Technology

Breaking Down How Amazon Makes Money

‘Tis the season for shopping.

For many of us, that means buying things online – and if you are like most internet denizens, you’ll be picking up at least one item this holiday season through the the world’s largest e-commerce giant, Amazon.

The company’s sales numbers are growing at a staggering pace. Last year, Amazon had $136 billion in sales, and the company is projected to finish at the $177 billion mark this year.

What are the exact sources of Amazon’s revenue, and how does it all break down?

How Amazon Makes Money

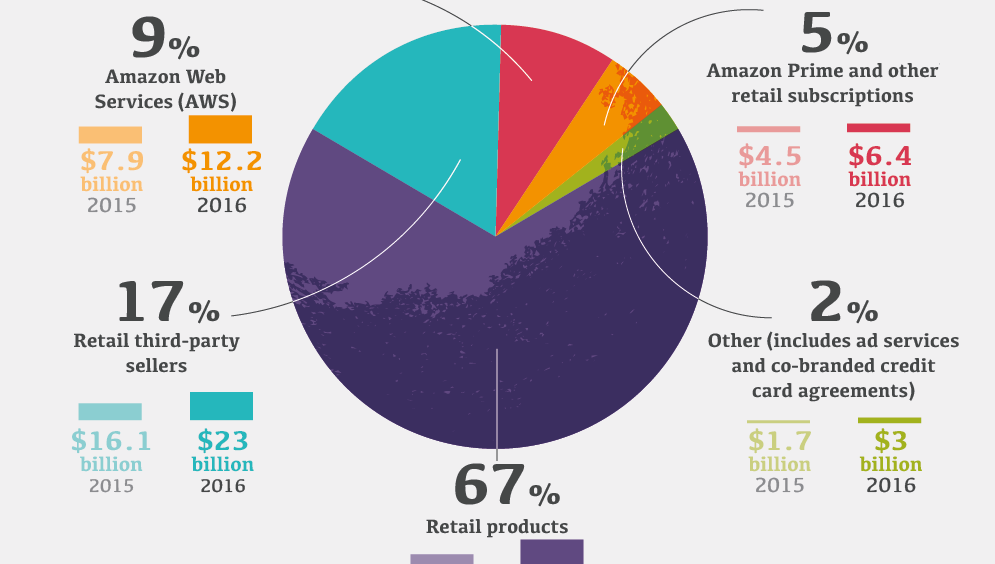

Today’s infographic comes to us from Sellbrite, and it dives into the company’s success, and how Amazon makes money:

To the chagrin of many investors, Amazon has traditionally spent a lot to make a little.

In 2016, for example, the company brought in $136 billion in net sales, but it spent $131.8 billion on operating expenses. That gave the company an operating income of $4.2 billion.

However, that high-growth strategy seems to be paying off.

During the same period, e-commerce revenue jumped 25%, AWS revenue increased 55%, and net income skyrocketed 302%. The growth has continued through 2017 and it’s why Jeff Bezos is now the richest person in the world.

A Closer Look

Here’s how Amazon makes money, according to the company’s last annual report for 2016:

| Revenue Stream | Net Sales (2016) | % of Total Revenue |

|---|---|---|

| Retail products | $91.4B | 67.2% |

| Retail 3rd party sellers | $23.0B | 16.9% |

| Amazon Web Services (AWS) | $12.2B | 9.0% |

| Subscriptions (Amazon Prime, etc.) | $6.4B | 4.7% |

| Other (ads, co-branded credit cards) | $3.0B | 2.2% |

| Total Revenue | $136.0B | 100.0% |

Which areas of Amazon’s business are growing the fastest – and where is the company investing in the future?

Here are just a few directions in which the Jeff Bezos Empire is expanding:

Ads

In 2017, the size of Amazon’s advertising business (forecasted at $1.65 billion) has already surpassed those belonging to Twitter ($1.21 billion) and Snapchat ($642 million). Of course, Amazon is still a longshot from impacting the Google and Facebook ad oligopoly, but the two leaders would be wise to take the emerging threat seriously.

Why would Amazon ads work well? The company has a vast database of user info to allow for effective targeting, as well as high margins.

Prime Video

In 2017, Amazon is spending $4.5 billion on creating original content. It has fewer dollars allocated to content than Netflix, but it’s still more than double what HBO spends each year. By the way, Amazon Prime Video is now live in an impressive 200 countries.

International

With 65% of U.S. households having access to Amazon Prime subscriptions, a focus on international sales is the biggest lever that Amazon can pull for future growth. The company is eyeing obvious countries, but less obvious ones as well. In India for example, Amazon’s marketplace is the fastest-growing in the country.

B2B

Amazon is also leveraging its strong logistics platform to provide goods for small businesses, rather than just consumers.

Shipping and Logistics

Fulfillment by Amazon (FBA) is already a booming business that allows small businesses to tap into the scale of Amazon. Investing in shipping also betters the customer experience – a key objective for Amazon. However, it’s still possible that the company could take shipping and logistics a step further: domination in the $200 billion parcel shipping market would be a strategic and attainable prize.

With many other ways for the e-commerce giant to grow, it’ll be interesting to breakdown how Amazon makes money in 2018.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001