Money

Wealth Needed to Join the Top 1%, by Country

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Wealth Needed to Join the Top 1%, by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

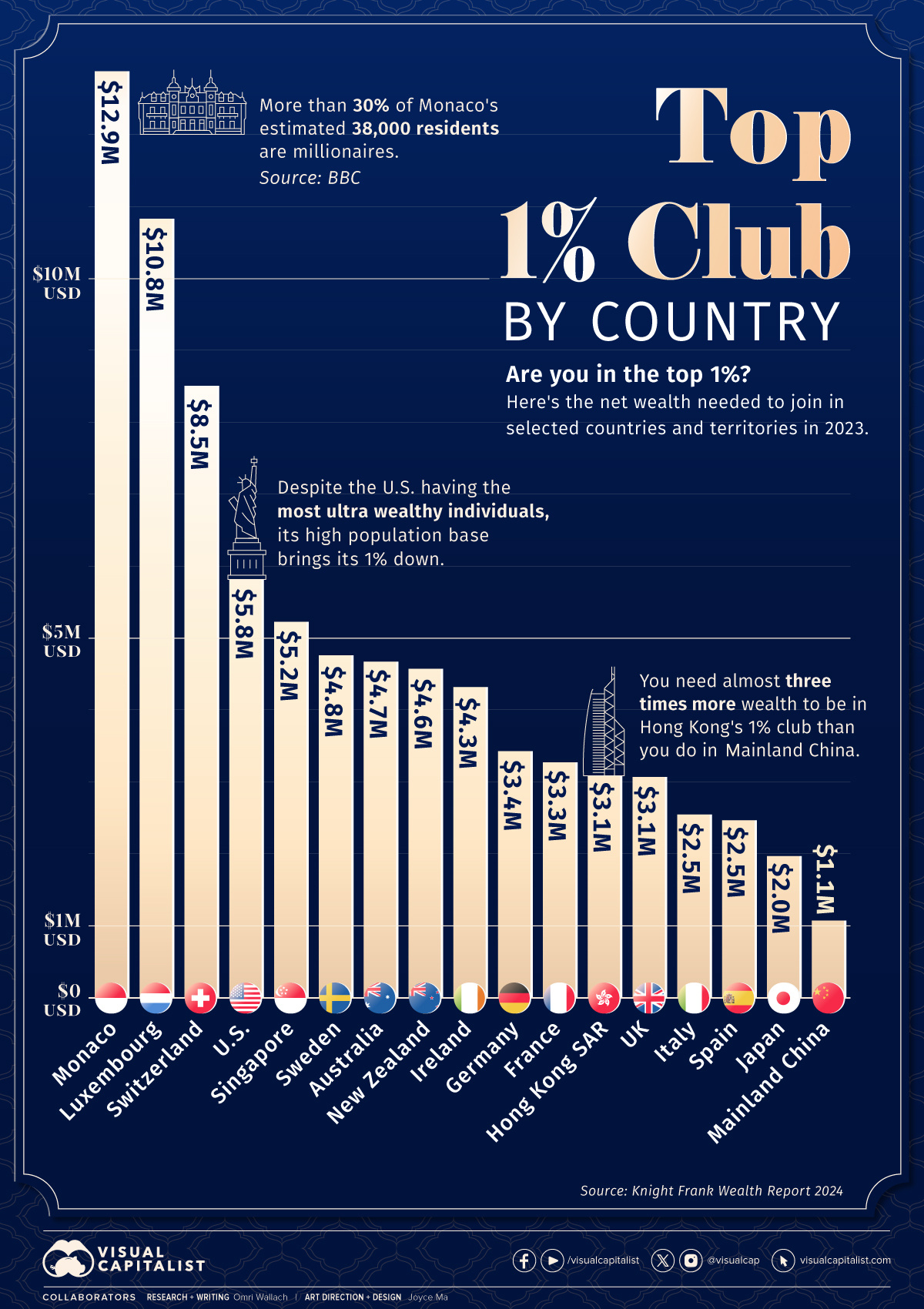

The last decade has witnessed a remarkable surge in the global number of millionaires.

By 2022, 1.1% of the world’s adults were millionaires, up from 0.6% in 2012. So, how to know if you belong to the top 1% in your country?

In this infographic, we illustrate the net wealth required to enter the club in selected countries and territories. The data is sourced from the Knight Frank Wealth Report 2024.

The 1% Club

The individual net wealth required to join the top 1% can vary across countries.

European hubs top the list, with small countries like Monaco or Luxembourg having extremely high wealth barriers to joining the top 1%.

| Countries | Region | Wealth (USD) | Population |

|---|---|---|---|

| 🇲🇨 Monaco | Europe | $12,883,000 | 36,297 |

| 🇱🇺 Luxembourg | Europe | $10,832,000 | 654,768 |

| 🇨🇭 Switzerland | Europe | $8,509,000 | 8,796,669 |

| 🇺🇸 U.S. | N. America | $5,813,000 | 339,996,563 |

| 🇸🇬 Singapore | Asia | $5,227,000 | 6,014,723 |

| 🇸🇪 Sweden | Europe | $4,761,000 | 10,612,086 |

| 🇦🇺 Australia | Oceania | $4,673,000 | 26,439,111 |

| 🇳🇿 New Zealand | Oceania | $4,574,000 | 5,228,100 |

| 🇮🇪 Ireland | Europe | $4,321,000 | 5,056,935 |

| 🇩🇪 Germany | Europe | $3,430,000 | 83,294,633 |

| 🇫🇷 France | Europe | $3,273,000 | 64,756,584 |

| 🇭🇰 Hong Kong SAR | Asia | $3,094,000 | 7,491,609 |

| 🇬🇧 UK | Europe | $3,070,000 | 67,736,802 |

| 🇮🇹 Italy | Europe | $2,548,000 | 58,870,762 |

| 🇪🇸 Spain | Europe | $2,468,000 | 47,519,628 |

| 🇯🇵 Japan | Asia | $1,971,000 | 123,294,513 |

| 🇨🇳 China (mainland) | Asia | $1,074,000 | 1,425,671,352 |

According to this year’s report, Monaco leads with $12.9 million required to join the 1% club. Currently, more than 30% of Monaco’s estimated 38,000 residents are millionaires.

Luxembourg follows at $10.8 million, with Switzerland at $8.5 million securing the third position.

The U.S. ranks fourth at $5.8 million. Despite having the most ultra-wealthy individuals, the country’s high population base brings the law of averages into play.

In the Asia Pacific region, Singapore leads the pack with a requirement of $5.2 million, while Hong Kong comes second at $3.1 million.

Interestingly, a person in Hong Kong needs almost three times more wealth to join the 1% club compared to someone in Mainland China.

How to Join the 1% Club?

To be part of the top 1% club of one’s country or region often requires a combination of advanced education, entrepreneurship, strategic investments, and even luck. While there’s no guaranteed path to entry, consistency and time are key factors.

In the U.S., for instance, many individuals and families who have surpassed the 1% threshold have done so over time.

Economy

Ranked: The Top 20 Countries in Debt to China

The 20 nations featured in this graphic each owe billions in debt to China, posing concerns for their economic future.

Ranked: The Top 20 Countries in Debt to China

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we ranked the top 20 countries by their amount of debt to China. These figures are as of 2022, and come from the World Bank (accessed via Yahoo Finance).

The data used to make this graphic can be found in the table below.

| Country | Total external debt to China ($B) |

|---|---|

| 🇵🇰 Pakistan | $26.6 |

| 🇦🇴 Angola | $21.0 |

| 🇱🇰 Sri Lanka | $8.9 |

| 🇪🇹 Ethiopia | $6.8 |

| 🇰🇪 Kenya | $6.7 |

| 🇧🇩 Bangladesh | $6.1 |

| 🇿🇲 Zambia | $6.1 |

| 🇱🇦 Laos | $5.3 |

| 🇪🇬 Egypt | $5.2 |

| 🇳🇬 Nigeria | $4.3 |

| 🇪🇨 Ecuador | $4.1 |

| 🇰🇭 Cambodia | $4.0 |

| 🇨🇮 Côte d'Ivoire | $3.9 |

| 🇧🇾 Belarus | $3.9 |

| 🇨🇲 Cameroon | $3.8 |

| 🇧🇷 Brazil | $3.4 |

| 🇨🇬 Republic of the Congo | $3.4 |

| 🇿🇦 South Africa | $3.4 |

| 🇲🇳 Mongolia | $3.0 |

| 🇦🇷 Argentina | $2.9 |

This dataset highlights Pakistan and Angola as having the largest debts to China by a wide margin. Both countries have taken billions in loans from China for various infrastructure and energy projects.

Critically, both countries have also struggled to manage their debt burdens. In February 2024, China extended the maturity of a $2 billion loan to Pakistan.

Soon after in March 2024, Angola negotiated a lower monthly debt payment with its biggest Chinese creditor, China Development Bank (CDB).

Could China be in Trouble?

China has provided developing countries with over $1 trillion in committed funding through its Belt and Road Initiative (BRI), a massive economic development project aimed at enhancing trade between China and countries across Asia, Africa, and Europe.

Many believe that this lending spree could be an issue in the near future.

According to a 2023 report by AidData, 80% of these loans involve countries in financial distress, raising concerns about whether participating nations will ever be able to repay their debts.

While China claims the BRI is a driver of global development, critics in the West have long warned that the BRI employs debt-trap diplomacy, a tactic where one country uses loans to gain influence over another.

Editor’s note: The debt shown in this visualization focuses only on direct external debt, and does not include publicly-traded, liquid, debt securities like bonds. Furthermore, it’s worth noting the World Bank data excludes some countries with data accuracy or reporting issues, such as Venezuela.

Learn More About Debt from Visual Capitalist

If you enjoyed this post, check out our breakdown of $97 trillion in global government debt.

-

Markets6 days ago

Markets6 days agoThe Top Private Equity Firms by Country

-

Countries2 weeks ago

Countries2 weeks agoCountries With the Largest Happiness Gains Since 2010

-

Economy2 weeks ago

Economy2 weeks agoVC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

Demographics2 weeks ago

Demographics2 weeks agoThe Countries That Have Become Sadder Since 2010

-

Money2 weeks ago

Money2 weeks agoCharted: Who Has Savings in This Economy?

-

Technology2 weeks ago

Technology2 weeks agoVisualizing AI Patents by Country

-

Economy2 weeks ago

Economy2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth1 week ago

Wealth1 week agoCharted: Which City Has the Most Billionaires in 2024?