Technology

Electronic Health Records as a GPS for Healthcare

Electronic Health Records as a GPS for Healthcare

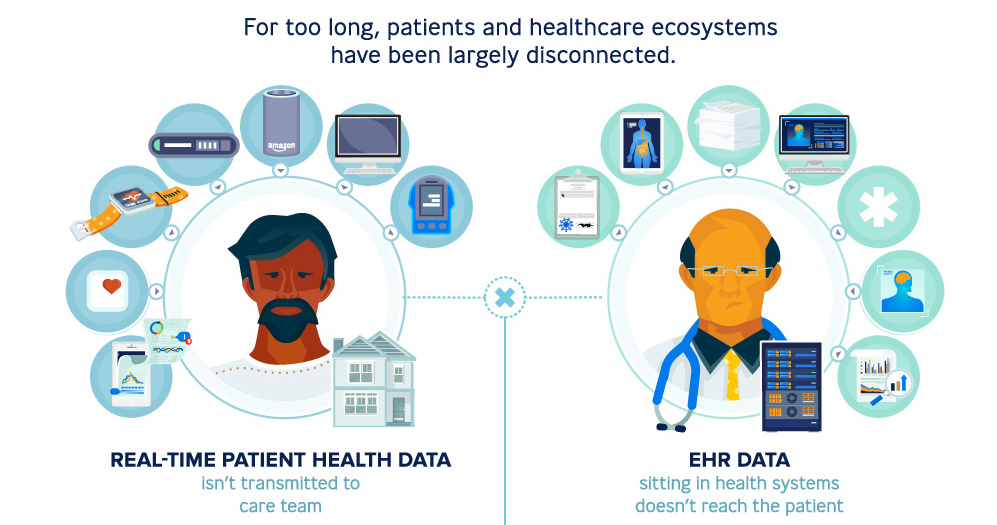

As patients are bombarded with more choice and information than ever, the burdened health system seems to lack the appropriate support to manage increasing demands for personalized and convenient care.

Today’s infographic comes to us from Publicis Health, and it demonstrates how electronic health records are an important piece in the puzzle to improve experiences for patients and providers alike.

At a Crossroads

As it stands, the current healthcare industry faces several challenges. Patients today have more complex needs and wants, while physicians are struggling to keep up.

- 25% of Americans have multiple chronic conditions.

- 63% of patients forget to adhere to medications.

- 40% of doctors feel that their work pace is chaotic.

- 60% of doctors feel that visits are too short to treat patients effectively.

Adding to these challenges, the healthcare industry is grappling with significant amounts of technological change, while also trying to keep costs in check. Between 2015 and 2017, hospitals lost $6.8 billion in operating income – that’s an average decline of nearly 40% in just two years.

A New Direction for Patient Care

Enter electronic health records (EHRs) – platforms used to conveniently store a patient’s health information and offer all sorts of services, from scheduling appointments and consultations to identifying patients at risk and guiding care decisions.

An improvement on physical paper charts, EHRs allow a patient’s medical history to be shared securely and instantly across different settings.

First conceived in 2009 under the Obama administration’s Health Information Technology for Economic and Clinical Health (HITECH) act, EHRs have rapidly evolved as they’ve been implemented in the industry, with 87% office-based doctors nationwide relying on the system.

Today, EHRs are a massive industry: the global market was worth $23.6 billion in 2016, and it’s expected to reach close to $33.3 billion by 2023. It’s clear their real capabilities are still just at the tip of the iceberg.

As technology progresses to incorporate artificial intelligence and big data into healthcare, the point of care for patients will likely extend beyond the four walls of a doctor’s office and out into the world. In other words, EHR systems act like a GPS, helping doctors and care teams navigate patient care more efficiently. This improves patient-doctor interactions, resulting in better outcomes.

Of course, there are always challenges to overcome. Here are a few key considerations for EHRs:

| What’s the Problem? | The Solve | Benefits |

|---|---|---|

| Apps aren’t for all ages | Conversational AI platforms | - All age groups are familiar with chat platforms - Streamline user interactions - Increases engagement |

| Expensive professional health system resources | AI-powered virtual assistance | - Concierge services for patients - Access accurate patient information - Increases engagement and adherence |

| Generic, one-way content | Personalized content | - Educational and relevant content, based on individual needs |

| Missed appointments or medication | Reminder services | - Supports optimal care - Improves adherence |

| Accessibility issues | Telemedicine or transportation services | - Enables patients with transportation challenges to receive the care they need |

Thinking Beyond EHR Systems

Capturing real world data and patient-reported outcomes will be important for wider applications, towards:

- A deeper understanding of patient journeys

- Informing clinical trial design and execution

- Better characterizing patient demographics

- Evaluating treatment options for sub-populations

In the future, healthcare and pharma companies could potentially use EHRs as one part of an entire suite of solutions to improve their workflow – and extend the point of care everywhere.

This is part six of a seven part series. Stay tuned for the final piece by subscribing to Visual Capitalist for free, as we wrap up the major transformative forces shaping the future of healthcare.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Business2 weeks ago

Business2 weeks agoAmerica’s Top Companies by Revenue (1994 vs. 2023)

-

Environment1 week ago

Environment1 week agoRanked: Top Countries by Total Forest Loss Since 2001

-

Markets1 week ago

Markets1 week agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population

-

Misc2 weeks ago

Misc2 weeks agoTesla Is Once Again the World’s Best-Selling EV Company

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.