Technology

Visualizing the Rise of Digital Payment Adoption

Digital Payments: The Evolution of Currency

Over the last decade, the digital payments landscape has undergone a structural shift.

Consumer behaviors are changing—moving towards contactless and cashless transactions. Meanwhile, as the magnitude of COVID-19 grows, these trends have only accelerated.

Today’s infographic navigates the digital payments ecosystem, exploring its history and innovative technologies, and how it continues to grow as a solution of choice for trillions of dollars of transactions each year.

Digital Payments Timeline

The origins of digital payments began over 25 years ago with then 21 year-old entrepreneur Dan Kohn in Nashua, New Hampshire, who sold a CD over the internet via credit card payment.

- 1994: First online purchase is made

A CD of Sting’s Ten Summoner’s Tales is sold for $12.48 on NetMarket. - 1997: First mobile payments and first contactless payments

Coca-Cola installs two vending machines in Helsinki that accept payment by text message. - 1999: Paypal launches electronic money transfer service

Early on, PayPal’s user base grew nearly 10% daily. Tesla CEO Elon Musk and venture capitalist Peter Thiel were among its co-founders. - 2003: Alibaba launches Alipay in China

Today, the mobile payment platform has witnessed stunning growth — leveraging digital wallets accepted by merchants in over 50 countries and regions. - 2007: M-PESA creates the first payments system for mobile phones

Kenya-based M-PESA launched its mobile banking and microfinancing service. Today, it has over 37 million active users on its platform across Africa. - 2009: Bitcoin enables secure, untraceable payments

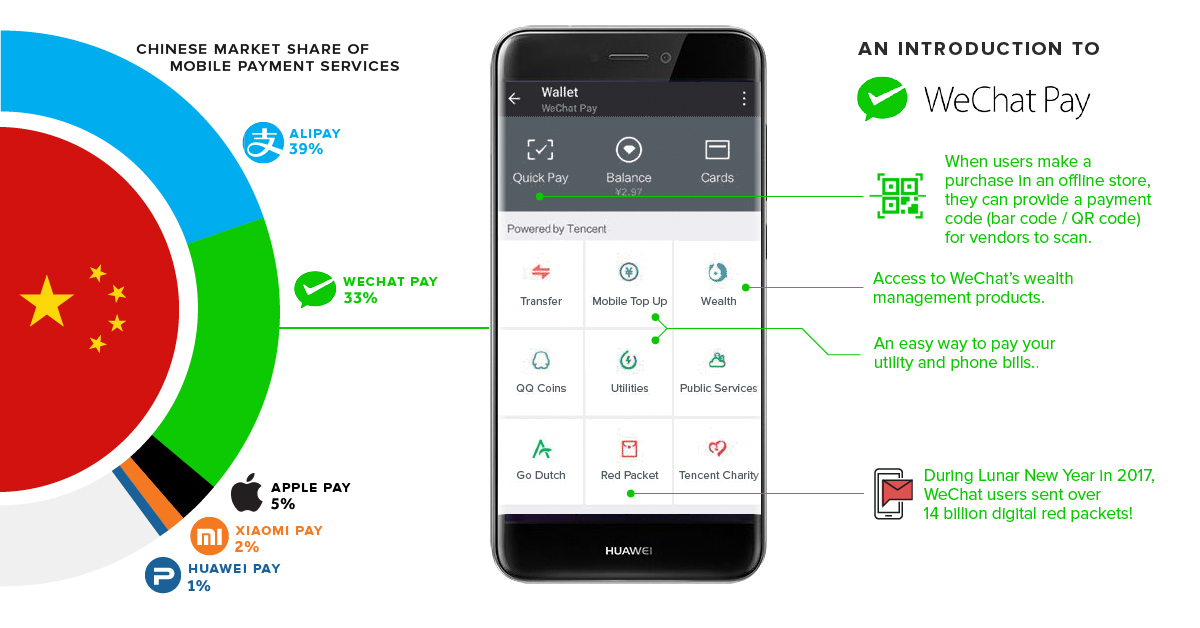

Satoshi Nakamoto develops the first decentralized payment network in the world. - 2013: WeChat Pay is rolled into the popular messaging platform

By 2018, it surpasses 800 million monthly active users. - 2014: Apple Pay launches

By 2023, over $2 trillion of mobile payment transactions could be authenticated by biometric technology.

As technological advances continue to unfold, advances in digital payment technologies are creating ripple effects globally.

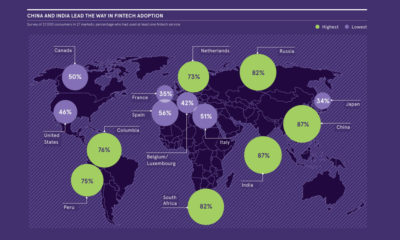

Geographical Differences in Adoption

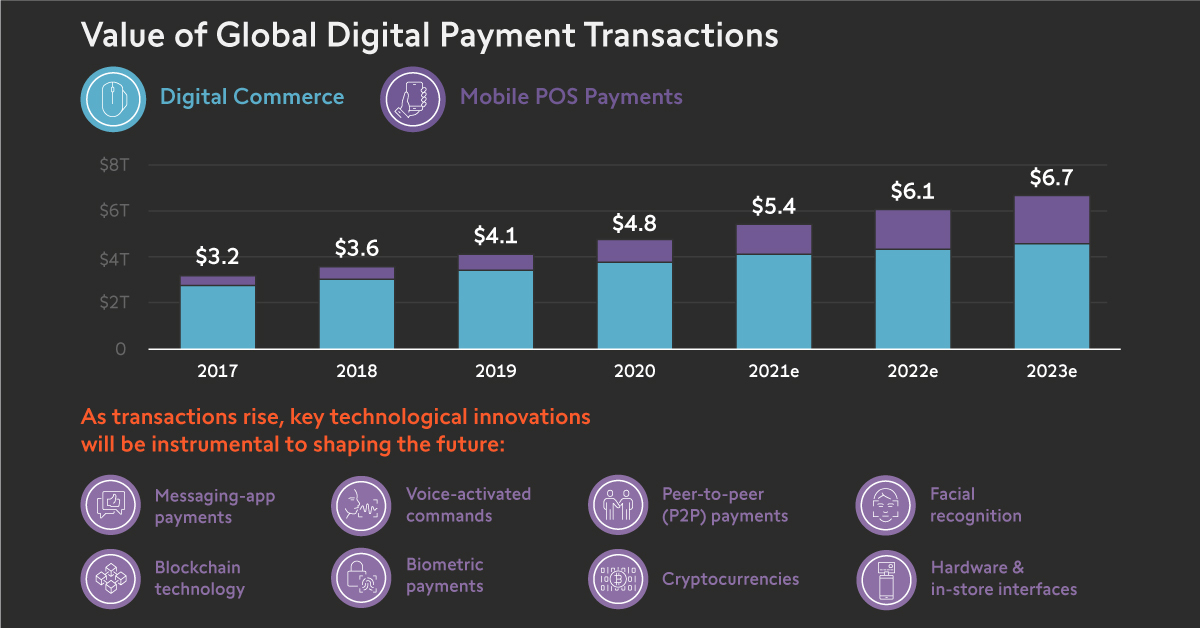

Unsurprisingly, the sheer volume of digital payments has continued to grow at a double-digit pace, now surpassing the $4.1 trillion mark.

How do cashless payments break down across different countries?

| Country | Daily Average Volume of Cashless Payments | Average Annual Cashless Payments Per Person |

|---|---|---|

| Singapore | 13M | 831 |

| South Korea | 77M | 547 |

| Sweden | 15M | 529 |

| Netherlands | 24M | 505 |

| U.S. | 444M | 495 |

| UK | 82M | 448 |

| Canada | 40M | 393 |

| Belgium | 12M | 372 |

| France | 64M | 363 |

| Switzerland | 7M | 299 |

| Germany | 61M | 269 |

| Russia | 95M | 237 |

| Spain | 24M | 185 |

| Brazil | 95M | 166 |

| China | 543M | 142 |

| Italy | 18M | 111 |

| Turkey | 17M | 77 |

| Indonesia | 30M | 42 |

| Mexico | 14M | 40 |

| India | 67M | 18 |

Source: BIS

Singapore has the highest number of cashless payments per individual, averaging 831 cashless payments annually. The country’s robust e-commerce market is supported by high-speed, reliable internet and a young, tech-savvy population.

With e-commerce spending accounting for about 6% of South Korea’s national GDP, it is another leading purveyor of a cashless society. Meanwhile, Sweden is projected to become a cashless nation as early as 2023.

Pivotal factors—including core infrastructure, consumer behavior and rising revenues—provide a glimpse into the rapidly changing payment horizon.

The Future of Digital Payments

As transactions rise, a number of other technological innovations could be instrumental to shaping the evolution of the digital payments industry:

- Messaging-app payments

Facebook Messenger, WhatsApp, and WeChat can leverage the reach of billions of users. - Voice-activated commands

Paying for gas, groceries, or retail via voice could soar. - Peer-to-peer (P2P) payments

Bank of America and Visa are investing heavily into P2P partnerships. - Cryptocurrencies

Over one million transactions take place daily on average. - Biometric payments

Smartphone biometric security features could spur traction across digital payments. - Facial recognition

May soon replace QR codes across retail, transit, and airports in China. - Crypto wallet adoption

Blockchain wallet users are predicted to soar to 200 million by 2030. - Hardware & in-store interfaces

Square, Stripe, and Clover are driving new mobile processing integrations.

The $4.1T digital payments ecosystem is facing a notable transition, catalyzed by a wave of global advancements and disruption. As the industry continues to widen its reach, consumers and investors alike can benefit from the shift towards a cashless economy.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Travel1 week ago

Travel1 week agoAirline Incidents: How Do Boeing and Airbus Compare?

-

Markets3 weeks ago

Markets3 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America