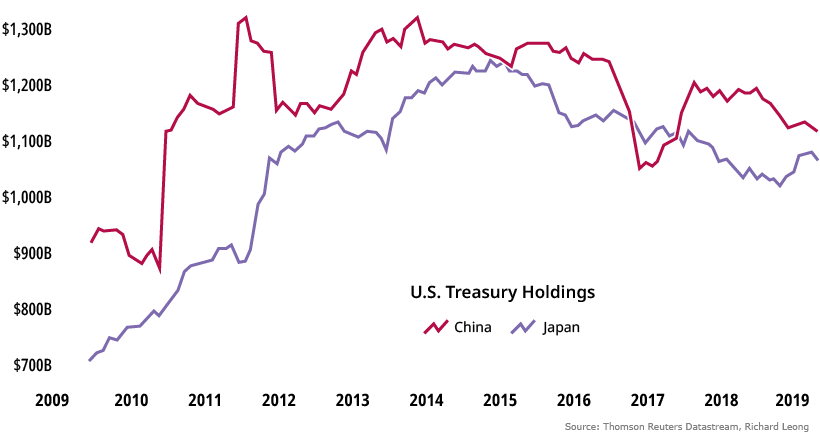

Internationally, the biggest owners of debt include China and Japan, each with over $1 trillion.

| Rank | Country | U.S. Debt Holdings | Percentage of Foreign U.S. Debt Held (%) |

|---|---|---|---|

| #1 | 🇨🇳 China | $1.11 trillion | 17.3% |

| #2 | 🇯🇵 Japan | $1.06 trillion | 16.5% |

| #3 | 🇧🇷 Brazil | $307 billion | 4.8% |

| #4 | 🇬🇧 United Kingdom | $301 billion | 4.7% |

| #5 | 🇮🇪 Ireland | $270 billion | 4.2% |

| #6 | 🇨🇭 Switzerland | $227 billion | 3.5% |

| #7 | 🇱🇺 Luxembourg | $224 billion | 3.5% |

| #8 | 🇰🇾 Cayman Islands | $217 billion | 3.4% |

| #9 | 🇭🇰 Hong Kong | $206 billion | 3.2% |

| #10 | 🇧🇪 Belgium | $180 billion | 2.8% |

| #11 | 🇸🇦 Saudi Arabia | $177 billion | 2.8% |

| #12 | 🇹🇼 Taiwan | $171 billion | 2.7% |

Why does China hold so much of the foreign-owned U.S. debt?

China has accumulated Treasury securities over decades, as part of its strategy to keep its domestic currency from strengthening. Interestingly, the export-heavy nation has reduced its swath of Treasurys in recent months, selling off close to $200 billion of them.

Although China has $1.11 trillion of Treasurys left in reserve, the general consensus is that dumping all of them at once would destabilize the global financial system, having an equally negative effect on China as well.

That said, with foreign nations holding U.S. debt, such a risk will always exist.

Gimme Shelter

While it’s not surprising to see countries like China, Japan, or Brazil on the list of top foreign debt holders, what are places like the Cayman Islands, Luxembourg, or Ireland doing on the list?

Two simple facts help to explain these anomalies.

Firstly, despite having a population of just 60,000 people, the Cayman Islands is a hedge fund capital with over 10,000 funds domiciled there. Luxembourg makes the list for similar reasons, given that it is the European-based tax shelter equivalent.

Ireland, on the other hand, is the overseas headquarters for many U.S.-based tech giants like Facebook or Alphabet. Apparently, these corporations like to hold their overseas profits in highly-liquid Treasurys, rather than paying a repatriation tax to bring the cash back to American soil.

Markets

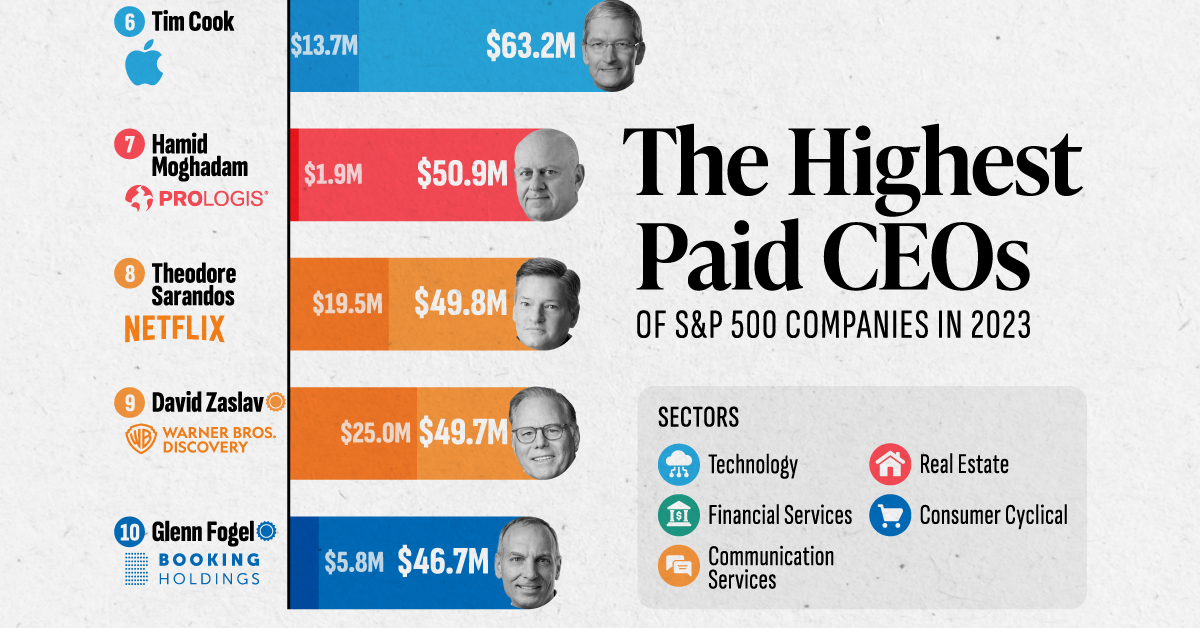

The Top 10 Highest Paid CEOs in America

As median S&P 500 executive compensation hits record levels, we show the highest paid CEOs in America in 2023.

The Top 10 Highest Paid CEOs in America

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The median pay for S&P 500 CEOs soared to an all-time high of $15.7 million in 2023, as a strong stock market boosted executive compensation.

Some of the highest paid CEOs in America earned nine-figure pay packages, with the vast majority of CEO compensation tied to stock awards. Overall, executives in the index earned on average 196 times more than the median S&P 500 employee, up from 185 in 2022.

This graphic shows the top 10 highest paid CEOs of S&P 500 companies, based on analysis from The Wall Street Journal and MyLogIQ.

The Highest-Earning S&P 500 CEOs in 2023

Here are the S&P 500 chief executives who received the highest compensation packages last year:

| Rank | CEO | Company | Total Pay | Cash Pay | Sector |

|---|---|---|---|---|---|

| 1 | Hock Tan | Broadcom | $161.8M | $1.2M | Technology |

| 2 | Nikesh Arora | Palo Alto Networks | $151.4M | $2.3M | Technology |

| 3 | Stephen Schwarzman | Blackstone | $119.8M | $0.4M | Financial Services |

| 4 | Christopher Winfrey | Charter Communications | $89.1M | $5.2M | Communication Services |

| 5 | Will Lansing | Fair Isaac | $66.4M | $2.0M | Technology |

| 6 | Tim Cook | Apple | $63.2M | $13.7M | Technology |

| 7 | Hamid Moghadam | Prologis | $50.9M | $1.9M | Real Estate |

| 8 | Theodore Sarandos | Netflix | $49.8M | $19.5M | Communication Services |

| 9 | David Zaslav | Warner Bros. Discovery | $49.7M | $25.0M | Communication Services |

| 10 | Glenn Fogel | Booking Holdings | $46.7M | $5.8M | Consumer Cyclical |

Total pay includes equity awards and cash pay.

Hock Tan, CEO of chipmaker Broadcom, tops the list, with an annual compensation of $161.8 million in 2023.

Like Nvidia, the company has benefited from surging demand for AI technologies. Broadcom supplies the networking chips used in data centers for big tech companies, including Microsoft. Between 2022 and 2023, Tan’s salary doubled, earning 510 times the median pay of employees.

Ranking in third is Stephen Schwarzman, who runs the biggest private equity firm in the world, Blackstone. The executive’s $119.8 million pay package was bolstered by a 83% rise in its share price last year. The firm is the world’s largest owner of commercial property, with approximately 12,500 real estate assets overall.

Meanwhile, Apple CEO Tim Cook received $63.2 million in 2023—a sharp decline from the $99.4 million earned in the prior year. This rare pay cut was the result of shareholder pushback and requests from Cook himself.

Overall, four of the top 10 highest paid CEOs in America are in the tech sector, with each experiencing double-digit share price gains over 2023.

CEO Pay Has Doubled Over the Last Decade

Below, we show the increasing magnitude of executive earnings since 2013:

| Year | Median Total Compensation for CEOs of S&P 500 Companies |

|---|---|

| 2023 | $15.7M |

| 2022 | $14.5M |

| 2021 | $14.8M |

| 2020 | $13.2M |

| 2019 | $12.2M |

| 2018 | $11.7M |

| 2017 | $10.6M |

| 2016 | $10.0M |

| 2015 | $9.9M |

| 2014 | $9.0M |

| 2013 | $7.4M |

Total pay includes equity awards and cash pay.

As we can see, the median total compensation of S&P 500 CEOs jumped over 8% between 2022 and 2023.

Going further, this figure has grown by twofold over the last 10 years as the U.S. stock market surged during a period of low interest rates. Overall, CEO pay is rising faster than median employee pay and this gap between CEOs and workers has continued to widen over many years. For perspective, the median pay of S&P 500 employees stood at $81,476 in 2023.

Often, CEO compensation is linked to the company’s financial performance, which is measured through share price movements and dividend payouts. In addition, the rise in CEO pay can be largely driven by stock awards granted to CEOs.

A separate analysis from Equilar found that on average, 70% of S&P 500 CEO compensation stemmed from stock awards, averaging a striking $9.4 million in 2023.

-

Sports2 weeks ago

Sports2 weeks agoRanked: Which NHL Team Takes Home the Most Revenue?

-

Real Estate1 week ago

Real Estate1 week agoMapped: The World’s Least Affordable Housing Markets in 2024

-

Energy1 week ago

Energy1 week agoVisualizing Saudi Aramco’s Massive Oil Reserves

-

Economy1 week ago

Economy1 week agoGDP Per Capita, by G7 Country (2019-2029F)

-

Sports1 week ago

Sports1 week agoA Look at Cristiano Ronaldo’s Euro Records

-

Misc1 week ago

Misc1 week agoChart: Which Countries Eat the Most Instant Noodles?

-

Culture1 week ago

Culture1 week agoRanked: The 10 Highest-Grossing Concert Tours of All Time

-

Demographics1 week ago

Demographics1 week agoCharted: Unauthorized Immigrants in the U.S., by Country of Origin