Markets

The Hardest Hit Companies of the COVID-19 Downturn: The ‘BEACH’ Stocks

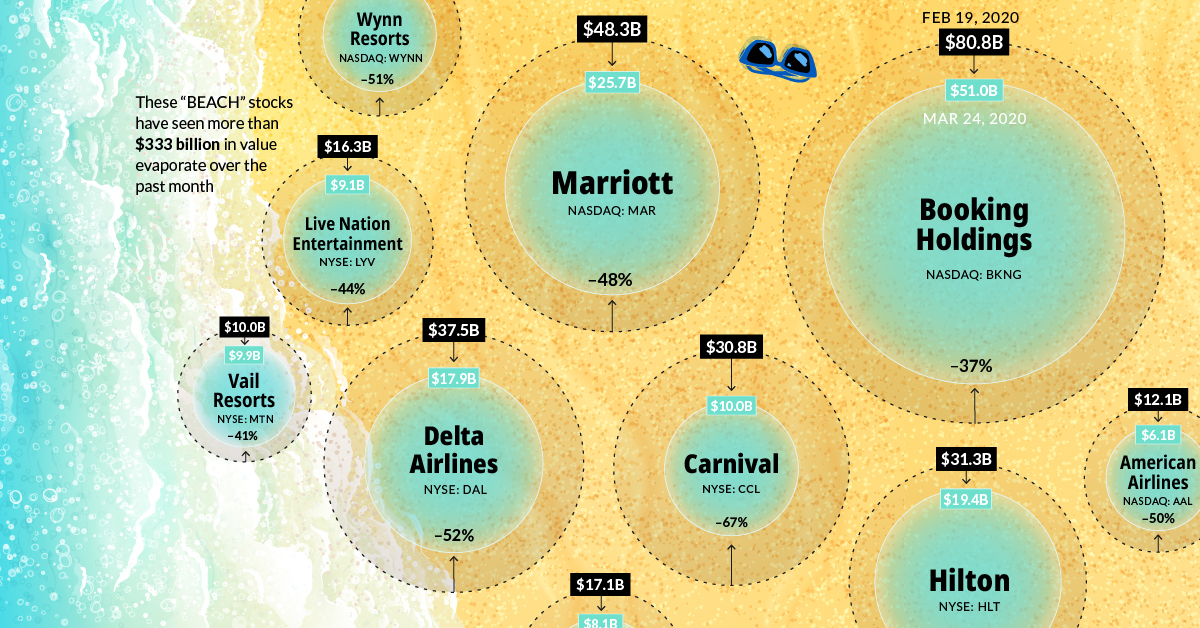

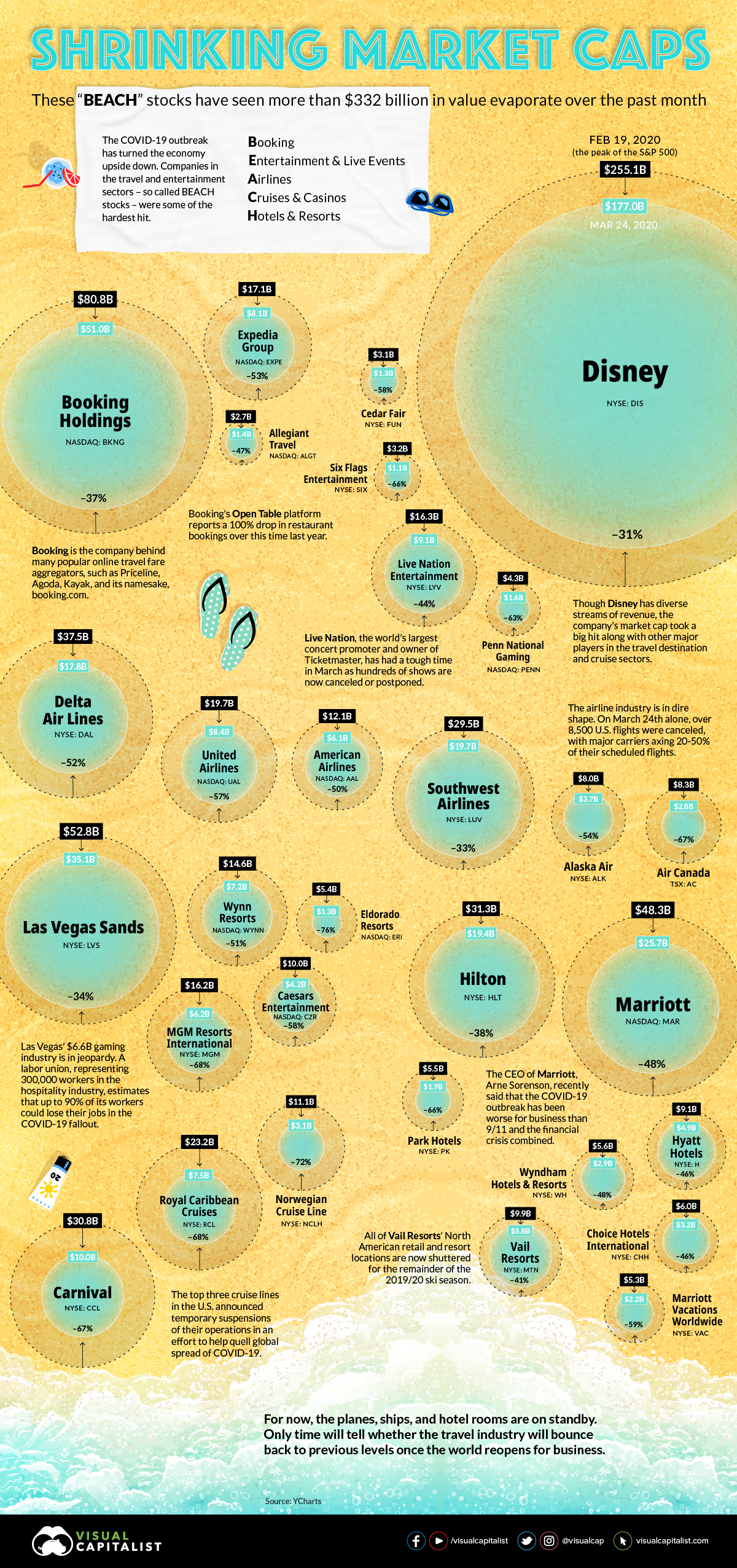

BEACH Stocks: $332B in Value Washed Away

The market’s latest storm has plunged the global travel industry into uncharted territory.

Since the S&P 500 market high on February 19, 2020, market capitalizations across BEACH industries—booking, entertainment, airlines, cruises, and hotels—have tumbled. The global airline industry alone has seen $157B wiped off valuations across 116 publicly traded airlines.

Investor confidence in cruise lines has also dropped. Between Carnival, Royal Caribbean, and Norwegian Cruise Line Holdings, over half of their market value has evaporated—equal to at least $42B in combined market capitalization.

Today’s infographic profiles the steep losses across BEACH companies. It looks at the ripple effects across individual companies and industries from the February 19 peak to date*.

*All numbers as of market close on March 24, 2020

Falling Off A Cliff

As the COVID-19 pandemic has spread to over 100 countries, many governments have implemented sweeping travel restrictions.

The impact across BEACH industries is far-reaching, with some valuations declining to nearly a quarter of their previous total.

| Company | Ticker | Category | Market Cap: 02/19/2020 | Market Cap: 03/24/2020 | % Change |

|---|---|---|---|---|---|

| Booking Holdings | BKNG | Booking | $80.8B | $51B | -37% |

| Expedia Group | EXPE | Booking | $17.1B | $8.1B | -53% |

| Allegiant Travel | ALGT | Booking | $2.7B | $1.4B | -47% |

| Live Nation | LYV | Entertainment & Live Events | $16.3B | $9.1B | -44% |

| Six Flags | SIX | Entertainment & Live Events | $3.2B | $1.1B | -66% |

| Cedar Fair | FUN | Entertainment & Live Events | $3.1B | $1.3B | -58% |

| The Walt Disney Co | DIS | Entertainment & Live Events | $255.1B | $177B | -31% |

| Penn National Gaming | PENN | Entertainment & Live Events | $4.3B | $1.6B | -63% |

| Delta Air Lines | DAL | Airlines | $37.5B | $17.8B | -52% |

| United Airlines | UAL | Airlines | $19.7B | $8.4B | -57% |

| American Airlines | AAL | Airlines | $12.1B | $6.1B | -50% |

| Southwest Airlines | LUV | Airlines | $29.5B | $19.7B | -33% |

| Alaska Air Group | ALK | Airlines | $8B | $3.7B | -54% |

| Air Canada (in USD) | AC | Airlines | $8.3B | $2.8B | -67% |

| Carnival | CCL | Cruise & Casino | $30.8B | $10B | -67% |

| Royal Caribbean Cruises | RCL | Cruise & Casino | $23.2B | $7.5B | -68% |

| Norwegian Cruise Lines | NCLH | Cruise & Casino | $11.1B | $3.1B | -72% |

| Las Vegas Sands | LVS | Cruise & Casino | $52.8B | $35.1B | -34% |

| MGM Resorts International | MGM | Cruise & Casino | $16.2B | $6.2B | -68% |

| Wynn Resorts | WYNN | Cruise & Casino | $14.6B | $7.2B | -51% |

| Caesars Entertainment | CZR | Cruise & Casino | $10B | $4.2B | -58% |

| Eldorado Resorts | ERI | Cruise & Casino | $5.4B | $1.3B | -76% |

| Marriott International | MAR | Hotels & Resorts | $48.3B | $25.7B | -48% |

| Hilton | HLT | Hotels & Resorts | $31.3B | $19.4B | -38% |

| Hyatt Hotels | H | Hotels & Resorts | $9.1B | $4.9B | -46% |

| Choice Hotels International | CHH | Hotels & Resorts | $6B | $3.2B | -46% |

| Wyndham Hotels & Resorts | WH | Hotels & Resorts | $5.6B | $2.9B | -48% |

| Park Hotels | PK | Hotels & Resorts | $5.5B | $1.9B | -66% |

| Vail Resorts | MTN | Hotels & Resorts | $9.98B | $5.8B | -41% |

| Marriott Vacations Worldwide | VAC | Hotels & Resorts | $5.3B | $2.2B | -59% |

For instance, the consequences on various travel bookings brands have been severe. Booking Holdings, the parent company to Booking.com, Priceline, Kayak and OpenTable, witnessed share price declines of over 35% since the peak.

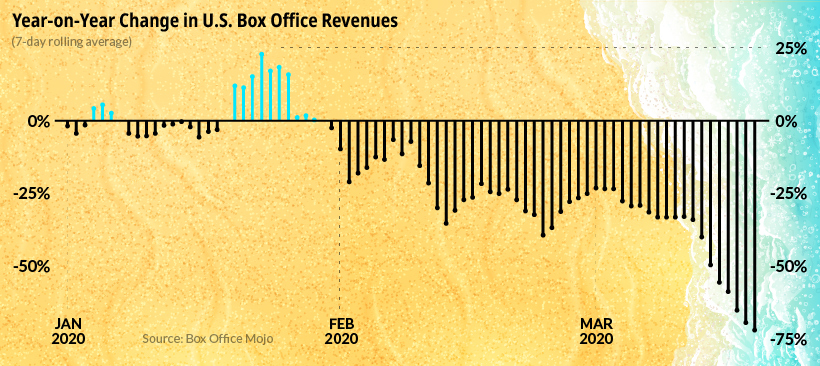

Empty Stadiums

Across the entertainment industry, ticket sales for concerts, movies, and other events are falling precipitously due to cancellations or postponements.

Upwards of $5B in global film industry losses could result from the COVID-19 pandemic.

Chilling footage of the Las Vegas strip, as well as other tourist epicenters around the world, shows deserted streets as visitors opt to stay home instead.

Bracing For Impact

Meanwhile, worldwide airline revenue is estimated to fall by as much as $113B in 2020.

In under two months, the share price of Delta Airlines has fallen over 50% as the company anticipates a capacity reduction of 40%, the largest in its history.

| Company | Ticker | Feb 19 2020 Share Price | Mar 24 2020 Share Price |

|---|---|---|---|

| Delta Air Lines | NYSE:DAL | $58.5 | $26.9 |

| United Airlines | NASDAQ:UAL | $79.4 | $33 |

| American Airlines | NASDAQ:AAL | $28.3 | $13.9 |

| Southwest Airlines | NYSE:LUV | $56.89 | $37.7 |

| Alaska Air Group | NYSE:ALK | $65.2 | $28.9 |

| Air Canada (in CAD) | TSX:AC | $45.3 | $15.1 |

The global airline industry—which employs over 10M people—supports $2.7T in global economic activity across an average of 12M passengers per day.

Aruba, Jamaica No More

As for the cruise line industry, global operations came to a 30-day standstill in mid-March. Over 800 COVID-19 cases and 10 deaths across three cruise ships have been discovered.

“COVID-19 on cruise ships poses a risk for rapid spread of disease, causing outbreaks in a vulnerable population, and aggressive efforts are required to contain spread.”

—CDC

Carnival, a Miami-based company, has witnessed its share price fall to around one third of its February 19 value. Similarly, Royal Caribbean Cruises, which has seen its market cap plummet almost 70%, announced that it will suspend trips until mid-May.

Occupancy Dilemma

As the hotel industry is impacted by the global outbreak, share prices have also realized a significant slump. In the U.S., an estimated $1.4B in revenue is vanishing each week. If occupancy levels fall by just 30% this year, the U.S. hotel industry could see approximately 4 million jobs wiped out.

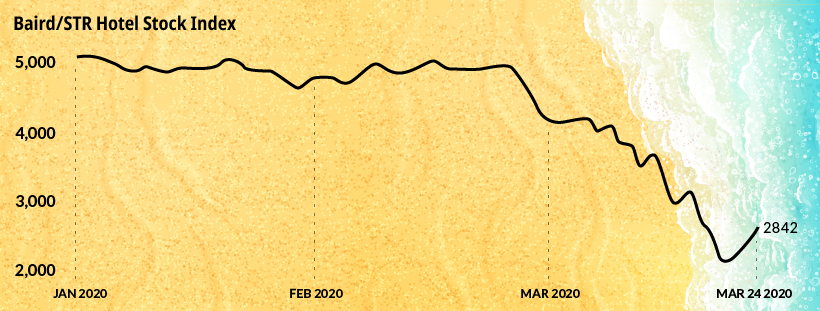

The Baird/STR Hotel Stock Index, which serves as a benchmark for the sector’s overall health, has declined over 47% year-to-date.

Global Stimulus Response

A number of travel industries around the world are calling for stimulus packages.

On March 25, the U.S. Congress finalized a historic $2T deal, which includes $25B in grants for the airline industry. In the UK, officials are providing small businesses in hospitality and leisure grants that are worth up to $30,000 as part of its $400B bailout plan.

China, Germany, Italy, and Spain have outlined multibillion dollar proposals in response to COVID-19. Overall, at least eleven countries have announced stimulus plans along with the European Commission and the IMF.

When Will the Travel Wave Hit Again?

Amid the COVID-19 pandemic one thing is clear: the impact on the travel industry will have a marked effect on the broader economy.

Travel is closely linked with oil, as transportation accounts for over 60% of global demand. In Q2 2020, global oil consumption is projected to fall by 25M barrels per day.

Along with this, discretionary consumer spending makes up over one third of America’s GDP. The impact of the pandemic across this sector is expected to contribute to a 10% decline or more in U.S. GDP for the second quarter.

As conditions materially improve around the world—with China beginning to open up flights—positive signs are emerging from under the surface. Will BEACH industries quickly bounce back as infection rates drop, or will a slow and painful recovery unfold in the months ahead?

Markets

Visualizing Global Inflation Forecasts (2024-2026)

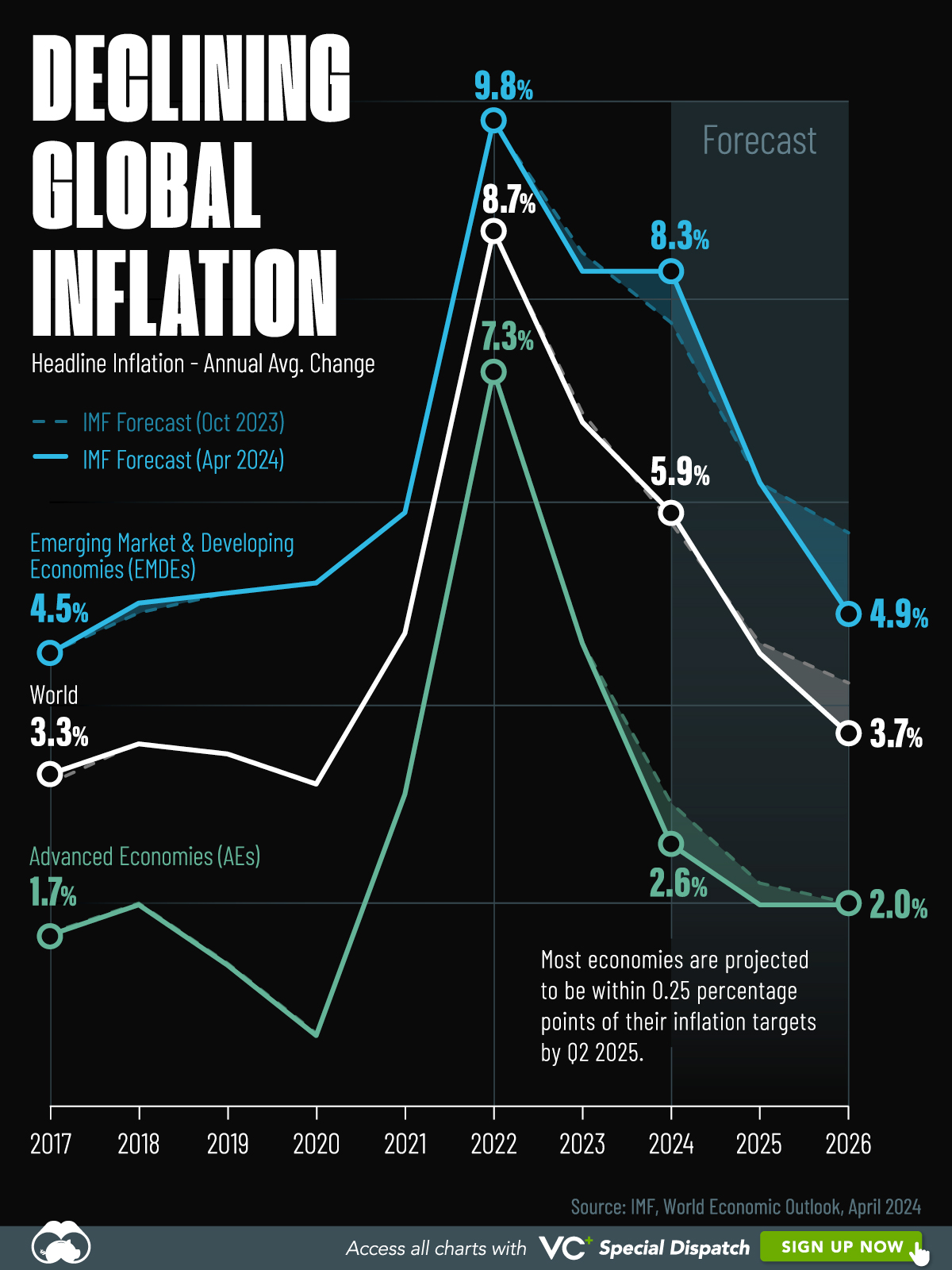

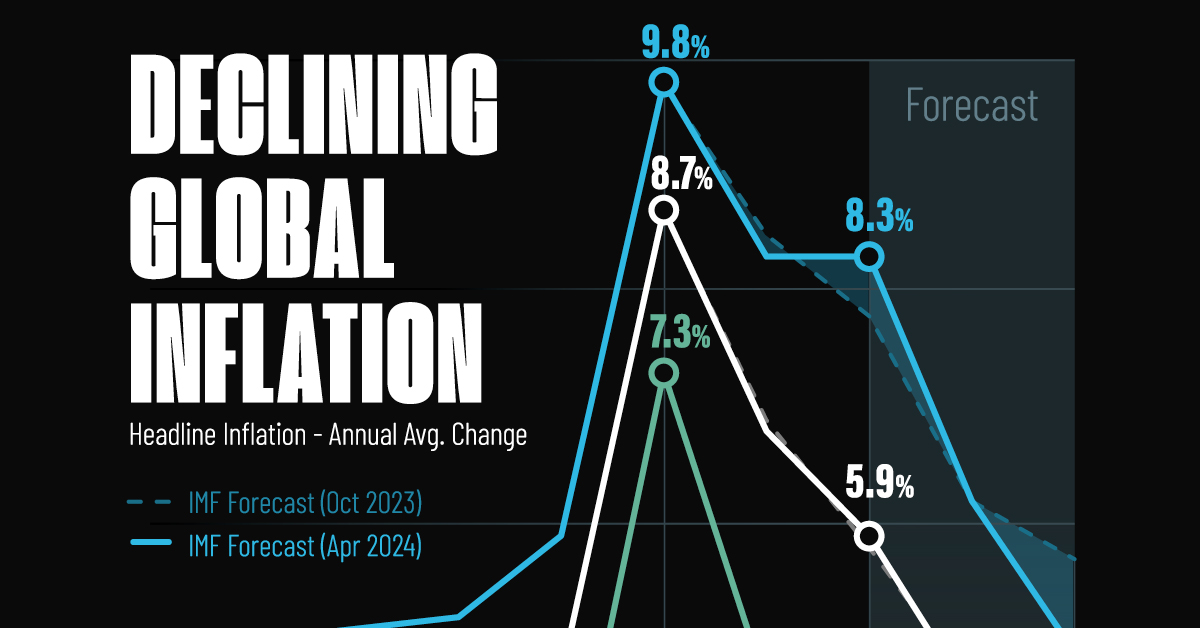

Here are IMF forecasts for global inflation rates up to 2026, highlighting a slow descent of price pressures amid resilient global growth.

Visualizing Global Inflation Forecasts (2024-2026)

Global inflation rates are gradually descending, but progress has been slow.

Today, the big question is if inflation will decline far enough to trigger easing monetary policy. So far, the Federal Reserve has held rates for nine months amid stronger than expected core inflation, which excludes volatile energy and food prices.

Yet looking further ahead, inflation forecasts from the International Monetary Fund (IMF) suggest that inflation will decline as price pressures ease, but the path of disinflation is not without its unknown risks.

This graphic shows global inflation forecasts, based on data from the April 2024 IMF World Economic Outlook.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

The IMF’s Inflation Outlook

Below, we show the IMF’s latest projections for global inflation rates through to 2026:

| Year | Global Inflation Rate (%) | Advanced Economies Inflation Rate (%) | Emerging Market and Developing Economies Inflation Rate (%) |

|---|---|---|---|

| 2019 | 3.5 | 1.4 | 5.1 |

| 2020 | 3.2 | 0.7 | 5.2 |

| 2021 | 4.7 | 3.1 | 5.9 |

| 2022 | 8.7 | 7.3 | 9.8 |

| 2023 | 6.8 | 4.6 | 8.3 |

| 2024 | 5.9 | 2.6 | 8.3 |

| 2025 | 4.5 | 2.0 | 6.2 |

| 2026 | 3.7 | 2.0 | 4.9 |

After hitting a peak of 8.7% in 2022, global inflation is projected to fall to 5.9% in 2024, reflecting promising inflation trends amid resilient global growth.

While inflation has largely declined due to falling energy and goods prices, persistently high services inflation poses challenges to mitigating price pressures. In addition, the IMF highlights the potential risk of an escalating conflict in the Middle East, which could lead to energy price shocks and higher shipping costs.

These developments could negatively affect inflation scenarios and prompt central banks to adopt tighter monetary policies. Overall, by 2026, global inflation is anticipated to decline to 3.7%—still notably above the 2% target set by several major economies.

Adding to this, we can see divergences in the path of inflation between advanced and emerging economies. While affluent nations are forecast to see inflation edge closer to the 2% target by 2026, emerging economies are projected to have inflation rates reach 4.9%—falling closer to their pre-pandemic averages.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Best of6 days ago

Best of6 days agoBest Visualizations of April on the Voronoi App

-

Brands2 weeks ago

Brands2 weeks agoHow Tech Logos Have Evolved Over Time

-

Energy2 weeks ago

Energy2 weeks agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoCountries With the Largest Happiness Gains Since 2010

-

VC+2 weeks ago

VC+2 weeks agoVC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

Demographics2 weeks ago

Demographics2 weeks agoThe Countries That Have Become Sadder Since 2010

-

Money2 weeks ago

Money2 weeks agoCharted: Who Has Savings in This Economy?

-

Technology1 week ago

Technology1 week agoVisualizing AI Patents by Country

Can I share this graphic?

Can I share this graphic? When do I need a license?

When do I need a license? Interested in this piece?

Interested in this piece?