Datastream

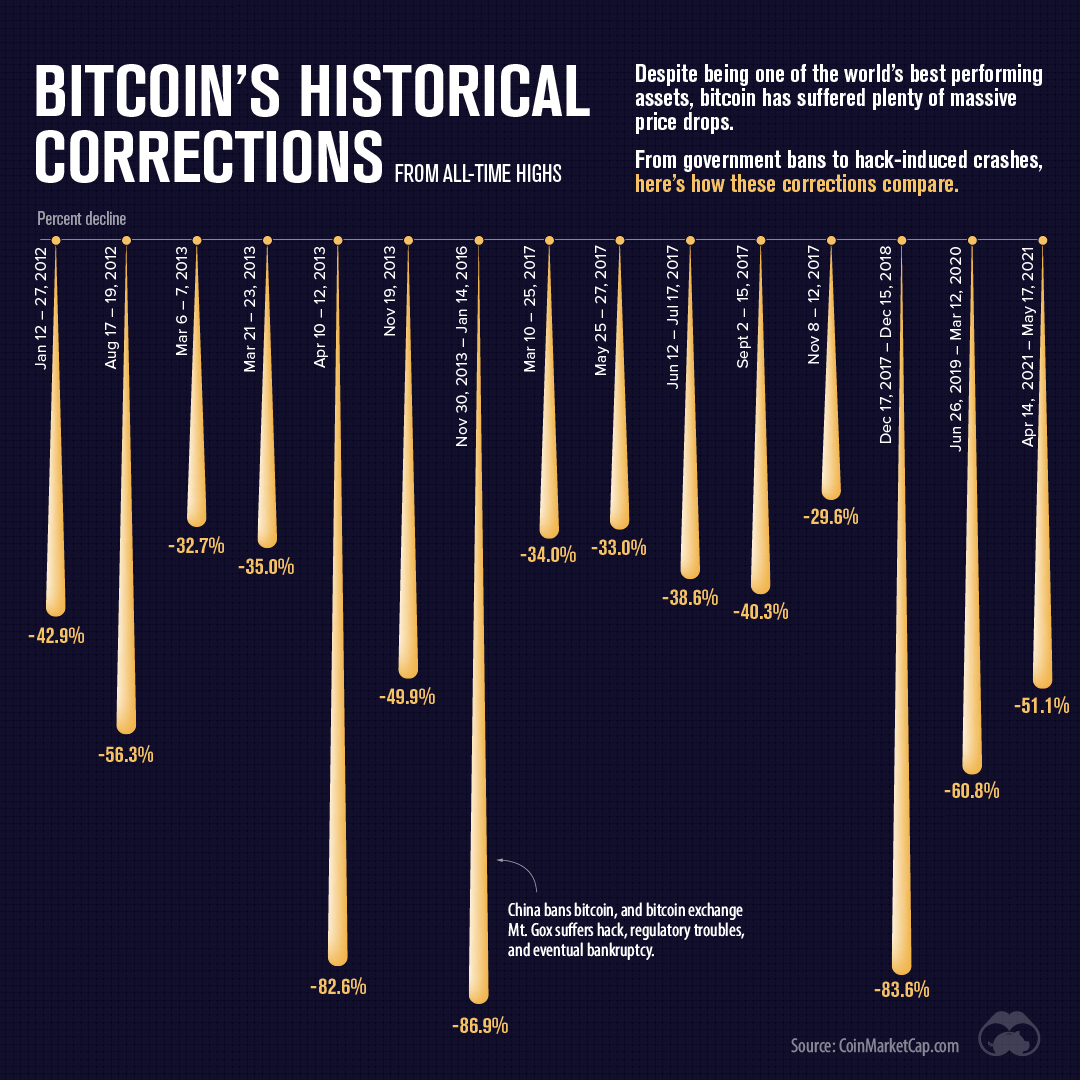

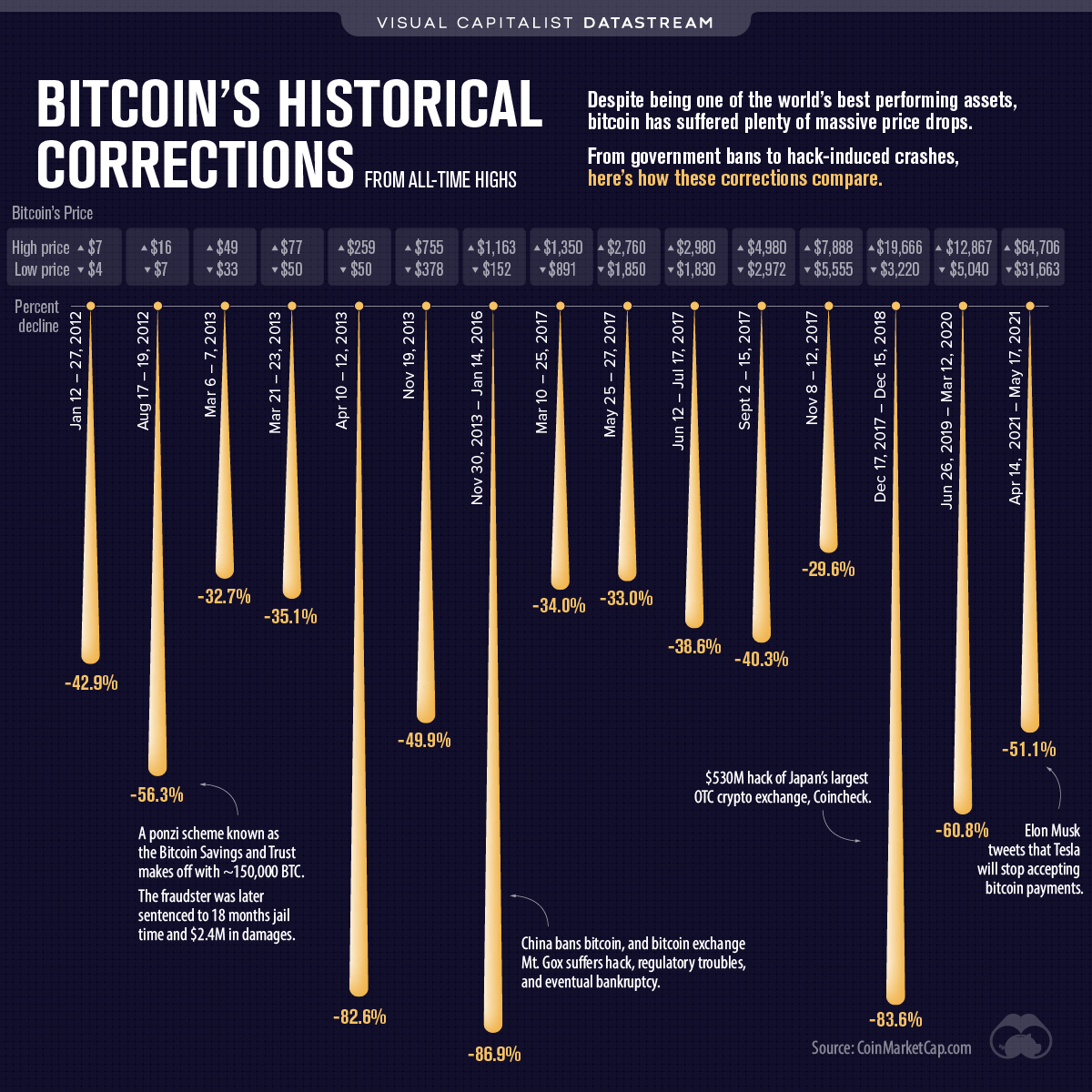

The Bitcoin Crash of 2021 Compared to Past Sell-Offs

The Briefing

- Bitcoin had its latest price correction, pulling back more than 50% from its all-time highs

- Elon Musk’s tweet announcing Tesla’s suspension of bitcoin purchases accelerated the price drop

Bitcoin’s Latest Crash: Not the First, Not the Last

While bitcoin has been one of the world’s best performing assets over the past 10 years, the cryptocurrency has had its fair share of volatility and price corrections.

Using data from CoinMarketCap, this graphic looks at bitcoin’s historical price corrections from all-time highs.

With bitcoin already down ~15% from its all-time high, Elon Musk’s tweet announcing Tesla would stop accepting bitcoin for purchases helped send the cryptocurrency down more than 50% from the top, dipping into the $30,000 price area.

“Tesla has suspended vehicle purchases using Bitcoin. We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.”

– @Elonmusk

Crypto Cycle Top or Bull Run Pullback?

It’s far too early to draw any conclusions from bitcoin’s latest drop despite 30-40% pullbacks being common pit stops across bitcoin’s various bull runs.

While this drop fell a bit more from high to low than the usual bull run pullback, bitcoin’s price has since recovered and is hovering around $39,000, about a 40% drop from the top.

Whether or not this is the beginning of a new downtrend or the ultimate dip-buying opportunity, there has been a clear change in sentiment (and price) after Elon Musk tweeted about bitcoin’s sustainability concerns.

The Decoupling: Blockchain, not Bitcoin

Bitcoin and its energy intensive consensus protocol “proof-of-work” has come under scrutiny for the 129 terawatt-hours it consumes annually for its network functions.

Some other cryptocurrencies already use less energy-intensive consensus protocols, like Cardano’s proof-of-stake, Solana’s proof-of-history, or Nyzo’s proof-of-diversity. With the second largest cryptocurrency, Ethereum, also preparing to shift away from proof-of-work to proof-of-stake, this latest bitcoin drop could mark a potential decoupling in the cryptocurrency market.

In just the past two months, bitcoin’s dominance in the crypto ecosystem has fallen from over 70% to 43%.

| Date | Bitcoin Dominance | Ethereum Dominance | Other Cryptocurrency |

|---|---|---|---|

| End of 2020 | 70.98% | 11.09% | 17.93% |

| January | 63.09% | 15.39% | 21.52% |

| February | 61.73% | 11.96% | 26.31% |

| March | 60.19% | 12.14% | 27.67% |

| April | 50.18% | 14.92% | 34.90% |

| May | 43.25% | 18.59% | 38.16% |

Source: TradingView

While the decoupling narrative has grown alongside Ethereum’s popularity as it powers NFTs and decentralized finance applications, it’s worth noting that the last time bitcoin suffered such a steep drop in dominance was the crypto market’s last cycle top in early 2018.

For now, the entire crypto market has pulled back, with the total cryptocurrency space’s market cap going from a high of $2.56T to today’s $1.76T (a 30% decline).

While the panic selling seems to have finished, the next few weeks will define whether this was just another dip to buy, or the beginning of a steeper decline.

»Like this? Here’s another article you might enjoy: Why the Market is Thinking about Bitcoin Differently

Where does this data come from?

Source: CoinMarketCap

Details: CoinMarketCap uses a volume weighted average of bitcoin’s market pair prices.

Datastream

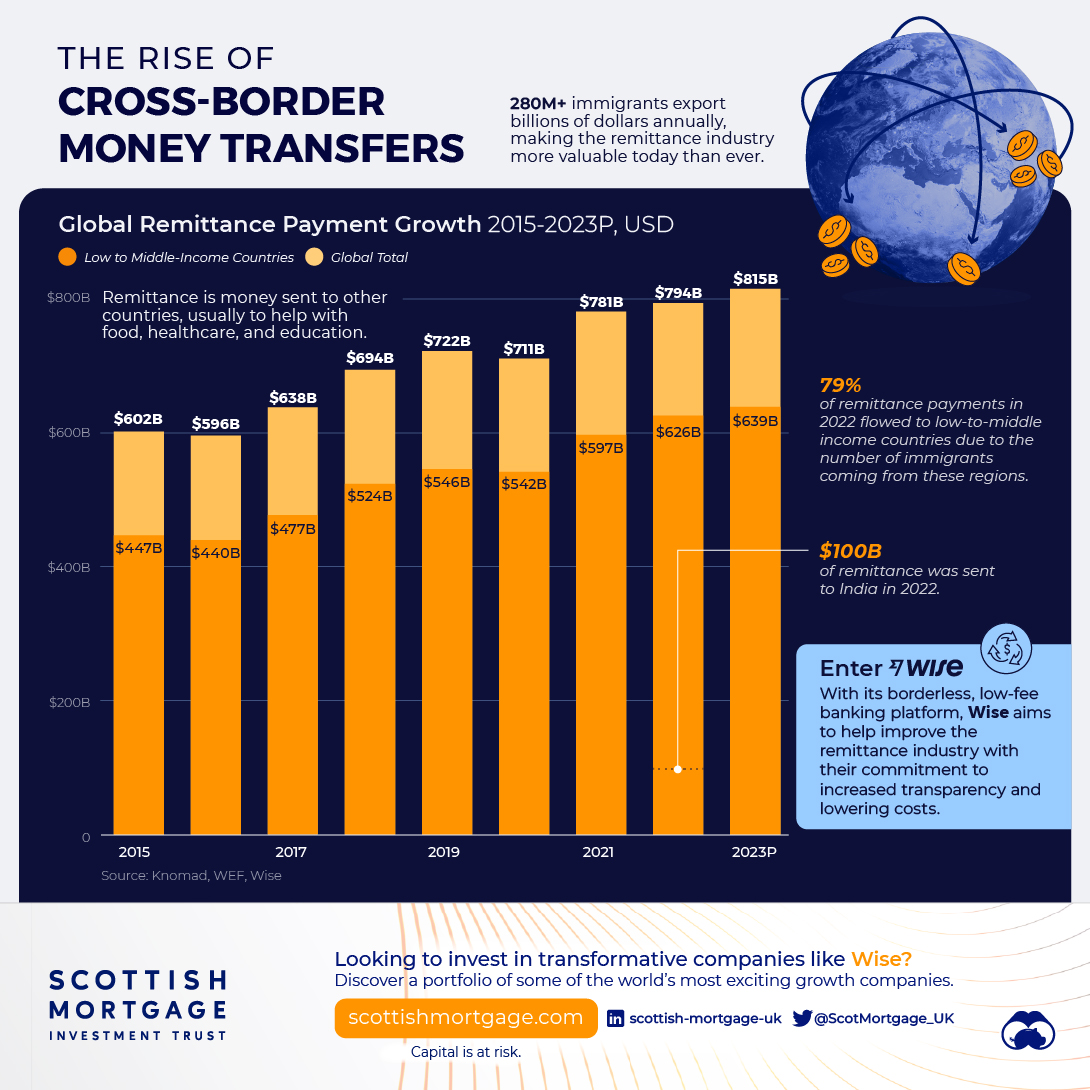

Charting the Rise of Cross-Border Money Transfers (2015-2023)

With over 280 million immigrants transferring billions of dollars annually, the remittance industry has become more valuable than ever.

The Briefing

- 79% of remittance payments in 2022 were made to low and middle-income countries.

- Borderless, low-cost money transfer services like those provided by Wise can help immigrants support their families.

The Rise of Cross-Border Money Transfers

The remittance industry has experienced consistent growth recently, solidifying its position as a key component of the global financial landscape. Defined as the transfer of money from one country to another, usually to support a dependent, remittances play a pivotal role in providing food, healthcare, and education.

In this graphic, sponsored by Scottish Mortgage, we delve into the growth of the remittance industry, and the key factors propelling its success.

Powered by Immigration

With over 280 million immigrants worldwide, the remittance industry has an important place in our global society.

By exporting billions of dollars annually back to their starting nations, immigrants can greatly improve the livelihoods of their families and communities.

This is particularly true for low and middle-income countries, who in 2022 received, on average, 79% of remittance payments, according to Knomad, an initiative of the World Bank.

| Year | Low/Middle Income (US$ Billion) | World Total (US$ Billion) |

|---|---|---|

| 2015 | $447B | $602B |

| 2016 | $440B | $596B |

| 2017 | $477B | $638B |

| 2018 | $524B | $694B |

| 2019 | $546B | $722B |

| 2020 | $542B | $711B |

| 2021 | $597B | $781B |

| 2022 | $626B | $794B |

| 2023 | $639B | $815B |

India is one of the global leaders in receiving remittance payments. In 2022 alone, over $100 billion in remittances were sent to India, supporting many families.

Enter Wise

As the global remittance industry continues to grow, it is important to acknowledge the role played by innovative money transfer operators like Wise.

With an inclusive, user-centric platform and competitive exchange rates, Wise makes it easy and cost-effective for millions of individuals to send money home, worldwide.

Connection Without Borders

But Wise doesn’t just offer remittance solutions, the company offers a host of account services and a payment infrastructure that has helped over 6.1 million active customers move over $30 billion in the first quarter of 2023 alone.

Want to invest in transformative companies like Wise?

Discover Scottish Mortgage Investment Trust, a portfolio of some of the world’s most exciting growth companies.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue