Wealth

Charting The Growing Generational Wealth Gap

The Growing Generational Wealth Gap

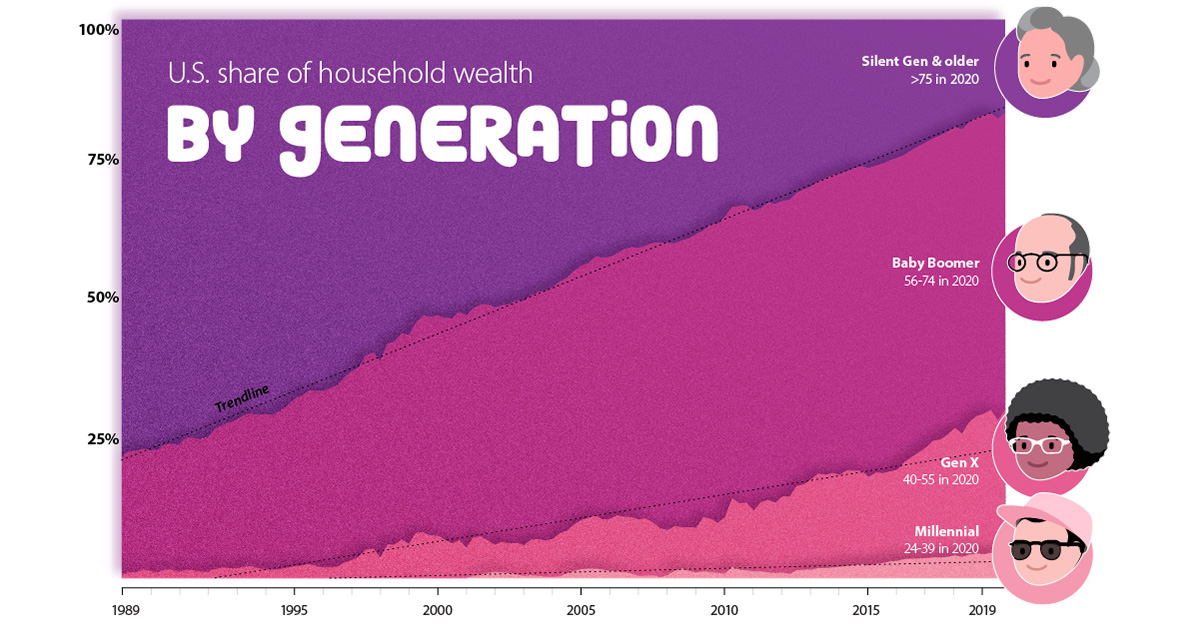

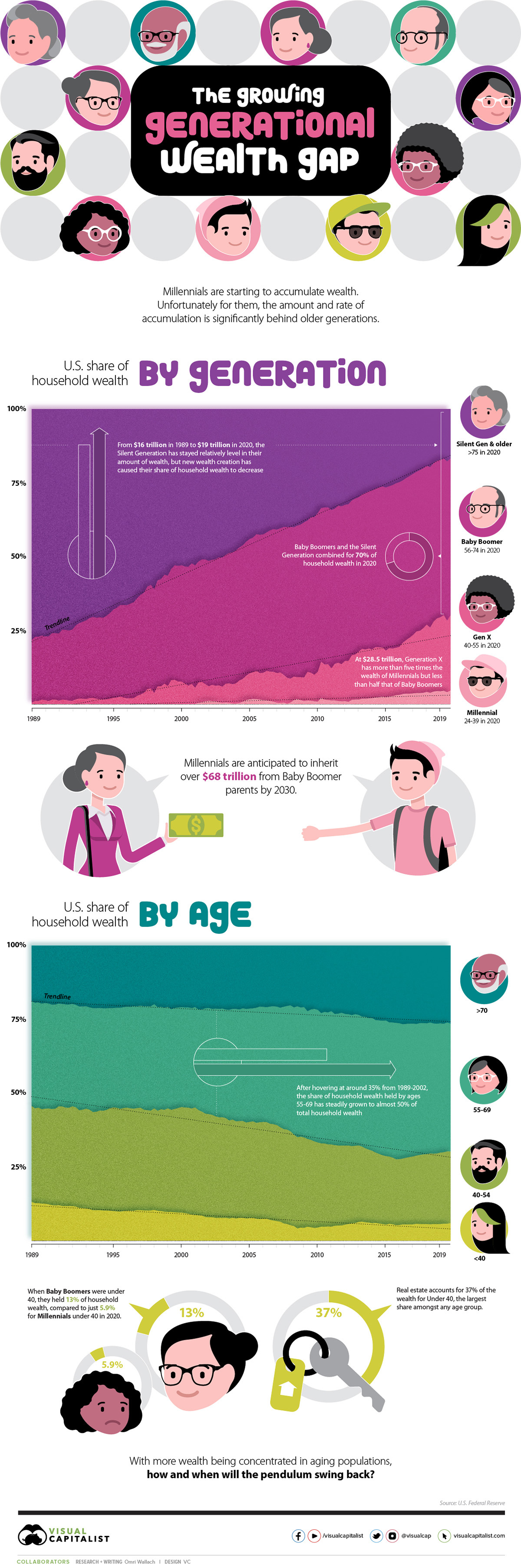

As young generations usher into adulthood, they inevitably begin to accumulate and inherit wealth, a trend that has broadly remained consistent.

But what has changed recently is the rate of accumulation.

In the U.S., household wealth has traditionally seen a relatively even distribution across different age groups. However, over the last 30 years, the U.S. Federal Reserve shows that older generations have been amassing wealth at a far greater rate than their younger cohorts.

As the visual above shows, the older have been getting richer, and the younger have been starting further back than ever before.

By Generation: Baby Boomers Benefit & Millennials Lag

To examine the proportion of wealth each generation holds, it’s important to clearly define each age group. Though personal definitions might differ, the U.S. Federal Reserve uses a clear metric:

| Generation | Birth Years | Age (2020) |

|---|---|---|

| Silent Generation & Earlier | 1945 and earlier | 75+ |

| Baby Boomers | 1946–1964 | 56–74 |

| Generation X | 1965–1980 | 40–55 |

| Millennials | 1981–1996 | 24–39 |

Relative to younger generations growing up, the Silent Generation and Greatest Generation before them have seen a decreasing share of household wealth over the last 30 years.

However, the numerical levels have been relatively stable. For these combined generations, total wealth has gone from $16 trillion in 1989 to $19 trillion in 2019, with a peak of $27 trillion in 2007. Considering this cohort has understandably shrunk over time—from an estimated 47 million to 23 million in 2019—their individual shares of wealth have actually increased.

Immediately following are the Baby Boomers, who held more than half of U.S. household wealth towards the end of 2020. At $59 trillion, the generation holds more than ten times the amount held by a comparative number of Millennials.

| Generation | Wealth (2019) | Population (2019) | Wealth/Person |

|---|---|---|---|

| Silent Generation & Older | $18.8 Trillion | 23.0 Million | $817,391 |

| Baby Boomers | $59.4 Trillion | 71.2 Million | $834,270 |

| Generation X | $28.6 Trillion | 65.0 Million | $440,000 |

| Millennials | $5.0 Trillion | 72.6 Million | $68,871 |

With $29 trillion held in 2019, Generation X has also been gaining in wealth over the last 30 years. It’s good enough for five times the wealth of Millennials, though at just $440k/person, they’ve fallen far behind Baby Boomers in rate of growth.

Finally, trying to catch up to their older cohorts are Millennials, who held the least amount of household wealth ($5 trillion) for the greatest population (73 million) in 2019, an average of just under $69k/person.

For a direct comparison, it took Generation X nine years to climb from their start of 0.4% of household wealth in 1989 to above 5%, while Millennials still haven’t crossed that threshold. But it’s not all doom and gloom for Millennials. Their rate of growth is starting to rise, with the generation’s level of wealth climbing from $3 trillion in 2016 to $5 trillion in 2019.

By Age: A Growing Share for 55+

Though the generational picture is stark, the difference in U.S. household wealth by age makes the picture of shifting wealth even clearer.

Until 2001, the shares of household wealth held by different age groups were relatively stable. People aged 40-54 and 55-69 held around 35% each of household wealth, retirees aged 70+ hovered around 20%, and younger people aged under 40 held around 10%.

Since that time, however, the shift in wealth to older generations is clear. The 70+ age group has seen their share of wealth increase to 26%, while the share held by ages 55-69 has grown from 35% to almost half.

But not all ages are seeing an increasing slice of wealth. The 40-54 age group saw its share drop sharply from 36% to 22% between 2001 and 2016 before starting to recover towards the end of the decade, while the youngest cohort now hover around just 5%.

Breaking down that wealth by components is even more eye-opening. The 39 and under age group holds 37.9% of their assets in real estate, the largest share amongst any age group (and concentrated in the hands of fewer people) while older age groups have their wealth spread out across real estate, equities, and pensions.

| Assets Held by Age (Percent of Total, 2020) | 70+ | 55–69 | 40–54 | ≤39 |

|---|---|---|---|---|

| Real estate | 21.6% | 20.5% | 27.6% | 37.9% |

| Consumer durables | 3.8% | 3.6% | 5.2% | 9.4% |

| Corporate equities and mutual fund shares | 24.6% | 23.1% | 18.6% | 8.1% |

| Pension entitlements | 16.3% | 25.0% | 21.9% | 21.0% |

| Private businesses | 7.9% | 9.7% | 12.1% | 8.1% |

| Other assets | 25.8% | 18.1% | 14.7% | 15.5% |

But the difference is as much in assets as it is in opportunity. In 1989, Baby Boomers and Generation X under 40 accounted for 13% of household wealth, compared to just 5.9% for Millennials and Generation Z under 40 in 2020.

Will the Tide Turn for Generation Z?

As new and accumulated wealth has been built up in older generations, it’s a matter of time before the pendulum starts to swing the other way.

The Millennials age group are expected to inherit $68 trillion by 2030 from Baby Boomer parents. Of course, that payout isn’t going to be even across the board, with wealthier families retaining the bulk of wealth and the majority of Millennials laden with debt.

And with Generation Z (born 1997-2012) starting to come of age, the uneven playing field is making it hard to begin accumulating wealth in the first place.

Since it is in the best interest of societies to have wealthy generations that can drive economic growth, potential solutions are being examined all over the political sphere. They include different taxation schemes, changing estate laws, and potentially cancelling student debt.

Whatever ends up happening, it’s important to track how the distribution of wealth changes over the coming decade, and begin accumulating your personal wealth as best as you can.

Money

Charted: Donald Trump’s Net Worth (2014-2024)

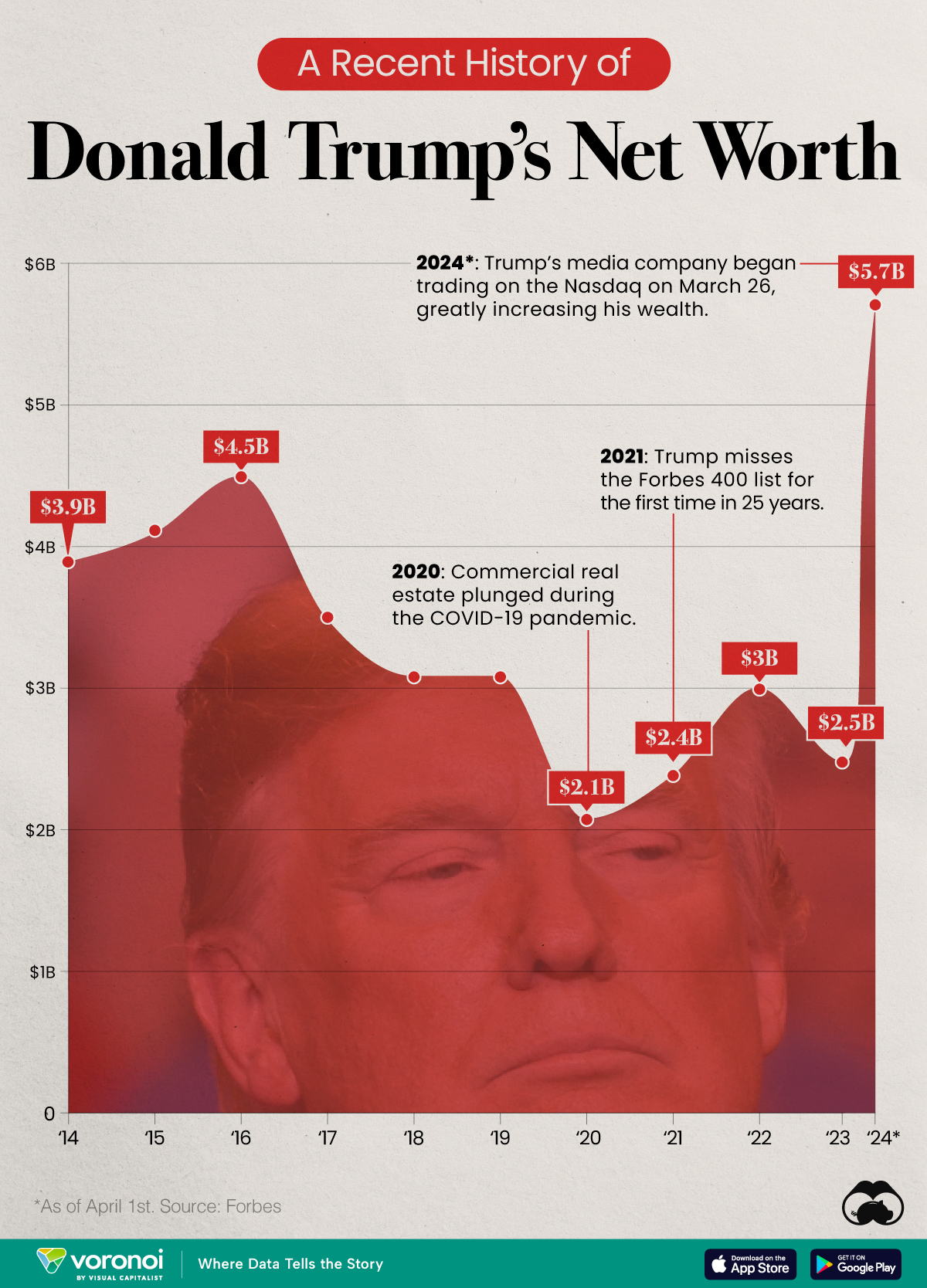

See how the Nasdaq debut of Trump Media & Technology Group has influenced Trump’s net worth, according to Forbes estimates.

Charted: Donald Trump’s Net Worth (2014-2024)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

On March 26, 2024, Trump Media & Technology Group (Ticker: DJT) debuted on the Nasdaq exchange, climbing over 30% in its first two days of trading. This gave the company a valuation of $9.4 billion, greatly increasing Donald Trump’s net worth.

To put this increase into perspective, we’ve visualized the past 10 years of Trump’s wealth as measured by Forbes.

Trump’s Net Worth Jumps After Nasdaq Listing

The data we used to create this graphic can be found in the table below. As of April 1, 2024, Trump’s net worth was measured at $5.7 billion. Note that Forbes updates this value regularly.

| Year | Net Worth ($B) |

|---|---|

| 2014 | 3.9 |

| 2015 | 4.1 |

| 2016 | 4.5 |

| 2017 | 3.5 |

| 2018 | 3.1 |

| 2019 | 3.1 |

| 2020 | 2.1 |

| 2021 | 2.4 |

| 2022 | 3.0 |

| 2023 | 2.5 |

| 2024 (As of April 1) | 5.7 |

It’s safe to say that going forward, Trump’s net worth will be largely influenced by the value of his stake in Trump Media & Technology Group (TMTG). SEC filings have revealed that the former president has a stake of at least 58.1% in the company.

What is Trump Media & Technology Group?

TMTG is a media company founded in 2021 by Trump, debuting on the Nasdaq as a public company after merging with Digital World Acquisition Corp, a special-purpose acquisition company (SPAC).

Also known as “blank check companies”, SPACs are shell corporations listed on a stock exchange that acquire a private company with the purpose of making it public (without going through an IPO).

TMTG released its X (formerly Twitter) competitor, Truth Social, in Feb 2022. According to estimates from SimilarWeb, the platform had around 5 million monthly users as of Feb 2024.

DJT Slips After Reporting Weak Financials

After its hot debut on the Nasdaq, DJT shares have stumbled, falling by more than 20% on April 1. This is due to recent disclosures which revealed that the company lost over $58 million in 2023.

Revenue in 2023 was $4.1 million, which is higher than the $1.5 million generated in 2022.

Learn More About the World’s Wealthiest Individuals

If you found this post interesting, check out our annual list of the world’s richest people, or this graphic ranking the world’s richest monarchs.

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes