Markets

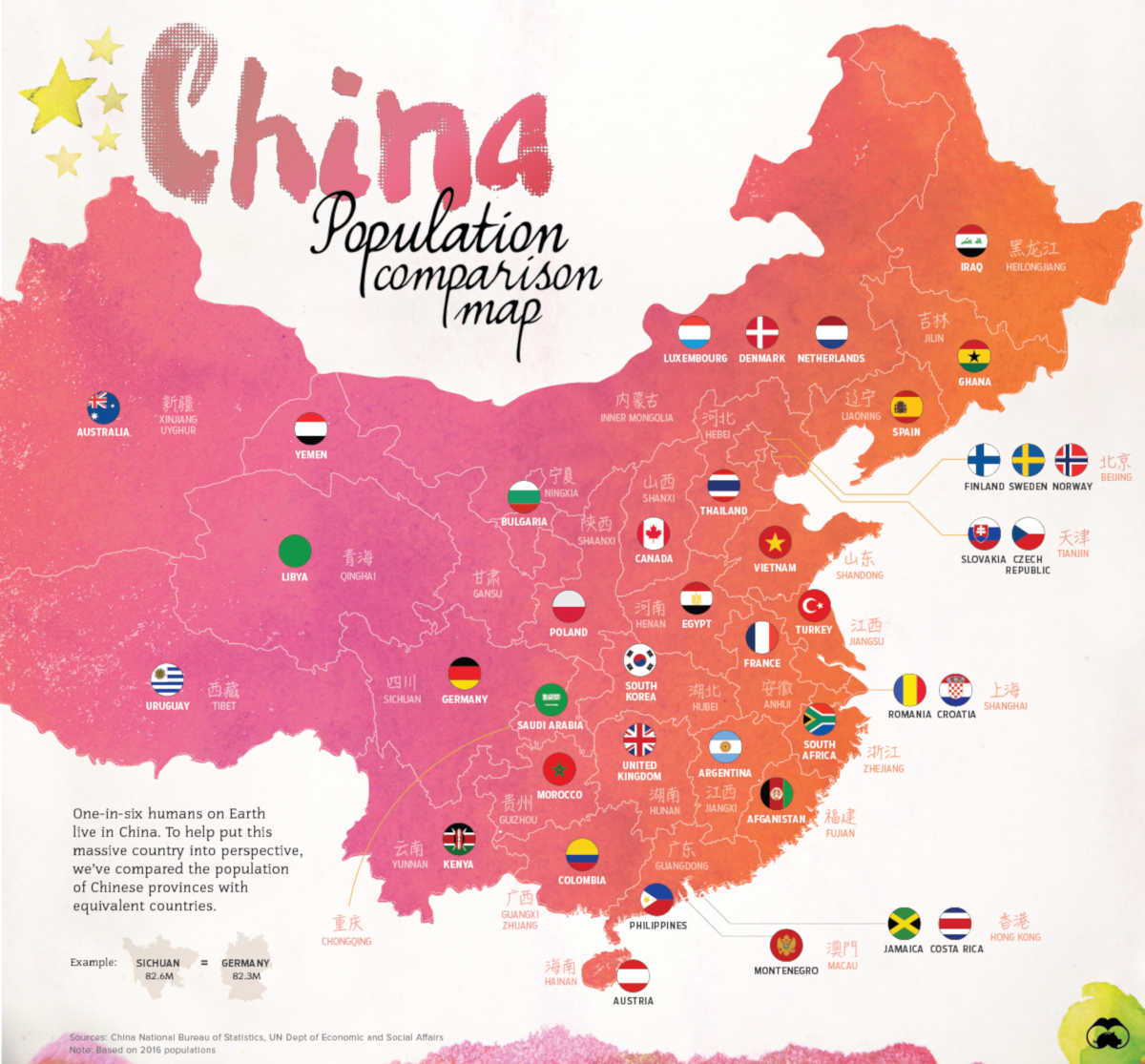

Map: China’s Provinces Rival Countries in Population Size

View a high resolution version of this graphic.

Chart: China’s Provinces Rival Countries in Population Size

The very mention of China triggers both awe and anxiety in the mainstream media.

With the globe’s largest GDP (PPP) at $23.12 trillion, China is indisputably a close contender for the title of world’s largest economic superpower along with the United States.

But what makes this possible in the first place? The country’s economic clout arguably stems from its human capital: a 1.4 billion-strong population.

A Force to be Reckoned With

Each of China’s 33 distinct regions is home to a population size on par with entire countries:

| Chinese Province | Population (millions) | Comparable Countries | Population (millions) |

|---|---|---|---|

| 🇨🇳 Anhui | 62 | 🇫🇷 France | 64.5 |

| 🇨🇳 Beijing | 21.7 | 🇫🇮 Finland, 🇸🇪 Sweden, 🇳🇴 Norway | 20.7 |

| 🇨🇳 Chongqing | 30.5 | 🇸🇦 Saudi Arabia | 31.7 |

| 🇨🇳 Fujian | 38.7 | 🇦🇫 Afghanistan | 34.6 |

| 🇨🇳 Gansu | 26.1 | 🇾🇪 Yemen | 29.1 |

| 🇨🇳 Guangdong | 110 | 🇵🇭 Philippines | 103.2 |

| 🇨🇳 Guangxi | 48.4 | 🇨🇴 Colombia | 48.7 |

| 🇨🇳 Guizhou | 35.5 | 🇲🇦 Morocco | 34.5 |

| 🇨🇳 Hainan | 9.1 | 🇦🇹 Austria | 8.7 |

| 🇨🇳 Hebei | 74.7 | 🇹🇭 Thailand | 69 |

| 🇨🇳 Heilongjiang | 38 | 🇮🇶 Iraq | 37.9 |

| 🇨🇳 Henan | 95.3 | 🇪🇬 Egypt | 90.2 |

| 🇭🇰 Hong Kong | 7.3 | 🇯🇲 Jamaica, 🇨🇷 Costa Rica | 7.7 |

| 🇨🇳 Hubei | 58.8 | 🇰🇷 South Korea | 51.2 |

| 🇨🇳 Hunan | 68.2 | 🇬🇧 United Kingdom | 65.6 |

| 🇨🇳 Jiangsu | 80 | 🇹🇷 Turkey | 79.8 |

| 🇨🇳 Jiangxi | 45.9 | 🇦🇷 Argentina | 43.6 |

| 🇨🇳 Jilin | 27.3 | 🇬🇭 Ghana | 27.6 |

| 🇨🇳 Liaoning | 43.8 | 🇪🇸 Spain | 46.4 |

| 🇲🇴 Macau | 0.61 | 🇲🇪 Montenegro | 0.62 |

| 🇨🇳 Inner Mongolia | 25.2 | 🇩🇰 Denmark, 🇱🇺 Luxembourg, 🇳🇱 Netherlands | 23.3 |

| 🇨🇳 Ningxia | 6.7 | 🇸🇻 El Salvador | 6.3 |

| 🇨🇳 Qinghai | 5.9 | 🇸🇬 Singapore | 5.6 |

| 🇨🇳 Shaanxi | 38.1 | 🇵🇱 Poland | 38 |

| 🇨🇳 Shandong | 99.5 | 🇻🇳 Vietnam | 92.7 |

| 🇨🇳 Shanghai | 24.2 | 🇷🇴 Romania, 🇭🇷 Croatia | 24.5 |

| 🇨🇳 Shanxi | 36.8 | 🇨🇦 Canada | 36.2 |

| 🇨🇳 Sichuan | 82.6 | 🇩🇪 Germany | 82.3 |

| 🇨🇳 Tianjin | 15.6 | 🇸🇰 Slovakia, 🇨🇿 Czech Republic | 16 |

| 🇨🇳 Xinjiang | 24 | 🇦🇺 Australia | 24.4 |

| 🇨🇳 Xizang (Tibet) | 3.3 | 🇺🇾 Uruguay | 3.5 |

| 🇨🇳 Yunnan | 47.7 | 🇰🇪 Kenya | 45.4 |

| 🇨🇳 Zhejiang | 55.9 | 🇿🇦 South Africa | 55.6 |

To drill down further, China is composed of:

- 4 municipalities

- 5 autonomous regions

Guangxi, Inner Mongolia, Ningxia, Tibet, and Xinjiang - 2 special administrative regions (SAR)

Hong Kong and Macau

Beijing, Chongqing, Shanghai, and Tianjin

The remaining 22 are the officially-labeled provinces of China.

It’s worth noting that Taiwan is also claimed as one of China’s provinces, even though there is some ambiguity and disagreement around Taiwan’s actual political status.

Nevertheless, it’s clear that every region, and especially the massive cities with them, are substantial contributors to the country’s growth and success.

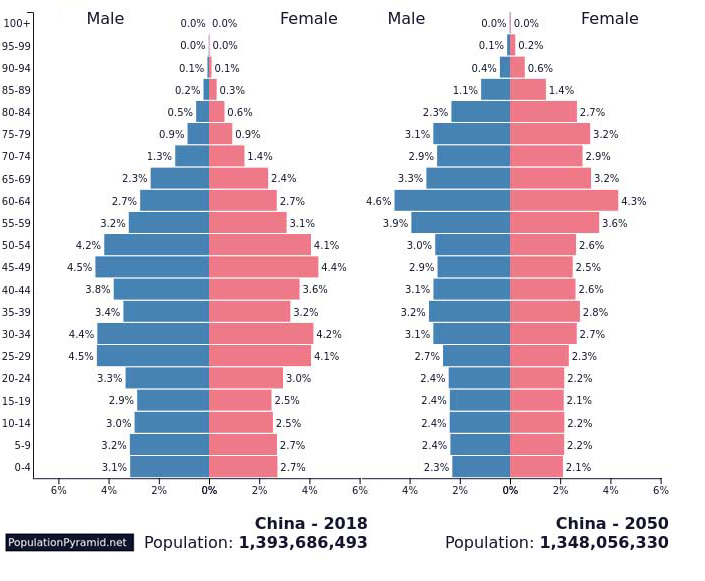

A New Demographic Era Ahead

Going forward, China’s population may cease to be a strength that contributes to rapid economic growth.

In the wake of the infamous one child policy, the country could soon by dealing with the demographic time bomb of a rapidly aging population.

Source: Population Pyramid

By 2050, almost four in ten people in China will be above the age of 60, which will create an added strain on the already declining working-age population.

The good news for China?

The country is making moves to combat the challenges ahead, including ambitious plans to build a $1 trillion artificial intelligence industry by 2030 – an attempt to close the impending labor gap.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?