Stocks

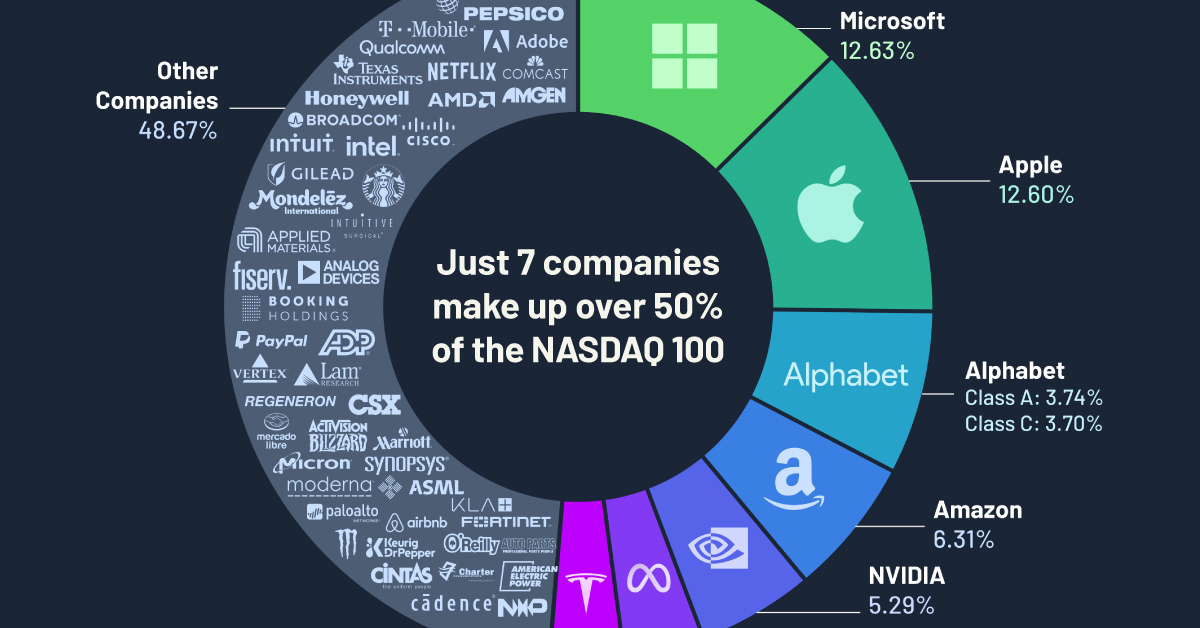

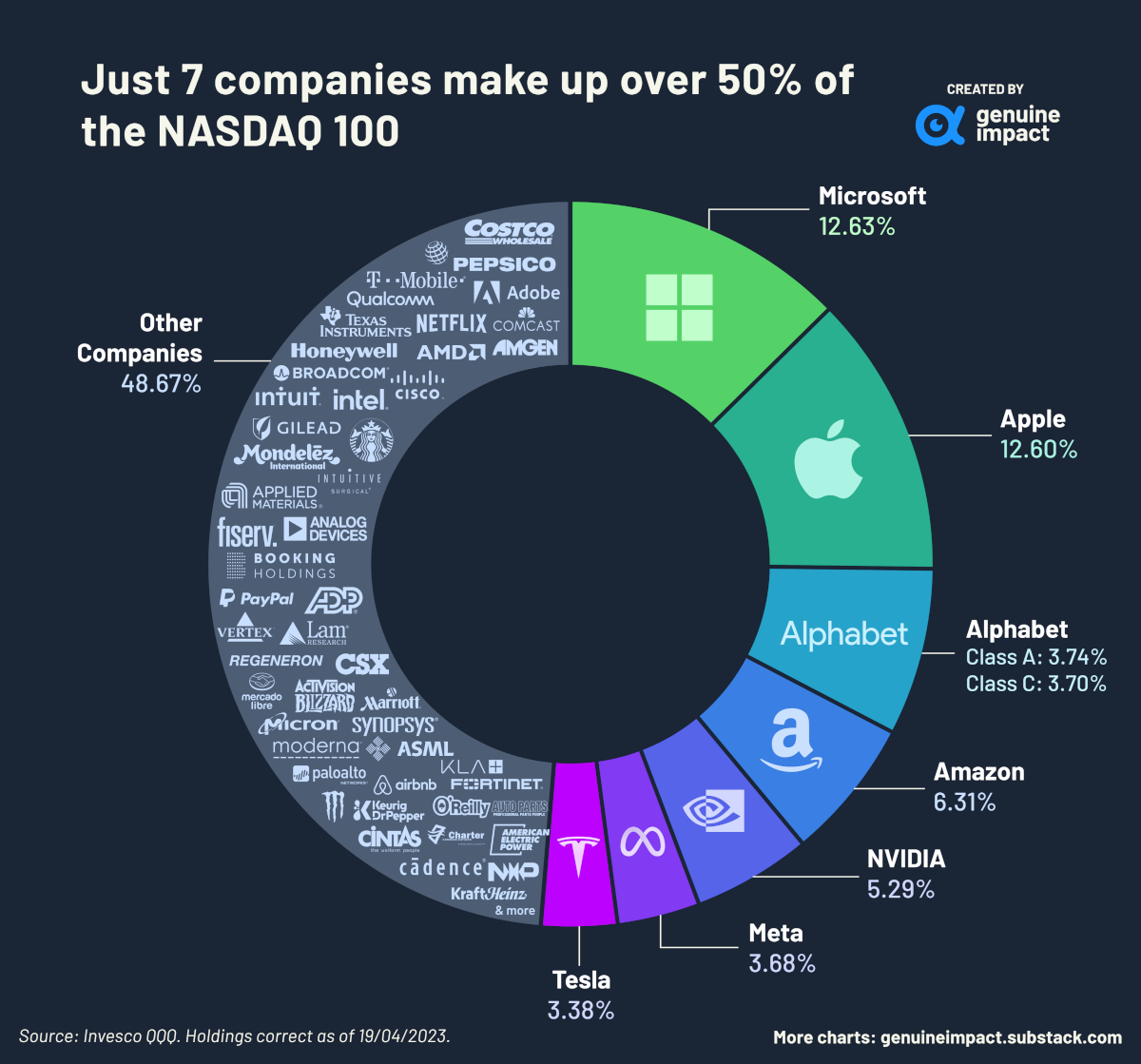

Charted: Companies in the Nasdaq 100, by Weight

Charted: Companies in the Nasdaq 100, by Weight

Launched in 1985, the Nasdaq 100 index tracks the performance of the largest, and most actively-traded, non-financial companies listed on the Nasdaq stock exchange.

The index is capitalization-weighted, meaning that stock weights in the index are based on each company’s market cap (with some rules to rebalance if companies have an oversized influence). For example, leaders Apple and Microsoft amounted to more than one-fourth of the Nasdaq 100’s total market capitalization alone as of April 2023.

One of the most well-known trackers of the index, Invesco QQQ’s ETF, is the data source for today’s visualization by Truman Du.

Just 7 Companies Dominate the Nasdaq 100

Microsoft and Apple, together with the next five ranked companies, made up over 50% of the total weight of the index in April. These companies are: Alphabet (Google), Amazon, NVIDIA, Meta, and Tesla, with Alphabet’s class A and class C shares occupying two spots.

Here’s a breakdown of all 100 companies on the Nasdaq 100, by percentage weight in the index on April 19, 2023.

| Company | Allocation |

|---|---|

| Microsoft | 12.63% |

| Apple | 12.60% |

| Amazon | 6.31% |

| NVIDIA | 5.29% |

| Alphabet (Class A) | 3.74% |

| Alphabet (Class C) | 3.70% |

| Meta (Class A) | 3.68% |

| Tesla | 3.38% |

| Broadcom | 2.03% |

| PepsiCo | 1.95% |

| Costco | 1.69% |

| Cisco | 1.51% |

| T-Mobile | 1.39% |

| Adobe | 1.33% |

| Comcast (Class A) | 1.23% |

| Texas Instruments | 1.23% |

| AMD | 1.11% |

| Netflix | 1.10% |

| Qualcomm | 1.01% |

| Honeywell International | 1.01% |

| Amgen | 1.01% |

| Intel | 0.99% |

| Intuit | 0.96% |

| Starbucks | 0.94% |

| Gilead Sciences | 0.80% |

| Intuitive Surgical | 0.80% |

| Booking Holdings | 0.77% |

| Mondelez International (Class A) | 0.74% |

| Analog Devices | 0.73% |

| Applied Materials | 0.71% |

| Automatic Data Processing | 0.69% |

| Regeneron Pharmaceuticals | 0.67% |

| PayPal Holdings | 0.65% |

| Vertex Pharmaceuticals | 0.65% |

| Fiserv | 0.56% |

| Activision Blizzard | 0.51% |

| Lam Research | 0.51% |

| Micron Technology | 0.51% |

| MercadoLibre | 0.50% |

| CSX Corp | 0.48% |

| Palo Alto Networks | 0.45% |

| Cadence Design | 0.45% |

| Synopsys | 0.44% |

| O'Reilly Automotive | 0.43% |

| Moderna | 0.42% |

| ASML Holding NV ADR | 0.42% |

| Monster Beverage | 0.42% |

| Marriott (Class A) | 0.41% |

| Fortinet | 0.40% |

| Charter Communications (Class A) | 0.40% |

| KLA Corp | 0.38% |

| Keurig Dr Pepper | 0.38% |

| Airbnb (Class A) | 0.38% |

| Kraft Heinz | 0.37% |

| American Electric Power | 0.37% |

| DexCom | 0.37% |

| Cintas Corp | 0.35% |

| Lululemon | 0.35% |

| AstraZeneca PLC ADR | 0.35% |

| NXP Semiconductors NV | 0.34% |

| Microchip Technology | 0.33% |

| Exelon Corp | 0.33% |

| Autodesk | 0.33% |

| Biogen | 0.32% |

| PDD Holdings Inc ADR | 0.32% |

| IDEXX Laboratories | 0.31% |

| Paychex | 0.30% |

| Workday (Class A) | 0.30% |

| Xcel Energy | 0.30% |

| Seagen | 0.29% |

| PACCAR | 0.29% |

| ODFL | 0.29% |

| Copart | 0.29% |

| Illumina | 0.28% |

| Ross Stores | 0.28% |

| EA | 0.27% |

| Marvell Technology | 0.27% |

| Global Foundries | 0.27% |

| Warner Bros. Discovery (Class A) | 0.27% |

| Dollar Tree | 0.25% |

| Baker Hughes (Class A) | 0.24% |

| Fastenal | 0.24% |

| Cognizant (Class A) | 0.24% |

| Enphase Energy | 0.23% |

| Walgreens Boots | 0.23% |

| Verisk Analytics | 0.23% |

| CrowdStrike Holdings (Class A) | 0.22% |

| CoStar Group | 0.22% |

| Ansys | 0.22% |

| Align Technology | 0.21% |

| Diamondback Energy | 0.20% |

| Constellation Energy | 0.19% |

| Atlassian Corp A | 0.19% |

| eBay | 0.18% |

| Datadog (Class A) | 0.16% |

| JD.com ADR | 0.13% |

| Zoom | 0.13% |

| Sirius XM Holdings | 0.12% |

| Zscaler | 0.11% |

| Lucid Group | 0.11% |

| Rivian (Class A) | 0.09% |

The dominance of these seven companies within the NASDAQ 100 is a reflection of how central they are to large parts of the wider consumer economy. The economic output and influence of the tech giants speaks for themselves, and Tesla still leads the (rapidly crowding) electric vehicle market.

Perhaps the underdog of the bunch is NVIDIA, which produces graphics processing units (GPUs) that power the visuals in many electronic devices and, more recently, artificial intelligence (AI) systems. The latter in particular has made investors incredibly bullish on the company, as NVIDIA’s stock has risen and the company has recently joined the coveted $1 trillion club.

It’s important to note that this snapshot changes drastically over time. For example, Intel and Cisco were massive components of the Nasdaq 100 in the 2000s but have seen their allocations drop, while others like Yahoo! are no longer publicly traded.

The Pros and Cons of Market Consolidation

Such imbalance in the Nasdaq 100 has both benefits and downsides.

The success of the biggest contingents can pull up the entire index, and the Nasdaq 100 has consistently outperformed broader markets. In fact, $10,000 invested in the Nasdaq 100 in 2013 would be worth $50,000 today, while the same investment in the S&P 500 would now be $30,000.

However, if even one of these large companies underperforms, it can have a major impact on the entire index. This outsized influence can also hide general market woes that may be affecting many other components of the index, and the economy.

With the advent of large language models of AI in 2022, the tech sector is on a precipice. Will AI lead to further profitability—and bigger market caps—or will it render entire companies defunct, leading to a big shakeup in the composition of the Nasdaq 100 index?

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Markets

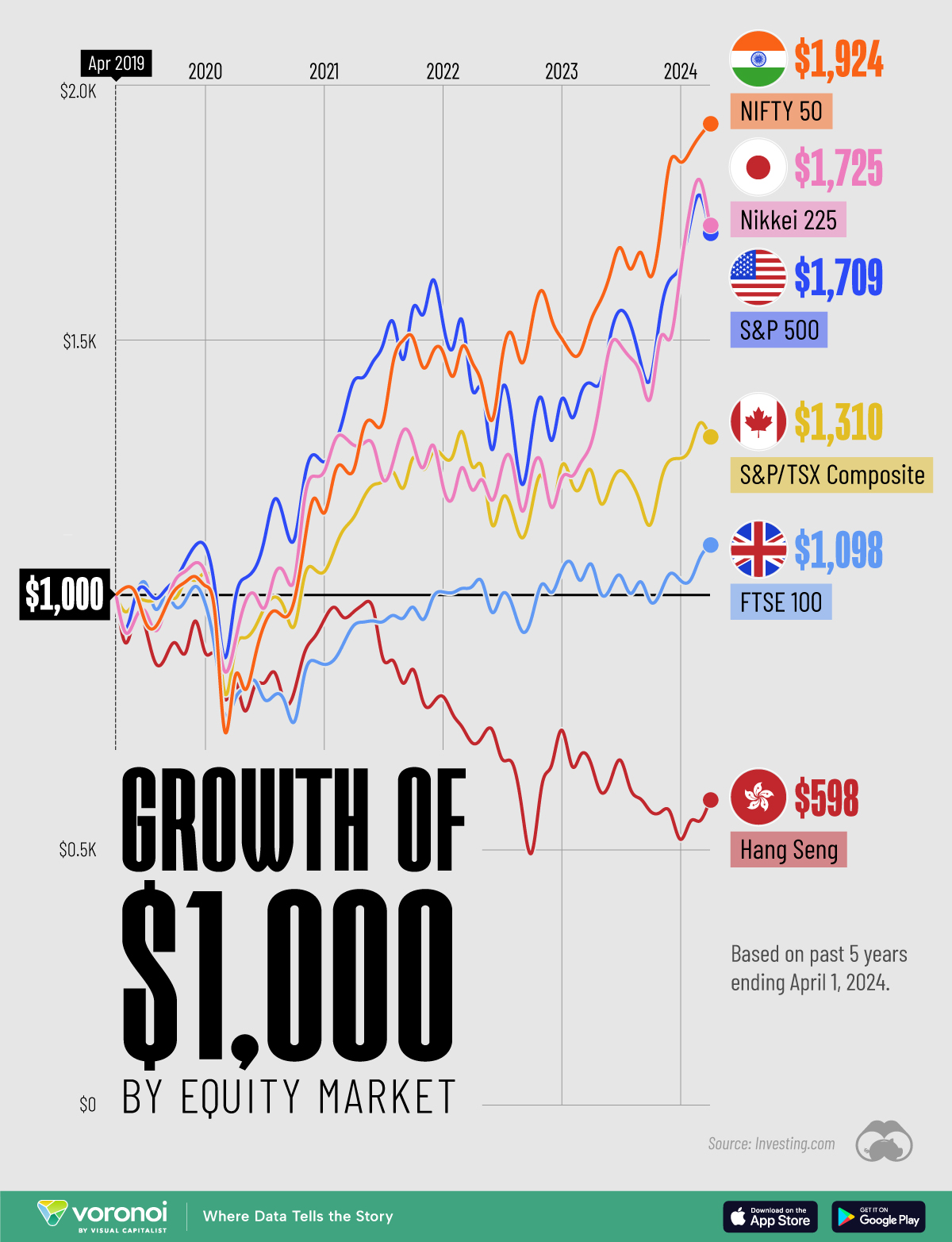

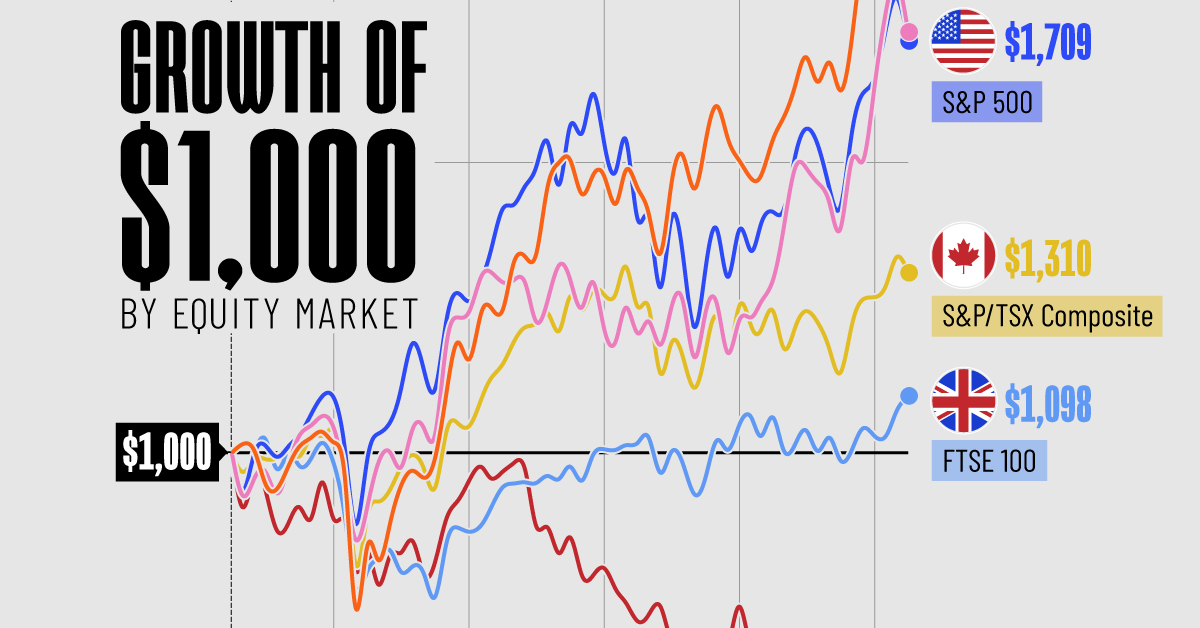

The Growth of a $1,000 Equity Investment, by Stock Market

In this graphic, we’ve visualized stock market growth by country over the past five years using major indices.

Visualizing Stock Market Growth by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we show the change in value of a $1,000 investment in various leading equity indexes from around the world. This data was sourced from Investing.com, and covers a five-year period from April 2019 to April 2024.

See the following table for the five-year annual return figures of the indexes shown above.

| Index | 5-Yr Return as of April 1, 2024 |

|---|---|

| 🇮🇳 NIFTY 50 | 92.4% |

| 🇯🇵 Nikkei 225 | 72.5% |

| 🇺🇸 S&P 500 | 70.9% |

| 🇨🇦 S&P/TSX Composite | 31.0% |

| 🇬🇧 FTSE 100 | 9.8% |

| 🇭🇰 Hang Seng | -40.2% |

In terms of stock market growth by country, India (represented here by the NIFTY 50) has impressively surpassed both the U.S. and Japan.

What is the NIFTY 50?

The NIFTY 50 is an index of the 50 largest and most actively traded Indian stocks. Similar to the S&P 500, it represents a range of industries and acts as a benchmark for investors to gauge the performance of the country’s broader stock market.

What’s Going on in India?

India’s multi-year bull market has led to several records being shattered in 2023. For example, the country’s total stock market market capitalization surpassed $4 trillion for the first time, while India-focused ETFs pulled in net inflows of $8.6 billion over the year.

A primary driver of this growth is the country’s fast-rising middle class. According to a report by Morgan Stanley, this “once-in-a-generation shift” will result in India having the third largest stock market globally by 2030, presumably behind the U.S. and China.

Japan Also Breaks Records

Japanese equities (represented in this graphic by the Nikkei 225) slightly outperformed the S&P 500 over the past five years. The index, which represents the top 225 companies on the Tokyo Stock Exchange, recently set a new record high for the first time since 1989.

Japanese companies have reported strong earnings as of late, partly thanks to a weak yen, which benefits many of the country’s export-reliant companies.

Learn More About Global Markets From Visual Capitalist

If you enjoyed this graphic, be sure to check out The World’s Biggest Stock Markets, by Country, which provides a unique perspective on country-level market capitalizations.

-

Markets6 days ago

Markets6 days agoMapped: Europe’s GDP Per Capita, by Country

-

Energy2 weeks ago

Energy2 weeks agoMapped: The Age of Energy Projects in Interconnection Queues, by State

-

Mining2 weeks ago

Mining2 weeks agoVisualizing Global Gold Production in 2023

-

Markets2 weeks ago

Markets2 weeks agoVisualized: Interest Rate Forecasts for Advanced Economies

-

Economy2 weeks ago

Economy2 weeks agoThe Most Valuable Companies in Major EU Economies

-

Markets1 week ago

Markets1 week agoThe World’s Fastest Growing Emerging Markets (2024-2029 Forecast)

-

Markets1 week ago

Markets1 week agoVisualizing Global Inflation Forecasts (2024-2026)

-

United States1 week ago

United States1 week agoCharted: What Southeast Asia Thinks About China & the U.S.