Markets

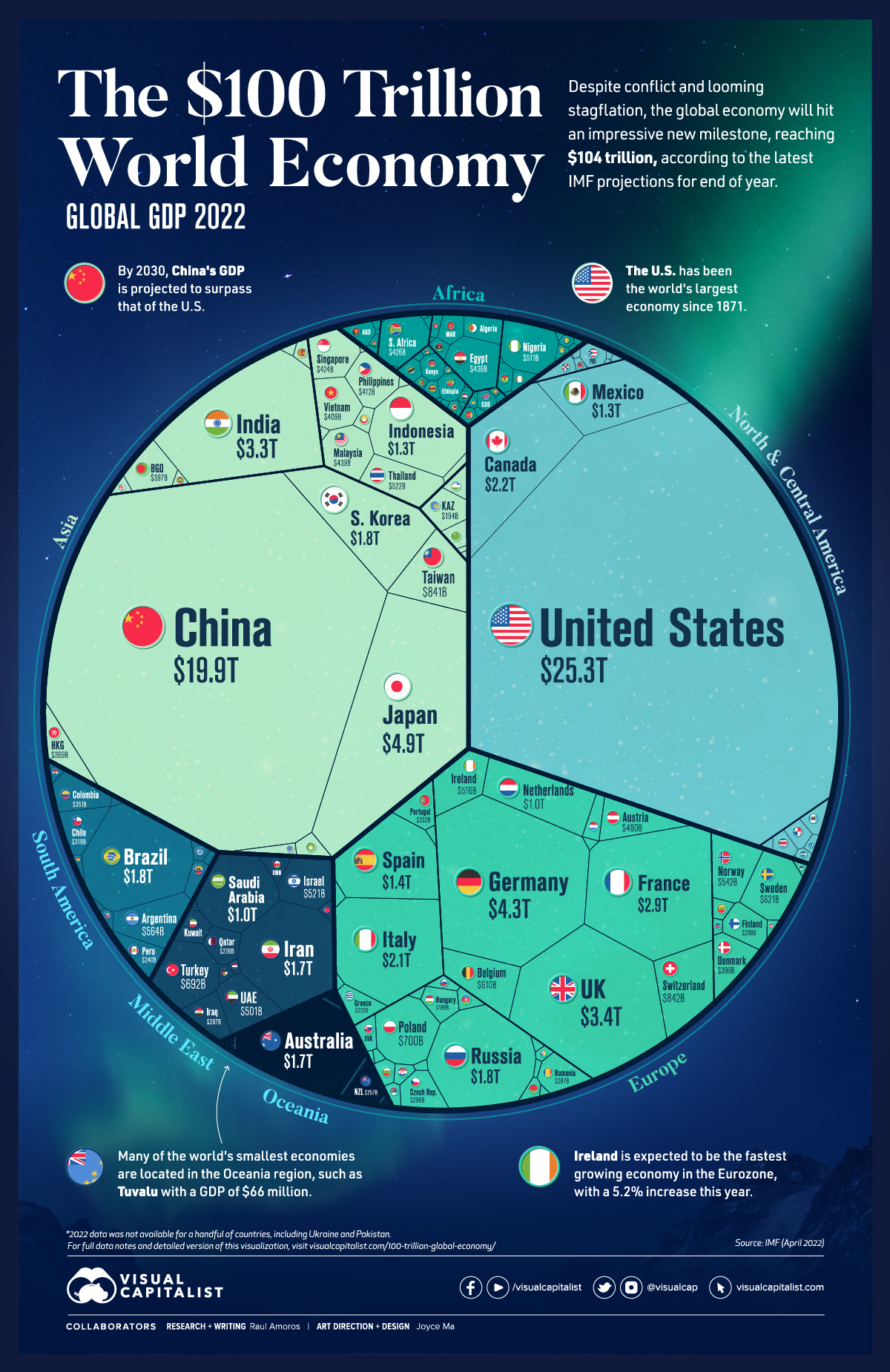

The $100 Trillion Global Economy in One Chart

Check out the latest 2023 update of the global economy in one chart.

Visualizing the $100 Trillion Global Economy in One Chart

Check out the latest 2023 update of the global economy in one chart.

Surpassing the $100 trillion mark is a new milestone for global economic output.

We’ve covered this topic in the past when the world’s GDP was $88 trillion (2020) and then $94 trillion (2021), and now according to the latest projections, the IMF expects the global economy to reach nearly $104 trillion in nominal value by the end of 2022.

Although growth keeps trending upwards, the recovery that was expected in the post-pandemic period is looking strained. Because of recent conflicts, supply chain bottlenecks, and subsequent inflation, global economic projections are getting revised downwards.

Global annual GDP growth for 2022 was initially projected to be 4.4% as of January, but this has since been adjusted to 3.6%.

Note: This data from the IMF represents the most recent nominal projections for end of year as of April 2022.

The 50 Largest Economies in the World

The United States is still the economic leader worldwide, with a GDP of $25.3 trillion—making up nearly one quarter of the global economy. China follows close behind at $19.9 trillion. Here’s a look at the top 50 countries in terms of GDP:

| Rank | Country | GDP (current prices, USD) |

|---|---|---|

| #1 | 🇺🇸 United States | $25.3 trillion |

| #2 | 🇨🇳 China | $19.9 trillion |

| #3 | 🇯🇵 Japan | $4.9 trillion |

| #4 | 🇩🇪 Germany | $4.3 trillion |

| #5 | 🇬🇧 United Kingdom | $3.4 trillion |

| #6 | 🇮🇳 India | $3.3 trillion |

| #7 | 🇫🇷 France | $2.9 trillion |

| #8 | 🇨🇦 Canada | $2.2 trillion |

| #9 | 🇮🇹 Italy | $2.1 trillion |

| #10 | 🇧🇷 Brazil | $1.8 trillion |

| #11 | 🇷🇺 Russia | $1.8 trillion |

| #12 | 🇰🇷 South Korea | $1.8 trillion |

| #13 | 🇦🇺 Australia | $1.7 trillion |

| #14 | 🇮🇷 Iran | $1.7 trillion |

| #15 | 🇪🇸 Spain | $1.4 trillion |

| #16 | 🇲🇽 Mexico | $1.3 trillion |

| #17 | 🇮🇩 Indonesia | $1.3 trillion |

| #18 | 🇸🇦 Saudi Arabia | $1.0 trillion |

| #19 | 🇳🇱 Netherlands | $1.0 trillion |

| #20 | 🇨🇭 Switzerland | $842 billion |

| #21 | 🇹🇼 Taiwan | $841 billion |

| #22 | 🇵🇱 Poland | $700 billion |

| #23 | 🇹🇷 Turkey | $692 billion |

| #24 | 🇸🇪 Sweden | $621 billion |

| #25 | 🇧🇪 Belgium | $610 billion |

| #26 | 🇦🇷 Argentina | $564 billion |

| #27 | 🇳🇴 Norway | $542 billion |

| #28 | 🇹🇭 Thailand | $522 billion |

| #29 | 🇮🇱 Israel | $521 billion |

| #30 | 🇮🇪 Ireland | $516 billion |

| #31 | 🇳🇬 Nigeria | $511 billion |

| #32 | 🇦🇪 United Arab Emirates | $501 billion |

| #33 | 🇦🇹 Austria | $480 billion |

| #34 | 🇲🇾 Malaysia | $439 billion |

| #35 | 🇪🇬 Egypt | $436 billion |

| #36 | 🇿🇦 South Africa | $426 billion |

| #37 | 🇸🇬 Singapore | $424 billion |

| #38 | 🇵🇭 Philippines | $412 billion |

| #39 | 🇻🇳 Vietnam | $409 billion |

| #40 | 🇩🇰 Denmark | $399 billion |

| #41 | 🇧🇩 Bangladesh | $397 billion |

| #42 | 🇭🇰 Hong Kong SAR | $369 billion |

| #43 | 🇨🇴 Colombia | $351 billion |

| #44 | 🇨🇱 Chile | $318 billion |

| #45 | 🇫🇮 Finland | $298 billion |

| #46 | 🇮🇶 Iraq | $297 billion |

| #47 | 🇨🇿 Czechia | $296 billion |

| #48 | 🇷🇴 Romania | $287 billion |

| #49 | 🇳🇿 New Zealand | $257 billion |

| #50 | 🇵🇹 Portugal | $252 billion |

The frontrunner in Europe is Germany at $4.3 trillion, with the UK coming in second place. One significant change since the last reported figures is that Brazil now cracks the top 10, having surpassed South Korea. Russia falls just outside, in 11th place, with a GDP of $1.8 trillion.

While China’s GDP growth has slowed in recent years, projections still indicate that the country will overtake the U.S. by 2030, dethroning the world’s economic leader.

One region also expected to experience growth in the near future is the Middle East and North Africa, thanks to higher oil prices—Iraq and Saudi Arabia in particular are leading this charge. Regional GDP growth in the area is expected to be around 5% in 2022.

The 50 Smallest Economies in the World

Some of the world’s smallest economies were hit particularly hard by the pandemic, and have subsequently been the most affected by the inflation and food supply shortages resulting from the war in Ukraine.

Here’s a look at the countries worldwide with the lowest GDP in 2022:

| Rank | Country | GDP (current prices, USD) |

|---|---|---|

| #191 | 🇹🇻 Tuvalu | $66 million |

| #190 | 🇳🇷 Nauru | $134 million |

| #189 | 🇰🇮 Kiribati | $216 million |

| #188 | 🇵🇼 Palau | $244 million |

| #187 | 🇲🇭 Marshall Islands | $267 million |

| #186 | 🇫🇲 Micronesia | $427 million |

| #185 | 🇸🇹 São Tomé and Príncipe | $1 billion |

| #184 | 🇹🇴 Tonga | $1 billion |

| #183 | 🇩🇲 Dominica | $1 billion |

| #182 | 🇼🇸 Samoa | $1 billion |

| #181 | 🇻🇨 Saint Vincent and the Grenadines | $1 billion |

| #180 | 🇻🇺 Vanuatu | $1 billion |

| #179 | 🇰🇳 Saint Kitts and Nevis | $1 billion |

| #178 | 🇬🇩 Grenada | $1 billion |

| #177 | 🇰🇲 Comoros | $1 billion |

| #176 | 🇦🇬 Antigua and Barbuda | $2 billion |

| #175 | 🇬🇼 Guinea-Bissau | $2 billion |

| #174 | 🇸🇧 Solomon Islands | $2 billion |

| #173 | 🇸🇲 San Marino | $2 billion |

| #172 | 🇸🇨 Seychelles | $2 billion |

| #171 | 🇹🇱 Timor-Leste | $2 billion |

| #170 | 🇧🇿 Belize | $2 billion |

| #169 | 🇨🇻 Cabo Verde | $2 billion |

| #168 | 🇱🇨 Saint Lucia | $2 billion |

| #167 | 🇬🇲 The Gambia | $2 billion |

| #166 | 🇱🇸 Lesotho | $3 billion |

| #165 | 🇪🇷 Eritrea | $3 billion |

| #164 | 🇨🇫 Central African Republic | $3 billion |

| #163 | 🇧🇹 Bhutan | $3 billion |

| #162 | 🇸🇷 Suriname | $3 billion |

| #161 | 🇦🇼 Aruba | $3 billion |

| #160 | 🇦🇩 Andorra | $3 billion |

| #159 | 🇧🇮 Burundi | $3 billion |

| #158 | 🇱🇷 Liberia | $4 billion |

| #157 | 🇩🇯 Djibouti | $4 billion |

| #156 | 🇸🇱 Sierra Leone | $4 billion |

| #155 | 🇸🇿 Eswatini | $5 billion |

| #154 | 🇫🇯 Fiji | $5 billion |

| #153 | 🇲🇻 Maldives | $6 billion |

| #152 | 🇧🇧 Barbados | $6 billion |

| #151 | 🇸🇸 South Sudan | $6 billion |

| #150 | 🇲🇪 Montenegro | $6 billion |

| #149 | 🇹🇯 Tajikistan | $8 billion |

| #148 | 🇸🇴 Somalia | $8 billion |

| #147 | 🇹🇬 Togo | $9 billion |

| #146 | 🇰🇬 Kyrgyzstan | $9 billion |

| #145 | 🇲🇷 Mauritania | $9 billion |

| #144 | 🇽🇰 Kosovo | $10 billion |

| #143 | 🇲🇺 Mauritius | $11 billion |

| #142 | 🇲🇼 Malawi | $12 billion |

The smallest economy in the world measured in the IMF rankings is Tuvalu at $66 million. Most of the bottom 50 are considered low- to middle-income and emerging/developing countries. According to the World Bank, in developing countries, the level of per capita income in 2022 will be about 5% below the pre-pandemic trends.

Some countries are actually projected to experience negative GDP growth this year, particularly emerging and developing economies in Europe.

For example, Russia is expected to experience a GDP growth rate of -8.5% in 2022, though it still remains to be seen how the cost of war and increasingly harsh global sanctions impact the country’s economic prospects.

Inflation, Stagflation, Recession – How Bad is it?

While global economic growth has already been revised downwards, it’s possible the situation could be even more serious. Organizations like the World Bank say that risks of stagflation are rising. Stagflation, which hasn’t occurred since the 1970s, is defined as an economy that’s experiencing rising inflation combined with a stagnant economic output.

Currently, global consumer inflation is currently pegged at 7%. Daily goods are becoming increasingly difficult to purchase and interest rates are on the rise as central banks worldwide try to control the situation. As recent events in Sri Lanka demonstrate, low-income countries are particularly at risk to economic volatility.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive1 week ago

Automotive1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001